I propounded in March of 2012 that the Bank of Japan’s inflationist policies will prompt for capital flight via carry trades, which will be disguised as FDI’s and portfolio flows into ASEAN and the Philippines:

The foremost reason why many Japanese may invest in the Philippines under the cover of “the least problematic” technically represents euphemism for capital fleeing Japan because of devaluation policies—capital flight!…Japan’s investments in ASEAN do not seem to be country specific, but more of a regional dynamic. Or that the Japanese probably hedge their ASEAN exposure by spreading their investments throughout the region.

Signs of such capital flows I have noted here in July 2012

But the yen carry trade may not just be limited to ASEAN but to the emerging market space.

A report from Reuters partly affirms my prognosis: (bold mine)

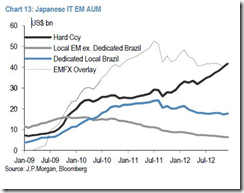

JP Morgan analysts calculate that EM-dedicated Japanese investment trusts, known as toshin, have seen inflows of $7 billion ever since the U.S. Fed announced its plan to embark on open-ended $40-billion-a-month money printing. That’s taken their assets under management to $67 billion. And in the week ended Jan 2, Japanese flows to emerging markets amounted to $234 million, they reckon. This should pick up once the yen debasement really gets going — many are expecting a 100 yen per dollar exchange rate by end-2013 (it’s currently at 88).At present, the lion’s share of Japanese toshin holdings — over $40 billion of it — are in hard currency emerging debt, JP Morgan says (see graphic).But if developed central banks’ seemingly endless money-printing starts to significantly inflate emerging currencies again, local currency debt is likely to become more attractive.

BoJ's policies will inflate bubbles not just EM currencies and debts denominated in EM local currencies but in their respective stock markets, as well.

I’ll post an update of Japan’s capital flight into ASEAN once I get the updated data.

No comments:

Post a Comment