From Bloomberg

Bank of England officials halted stimulus expansion after seven months of bond purchases as the threat of inflation trumped concerns about an economy that’s succumbed to a double-dip recession.

The nine-member Monetary Policy Committee led by Governor Mervyn King today held its quantitative easing target at 325 billion pounds ($524 billion), ending a second round of stimulus, a move forecast by 43 out of 51 economists in a Bloomberg News survey. Officials also left their benchmark interest rate at a record low of 0.5 percent. The pound erased its decline against the dollar.

With inflation on course to exceed Bank of England forecasts and the economy struggling to recover, policy makers have been divided on how to resolve the dilemma. Today’s decision signals price-growth worries are mounting even as the U.K. struggles with government budget cuts, high unemployment and threats from Europe’s debt crisis.

The double dip recession serves as evidence that the Bank of England’s (BoE) quantitative easing (QE) measures has failed to meet the goal of “stimulating” the economy.

Worst, the aftereffect has been a significant loss of purchasing power for the average Briton.

True, statistical consumer price inflation (CPI) has been lower compared to last year, but remains elevated relative to the 2009-10, as well as the average inflation rate from 1989 until 2010 of 2.72% [according to tradingeconomics.com, the source of most of the charts on this post].

So the recessionary environment along with elevated inflation rates…

…plus high unemployment rates represents an accrued symptom which characterized the 1970-1980s economic landscape known as stagflation (Wikipedia.org). In short, UK has been suffering from benign stagflation.

Also, since this BoE policy has been widely anticipated by the consensus, it does appear that today’s policy decision may have partly influenced the present weaknesses seen in the global commodity markets, as well as, in the world stock markets.

Of course, I have my doubts on the current stance of the BoE. I don’t think that they have totally abandoned the inflationist doctrine. I think that this has been more of a temporary lull.

That’s because if UK’s finance markets should endure more downside volatility, then this would have an adverse transmission effect to the balance sheets of UK’s banking system.

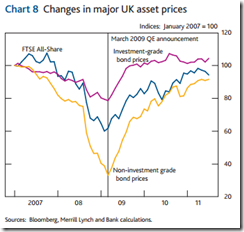

As this study from the BoE shows, since the introduction of the QE, prices of bonds and equity (via the FTSE all share) had been energized or the QE has provided pivotal support to their asset markets.

Yet BoE’s QEs have only added to the general indebtedness of the UK’s economy.

And like the Euro counterparts there has been no genuine “austerity” in the UK.

So unless there will be greater savings from the average British to finance government borrowing or foreign buyers step up the plate, then the BoE will have their hands full in trying to smooth out the management of government debt and the balance sheets of UK’s banking system overtime. Oh, essentially the same dilemma haunts the US and the Eurozone.

No comments:

Post a Comment