Everytime gold prices goes into hibernation, devotees of the state yell “where is inflation?!”

The “No Inflation” Propaganda

As I have been repeatedly saying, the impact of monetary inflation has always been relative. Inflation affects different economic sectors at different degrees and at different times. Politically favored sectors are the primary beneficiaries followed by the sectors that commercially interact with them, thus the gradient multiplier effect to the economy as earlier explained.

In the stock market, this phenomenon is manifested through what I call as the rotational process.

Yet today’s seeming benign conditions of consumer price inflation (CPI), which account for as symptoms of monetary inflation, does not imply of the absence of CPI inflation nor has CPI inflation solely been manifested on gold prices alone.

Nonetheless anti-gold arguments based on reductio ad absurdum and the fallacy of reading history into the future represents no less than pretexts for further inflationism and government interventions: no inflation today, thus inflate more!

These people should be reminded that economic laws are always in operation and applies equally to everyone. And that the inflation disease operates through different stages which means that CPI inflation could explode at any given time.

In reality, gold has been up for the 11th straight year despite the ephemeral bout of deflationary episode during the crisis of 2008.

Chart from Goldmoney.com

And gold’s 11 year phenomenal record rise came amidst the US Federal Reserve’s Bubble blowing policies.

The point is, prices of gold will continue to respond to policies and that there hardly are any market trends that moves in a straight line—unless the marketplace endures an episode of extreme pressure from embedded imbalances.

If they do, then markets must be experiencing an episode of extreme stress, symptomatic of the ventilation of acute systemic imbalances on the marketplace. They appear in the form of a blowoff phase (climax) of a bubble cycle or of hyperinflation in motion.

These extreme episodes are the black swan moments.

And the seemingly harmless CPI inflation landscape has been prompting for what seems as the crisis-political response feedback loop mechanism: where policymakers intervene in response to the market reactions and vice versa.

Political agents and their followers will naturally ‘selectively focus’ on data that supports or fits on their views, for the simple reason any admission of the CPI inflation threat will force them to reverse on their policies that would discomfit the markets and work against their interests (more below).

Until we see CPI inflation surge and or a major political backlash on central bank actions, we should expect this cycle of political interventionism/inflationism to continue.

And such actions will come under the half-truth discourse of a “no” or “little” inflation risk environment.

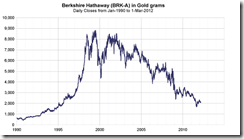

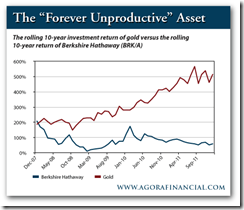

Gold Outperforms Obama Crony Warren Buffett’s Berkshire Hathaway

And it is also important to point out that gold has beaten the portfolio of the Obama crony and statist, Warren Buffett in spite of his repeated ranting against gold.

Whether priced in the equivalent of gold grams...

Chart from Pricedingold.com

Or based on relative performance…

Chart from the Daily Reckoning

“Unproductive” gold has clearly outperformed Mr. Buffett’s flagship Berkshire Hathaway over the past few years.

While past performance may not guarantee future outcomes, the second point is that fundamental drivers underpinning gold’s bullrun remains firmly in place.

Inflationism (expansion of monetary base in the US—see lower window—as well as in other developed economies) and the policy of negative real rates worldwide should continue to drive gold higher in spite of the current consolidation phase (chart from US Global Investors)

So, aside from highly distorted markets through various forms of market interventionism, I think this phase can be construed as a normal profit taking consolidation phase following the recent record run.

And reading price signals over the short term in an environment of heavy interventions can mislead, as acts of market interferences may have short to medium term volatile effects on the market’s price channels.

And given these highly politically influenced conditions, gold should continue to defy any statist expectations and beat the returns of Berkshire Hathaway.

Poker Bluff, Redux

It can also be observed that many of the current attributions to weak gold prices have centered on the supposed reluctance by policymakers to continue with “further stimulus”.

Such blarneys over withholding stimulus have been the dominant narrative and may have partly influenced the recent violent downside swing of September of 2011 and in March 2012 (two arrows indicated). I don’t recall of what news was ascribed to the December decline, I was on vacation.

Yet it has been a predilection, if not a habit, of the mainstream to associate current events to the market’s price actions (available bias).

We have seen this happen before through the gibberish of so called “exit strategy” in 2010. Then, I called this nonsensical propaganda as poker bluffing central bankers.

In reality in 2011, the US Federal Reserve monetized about 61% of US treasury issuance or a “whopping 8.6% of gross domestic product (GDP) on average per annum” according to Lawrence Goodman of Center for Financial Stability.

The US Federal Reserve financed most of the expenditures of the US government to compensate for the insufficiency of funding sources from private sector savings and the decline of foreign demand for US government papers. As US government expenditures continue to swell, the buyer and financier of last resort will be the US Federal Reserve.

The third point is that any constrains towards further “stimulus” would extrapolate to an outright default by the US government. Such event would ripple across the political spectrum that would adversely impact the favored banking industry and to welfare-warfare state. And US politicians and bureaucrats won’t likely resort to this option as this would put in jeopardy the survival of current political institutions or the cartelized central banking-welfare warfare state-banking system.

So policymakers will find ways and means to conduct more inflationism through overt or through stealth and possibly will come in different names.

Alternatively, this means another round of poker bluffing chatters.

Gold’s Correlation with Various Asset Classes

Lastly gold’s correlations with asset markets have been vacillating.

For most of the past years, the inflation tide has been manifested with gold’s leading the way relative to the equities as represented by the US S&P 500.

But this relationship appears on the rocks. During parts of 2011 (red ellipses), prices of gold and US equity markets parted ways. This came coincident to the end of QE 2.0 and the policy dithering by the US Federal Reserve. Then, gold prices rose as US stocks fell. This divergence was finally resolved when central bankers abroad reintroduced their versions of QE.

However, such divergence—but on an opposite path where gold has been in consolidation gold while the US S&P continues to ascend—seems to have remerged anew today.

My guess is that gold will close this anomalous divergence by heading higher.

My impression is that the gold appears to partly mirror the actions of the euro.

While the gold-Euro correlations has been loose over the past 3 years, where the upward streak of gold’s trend came amidst the sharp gyrations of the euro, recently gold seems to be moving in sympathy along with the euro’s decline.

Correlation should not be read as causation though. It would be mistake to think of gold as plainly anti-US dollar trade.

In reality, gold is the nemesis of fiat or political money, whether the US dollar, European euro, China’s yuan, Japanese yen, British pound or the Philippine Peso.

The bottom line is inflationism will continue to breath life into gold’s bullmarket, current volatility notwithstanding.

Betting against gold, says Professor Gary North, is the same as betting on governments. He who bets on governments and government money bets against 6,000 years of recorded human history.

No comments:

Post a Comment