The IMF reveals their true color.

From Bloomberg,

The International Monetary Fund endorsed nations’ use of capital controls in certain circumstances, making official a shift, which has been in the works for three years, that will guide the fund’s advice.In a reversal of its historic support for unrestricted flows of money across borders, the Washington-based IMF said controls can be useful when countries have little room for economic policies such as lowering interest rates or when surging capital inflows threaten financial stability. Still, it said the measures should be targeted, temporary and not discriminate between residents and non-residents.“Capital flows can have important benefits for individual countries across the fund membership and the global economy,” IMF staff wrote in a report discussed by the board on Nov. 16 and published today. They “also carry risks, however, as they can be volatile and large relative to the size of domestic markets.”Countries from Brazil to the Philippines have sought in recent years to manage inflows of capital that put upward pressure on their currencies and threatened to create asset bubbles. The new guidelines will enable the fund to provide consistent advice, though rules prevent it from imposing views about managing capital flows on its 188 member nations.

Capital (currency) controls treat the symptoms and not the disease.

The real disease has been the unhinged central banking-paper money system that perpetuates the worldwide bubble cycles. Such unstable system distorts the pricing structure that destabilizes economic balance, promotes high risk taking and encourages reckless yield chasing dynamics, and worst, redistributes wealth to the political elites and their cronies, whom are the first recipients of easy money bubble policies (the latter incidentally operates with an implied guarantee or moral hazard, they are usually beneficiaries of bailouts)

Eventually they all end up in a bubble bust.

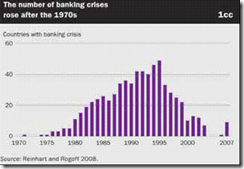

Countries with banking crisis exploded coincidentally after the Nixon Shock or the closing of the Bretton Woods gold exchange standard

Previously I warned that the penchant for greater interventionism in response to the recent crisis has sown the seeds of capital controls which risk the headway towards protectionism.

Capital controls are part of the grand scheme of financial repression policies designed by bankrupt governments to expropriate private sector resources.Aside from capital controls, other measures include, raising taxes, inflationism, negative interest rates, price controls and various regulatory proscriptions

Capital controls has short term impact and spawns black markets as the price spread between official and unofficial rates widens.

Yet capital controls or exchange rate controls will hardly prevent the inflation of bubbles borne out of internal or domestic policies. The Philippines, which has been cited by the article, should be a good example. Loose monetary policies have been in the process of puffing a property and stock market bubble which has been misconstrued by the mainstream as economic “growth” story.

As Austrian economist Dr. Frank Shostak warned

The idea that capital controls and fixing the external value of a currency can strengthen economic fundamentals is flawed. While capital controls may help boost economic activity in terms of GDP, they cannot lift the real net worth of the economy. On the contrary, capital controls will only add to distortions caused by the monetary pumping and the artificial lowering of interest rates, thereby making the inevitable economic bust much more severe.

No comments:

Post a Comment