Newswires say there has been a shortage of US dollars in the global financial system.

Bloomberg reports,

Central banks rebuilding foreign- exchange reserves at the fastest pace since 2004 are crowding out private investors seeking U.S. dollars, boosting demand even as the Federal Reserve considers printing more currency.

After falling to an all-time low of 60.5 percent in the second quarter of last year, the dollar’s share of global reserves rose 1.6 percentage points to 62.1 percent in December, the latest International Monetary Fund figures show. The buying has left the private sector with $2 trillion less than it needs, according to investment-flow data by Morgan Stanley, which sees the dollar gaining 8.2 percent in 2012, the most in seven years.

While the Fed has created more than $2 trillion under its stimulus programs since 2008, the flows signal that there may actually be a shortage of dollars to meet demand as Europe’s debt crisis deepens and the global economy slows. The dollar has risen 3.5 percent since the end of April against a basket of the most-widely traded currencies even amid speculation that the Fed, which meets this week, may undertake the type of stimulus measures that weakened it in the past.

“The market often assumes that people are long dollars, but many of those dollars are held by central banks, which are unlikely to move out,” Ian Stannard, head of European currency strategy at Morgan Stanley in London, said in a June 13 interview. “That leaves us with the private sector, which is short,” meaning they don’t have enough of them, he said. “In an environment where we see a global slowdown, the dollar will be well supported.”

Dollar Scarcity

Morgan Stanley says the potential scarcity of dollars among foreign private borrowers represents the U.S.’s net position with lenders abroad of minus $2.4 trillion, adding $4.8 trillion of U.S. financial assets held by central banks, and subtracting $500 billion of foreign official assets held by the U.S.

That equals about $2 trillion of demand from foreign private banks and companies. The gap has expanded from $400 billion in 2008, according to the New York-based firm. In 2002, there was a dollar surplus of $900 billion, the data show.

The shift in the share of global forex reserves weighted towards the US dollar hardly translates to a US dollar ‘shortage’. But it can be made to look that way.

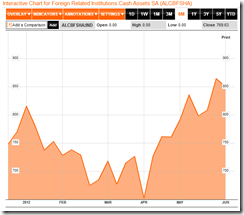

Instead, these accounts for symptoms of capital flight (see chart below of deposits of foreign lenders at the US Federal Reserve), ongoing liquidations (loan repayments margin calls etc..) and growing concern over a dysfunctional banking system, which has been magnified in Europe.

Chart from Bloomberg

The statement “many of those dollars are held by central bank” are manifestations of such concerns or of distorted price signals where politicians arduously struggle to protect privileged institutions from market forces through massive interventions. The ensuing uncertainty from regulations and political directions prompts the private sector to seek refuge in central banks than to operate normally.

The innuendo behind the dollar shortage analysis nonetheless represents the clamor for the FED to inject more money into the system.

As the great Ludwig von Mises once wrote,

In the opinion of the public, more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about.

Solve the problem of inflation with even more inflation. Yet people forget inflation is a policy that will not and cannot last.

No comments:

Post a Comment