Some good news in China.

From Bloomberg,

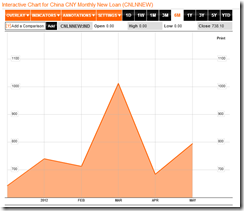

China’s new loans exceeded estimates in May and more money went into longer-term lending, signaling support for investment projects that may help to prevent a deeper economic slowdown.

Local-currency lending was 793.2 billion yuan ($125 billion), the People’s Bank of China said on its website yesterday. That was the most on record for the month of May and more than analysts’ 700 billion yuan median forecast. Loans extended for a year or more accounted for 34 percent of the total, up from 28 percent in April.

Premier Wen Jiabao’s efforts to engineer a resurgence in the world’s second-biggest economy may be aided by the jump in lending and signs of resilience in exports. At the same time, industrial-output growth was close to the lowest since 2009 in May, indicating additional measures will still be needed after last week’s interest-rate cut.

“Over the past several months, investors have been concerned that a large share of loans was for short-term financing, and hence would not help boost growth as much as large investment projects,” said Zhang Zhiwei, the Hong Kong- based chief China economist at Nomura, who previously worked for the International Monetary Fund. “The rising share of medium and long-term loans in May helps address this concern.”

HSBC Holdings Plc (5) said new loans may surge to as much as 1 trillion yuan this month. Nomura’s Zhang said the proportion of longer-term lending remains “relatively low” and has room to rise as banks lend more to infrastructure projects.

‘More Impressive’

M2 money supply grew 13.2 percent last month from a year earlier, compared with an estimate of 12.9 percent, yesterday’s report showed. The gain was 12.8 percent in April. New lending was up from 681.8 billion yuan in April.

“The lending figures are all the more impressive because loan growth in the first half of the month was reportedly extremely weak,” said Mark Williams, an economist at Capital Economics Ltd. in London who formerly advised the U.K. Treasury on China. “These figures point to a sharp rebound in lending in late May and suggest that banks and borrowers have responded rapidly to the government’s new emphasis on supporting growth.”

The nation’s top economic planning agency, the National Development and Reform Commission, is speeding approvals for investment projects. Baosteel Group Corp. and Wuhan Iron & Steel Group last month secured permission to build factories after previous delays caused by overcapacity concerns.

Efforts to bolster growth also include reductions in bank reserve requirements and delays in tightening rules for lenders’ capital. China has no plan to introduce stimulus on the scale unleashed during the global crisis in 2008, according to the state-run Xinhua News Agency.

While this may put a floor on the current downdraft, it is not clear where the bulk of the longer-term lending is coming from.

Since there has been NO declared fiscal stimulus (YET) while the private sector seems on a lull, signs are that most of these growth emanates from state owned companies (SOEs), such as Baosteel Group Corp. and Wuhan Iron & Steel Group.

If this is true then China’s stealth stimulus have been redirected to SOEs.

Up to what extent will this covert stimulus be? That should be the main question.

China’s shadow banking system from SOEs, local and regional government agencies have already been faced with huge loans of questionable quality to the tune of $1.7 trillion. The implication is that China’s government will either tolerate further inflation of her existing bubble or that such dramatic (but desperate) moves may be symbolic—engineered to spur a bandwagon effect to fire up ‘confidence’ or perk up the ‘animal spirits’—and thus be limited.

Like how global financial markets initially responded to announcement of Spain’s bailout, where embattled bulls surged out of the gate but whose rally eventually foundered as reality sunk in, short term spikes—from bailouts or as the above account—should be reckoned as knee jerk reactions rather than sustainable trends.

Further vigilance is required. Pay close heed to the Shanghai index, the yuan and the commodity markets/currencies.

No comments:

Post a Comment