I earlier noted that Japan’s currency, the yen, may function as a funding currency for interest rate and currency value arbitrages, or known as the carry trade, that may augment the ongoing bubble process in Philippines, as well as, in other ASEAN asset markets. It appears that the Yen carry may well be a global phenomenon.

Writes analyst Howard Simons at the Minyanville,

the BOJ may be ready to fly the Mission Accomplished banner in its war on the yen (yes, I just wrote this). The yen has regained its status as the cheapest currency to borrow, edging out other worthies such as the Hong Kong and Singapore dollars, the Swiss franc, and the US dollar.

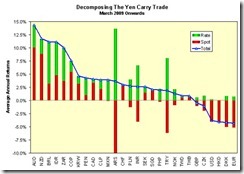

That status is pushing more and more currencies into a positive carry against the yen. Even in those many cases where the yen has gained on a spot-rate basis, the loss is being offset by a higher interest rate spread. The overall result is a positive total carry. As recently as November 2011, 20 currencies had negative carries against the yen over the post-March 2009 era; that number is down to six.

In short, more positive carries should translate to more carry trades.

Central bank policies have indeed been spawning numerous imbalances globally. And if the BoJ’s debasement policies continues, then we should expect international investors to take advantage of these emerging arbitrage opportunities.

Profit from folly.

Well you sure predicted things correctly, as Euro Yen carry trade investing has finally produced Liberalism's peak prosperity.

ReplyDeletehttp://tinyurl.com/aothrwx