I pointed out in last week that media, backed by the consensus, have been saying that China’s economy has been “recovering”. Such has been linked to the resurgent stock market as reflected by the Shanghai index

On the other hand, I have been pointing out that China’s government has been engaged in stealth stimulus via State Owned Enterprises (SoE) and from the PBoC which has been artificially boosting statistical recovery and has prompted for asset inflation.

Ironically the so-called recovering China has been reported to require another bout of record interventions from China’s central bank, the People’s Bank of China (PBOC) which has been slated for this week.

From the NASDAQ

China's central bank is set to pump a net 662 billion yuan ($106.3 billion) into the banking system this week through regular open-market operations, marking a record weekly liquidity injection in a bid to meet surging cash demand ahead of the Lunar New Year holiday, traders said Thursday.The People's Bank of China is offering CNY410 billion worth of 14-day reverse repurchase agreements, a short-term lending facility, they said.It injected a net CNY59 billion last week via its regular open-market operations after draining a net CNY49 billion the week before.

China’s government recently has been pinning the blame of easing policies, as well as currency wars, on developed economies that has led to domestic “imported inflation”. The reality is that there is no such thing as imported inflation. China’s concern over the growing risk of price inflation is a function of domestic policies.

As Kel Kelly at the Mises Institute explains

When the PBOC creates yuan, it expands the money supply. It is therefore this expansion in the money supply, not an artificially low currency per se that is creating price inflation in China.

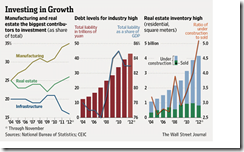

China’s economy has swimming in debt with the recent property bubble leading to record inventory levels (Wall Street Journal Blog).

Perhaps the real reason the why such record liquidity injection has been put in place has been about the tenuous state of the banking system.

According to Tim Staermose of the Sovereign Man:

That’s because, just as in the West, the Chinese government is engaging in a giant game of “extend and pretend.” Chinese banks have just rolled over 75% of all loans to local governments, which were supposed to have been repaid by the end of 2012.We’re talking about at least 3 trillion Chinese Yuan, or nearly half a TRILLION dollars worth of debt. It’s an enormous burden.

Global asset bubbles are about illusions based on policies of "extend and pretend". And China plays an important role in it.

Or perhaps an added reason could be that the PBoC's recent interventions in the currency markets could mean that China may have joined the currency war which she has been lamenting about. As an old saw goes, "If you can't beat them join them"

Doug Noland writes in article New Bull or Bigger Ro,Ro? Global central bank "international reserve assets" (excluding gold) - as tallied by Bloomberg – were up $712bn y-o-y, or 6.9%, to a record $10.960 TN. Over two years, reserves were $1.670 TN higher, for 18% growth. ... And M2 (narrow) "money" supply rose $9.8bn to $10.413 TN. "Narrow money" has expanded 6.7% ($653bn) over the past year.

ReplyDeleteI write in Stocks Trade Lower On Fears Of Eurozone Financial And Political Instability

The chart of the 200% Dollar ETF, UUP, shows a breakout, and the US Dollar, $USD, rose a strong 0.6%, to close at 80.19. The Swedish Krona, FXS, The Euro, FXE, Ths Swiss Franc, FXF, Rupe, ICN, the Australian Dollar, FXA, the Canadian Dollar, FXC, and the Emerging Market Currencies, CEW, traded lower. The Brazilian Real, BZF, rose to strong resistance. The US Dollar is no longer sinking it is rising; currencies are no longer floating, they are sinking. The US Dollar can no longer serve as the world’s reserve currency.

Derisking out of Nation investment, EFA, and Small Cap Nation Investment, IFSM, and deleveraging out of Commodities, DBC, on the exhaustion of the world central banks authority, has commenced competitive currency devaluation. Monetization of debt by the US Fed, the ECB, and the Bof Japan, and the PBOC, has finally turned “money good” investments, bad. Excessive credit liquidity has commenced the death of currencies. The chart of Major World Currencies, DBV, and Emerging Market Currencies, CEW, both show a trade lower from recent seven month peak highs. The chart of Commodity Currencies, CCX, shows a trade lower from an ascending wedge pattern.

Debt deflation, that is currency deflation, is causing the Milton Friedman Free To Choose Floating Currency System, that is the fiat money system, to start to die.

The twin spigots of Liberalism’s Finance, these being central banks monetary policies of credit liquidity, credit support, and quantitative easing, as well as currency carry trade investment based upon a falling Yen, have run dry and have turned toxic.

Liberalism’s Inflationism is turning into Authoritarianism’s Destructionism, with the result that the Age of Fiat Asset Inflation is ending, and the Age of Fiat Asset Deflation, is commencing.

The Mario Draghi Trade, that is the Euro Yen Currency Carry Trade, EUR/JPY, came to an end on February 7, 2012, as it closed lower at 125.50, as the Euro, FXE, closed 0.9% lower at 132.92, and the Yen, FXY, closed 0.1% lower at 104.71. With a full debased Yen Currency Carry Trade, there is no more fuel to stimulate Global Producers, FXR, or Nation Investment, EFA, and IFSM. As the dynamos of corporate profit and global growth, continue to wind down, a debt deflation cycle of falling currencies, and rising interest rates will intensify, causing the destruction of fiat wealth.

With increasing interest rates, on a Steepening 10 30 US Sovereign Debt Yield Curve, $TNX:$TNY,as is seen in the Steepner ETF, STPP, steepening, Bonds, BND, will be continually trading lower. And with the failure of Major World Currencies, DBV, and Emerging Market Currencies, CEW, and the derisking out of World Stocks, VT, VSS, and the deleveraging out of Commodities, DBC, a see saw destruction of fiat wealth has commenced.

A paradigm change is in the process of occuring. Liberalism’s democratic governance is pivoting to Authoritarianism’s regional governance. Investment choice is transitioning to leader diktat.

The chart of S&P 500, $SPX, shows a weekly gain of 0.4% to achieve an Elliott Wave 5 High to close at 1,157; with an ETF, SPY, close at 151.80. In contrast, the chart of World Stocks, ACWI, shows a weekly loss of 0.6% to enter an Elliott Wave 3 Down to close at 50.06. The chart of the Philippines, EPHE, shows a weekly gain of 1.9%, to an all time high of 38.60.