More signs of China’s hard landing or bursting bubble.

From the New York Times,

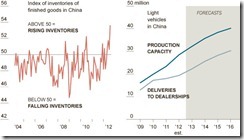

After three decades of torrid growth, China is encountering an unfamiliar problem with its newly struggling economy: a huge buildup of unsold goods that is cluttering shop floors, clogging car dealerships and filling factory warehouses.

The glut of everything from steel and household appliances to cars and apartments is hampering China’s efforts to emerge from a sharp economic slowdown. It has also produced a series of price wars and has led manufacturers to redouble efforts to export what they cannot sell at home.

The severity of China’s inventory overhang has been carefully masked by the blocking or adjusting of economic data by the Chinese government — all part of an effort to prop up confidence in the economy among business managers and investors.

But the main nongovernment survey of manufacturers in China showed on Thursday that inventories of finished goods rose much faster in August than in any month since the survey began in April 2004. The previous record for rising inventories, according to the HSBC/Markit survey, had been set in June. May and July also showed increases.

“Across the manufacturing industries we look at, people were expecting more sales over the summer, and it just didn’t happen,” said Anne Stevenson-Yang, the research director for J Capital Research, an economic analysis firm in Hong Kong. With inventories extremely high and factories now cutting production, she added, “Things are kind of crawling to a halt.”

This seems an obvious outcome from a politicized economy.

As I previously pointed out:

-Today Chinese economy has been roughly split 50-50 between state owned and privately owned enterprises

-State companies use political means of “higher taxes, stricter regulation, and bureaucratic meddling” to “drive out private competitors”

-State banks discriminate in terms of lending where “only four percent of their loans to private businesses”. Thus, the recourse of private businesses has been through the informal or shadow banking systems. Ironically, transacting with unofficial credit markets “can be a criminal offense punished by long jail terms or worse”

The implication of the above is that much of China’s present day economy remains influenced by political forces. This means we cannot trust statistical figures to show real economic growth as they may likely be manipulated for immediate political goals.

Politicization simply means State Owned Enterprises (SOE) have hardly been driven by the discipline of profit and losses, and instead have been focused on attaining goals as dictated by the officialdom. Thus, to pad up on economic statistics, numerous SOEs engaged in production that has led to the glut of unsold goods.

Since statistics have been used as guide for the implementation of policy objectives, the government’s manipulation of statistics has also added to the misallocation of resources.

Lastly, excess supply of goods are also symptoms of the recessionary phase of China’s business cycle. This has been caused by easy money policies from China’s central bank, designed to attain credit driven permanent state of quasi booms, and has been compounded by capital spending binge by the government.

As the great dean of Austrian school of economics wrote,

The inflationary boom thus leads to distortions of the pricing and production system. Prices of labor and raw materials in the capital goods industries had been bid up during the boom too high to be profitable once the consumers reassert their old consumption/investment preferences. The "depression" is then seen as the necessary and healthy phase by which the market economy sloughs off and liquidates the unsound, uneconomic investments of the boom, and reestablishes those proportions between consumption and investment that are truly desired by the consumers. The depression is the painful but necessary process by which the free market sloughs off the excesses and errors of the boom and reestablishes the market economy in its function of efficient service to the mass of consumers. Since prices of factors of production have been bid too high in the boom, this means that prices of labor and goods in these capital goods industries must be allowed to fall until proper market relations are resumed.

Surplus goods along with ghost cities and malls and the huge shadow banking system all adds up to exhibit signs of the unwinding phase of China’s bubble economy.

The inflationary boom may have segued into a financial and economic bust.

No comments:

Post a Comment