Central bank inflationism has only been fueling excessive speculation on global property markets. And the emergence of ghost communities, which are symptoms of bubbles, may not confined to China.

Belgravia, known as one of the wealthiest districts in the world, located at central London in the City of Westminster and the Royal Borough of Kensington and Chelsea, seem to be transforming into a ghost community largely due to foreign buyers.

From CNBC:

An odd thing was happening, or rather not happening, as dusk fell the other day across Belgravia, home to some of the world's most valuable real estate: almost no one seemed to be coming home. Perhaps half the windows were dark.It seems that practically the only people who can afford to live there don't actually want to. Last year, the real estate firm Savills found that at least 37 percent of people buying property in the most expensive neighborhoods of central London did not intend them to be primary residences."Belgravia is becoming a village with fewer and fewer people in it," said Alistair Boscawen, a local real estate agent. He works in "the nuts area" of London, as he put it, "where the house prices are bonkers" — anywhere from $7.5 million to $75 million, he said.The buyers, increasingly, are superwealthy foreigners from places like Russia, Kazakhstan, Southeast Asia and India. For them, London is just a stop in a peripatetic international existence that might also include New York, Moscow and Monaco.

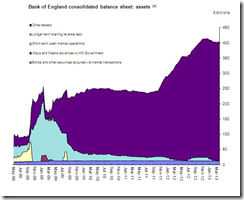

Rampant property speculation has partly been abetted by the weakening of the British pound relative to emerging markets currencies, largely brought about by the balance sheet expansion by the Bank of England.

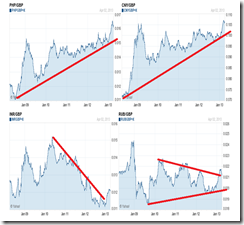

Except for India’s rupee, China’s yuan, the Philippine peso, and Russia’s ruble have mostly firmed against the British pound since 2008.

Yet prospects of a “triple dip” recession have only spurred political pressure on the Bank of England to pursue more quantitative easing which may add more fuel to more speculative frenzies.

Of course aside from sheer speculation, political money (e.g. slush funds) looking for overseas shelter could also play part in exacerbating speculative activities.

Ghost communities can be seen also in the US.

From the same CNBC article:

London is not the only city where the world's richest people leave their expensive properties vacant while they stay in their expensive properties someplace else; the same is true in parts of Manhattan. But the difference is that so many of them here are foreign, and that they look to be buying up entire neighborhoods."Many areas of central London have become prohibitively expensive for local residents," a recent report by the Smith Institute, a research group in London, said recently.

Worst, central bank fueled property bubbles incite social divisions or political chasms between haves and the have-nots epitomized by the politically correct terminology called “inequality”.

Again all these are symptoms of the global pandemic of bubbles.

Not just housing sitting empty but if no one lives there, local shops, bars, restaurants and cafes all close as well. Less jobs for local people......knock on effect....

ReplyDeletewhathouse.co.uk