The Economist’s sarcastic takedown of the the US tax agency the IRS: (bold mine)

WHEN Barack Obama fired the acting head of the Internal Revenue Service (IRS) earlier this month, he doubtless hoped to quell the hullabaloo about its seemingly partial treatment of applications for tax-exempt status from conservative groups. The IRS selected for extra scrutiny groups whose names included conservative buzzwords, such as “tea party”, “9/12” and “patriot”. Republicans accuse the taxmen of persecuting anti-tax groups. The IRS’s defenders insist that a few low-level functionaries simply made a clumsy attempt at an administrative short-cut. But the main reason why Americans dislike dealing with the IRS is not, however, the bureaucrats’ fault. Congress keeps making the tax code more complex. It is now 4m words long, and has been changed over 4,000 times since 2001. Americans spend 6.1 billion hours a year complying with it—enough work to keep over 3m people employed full-time without producing anything. Nearly 90% of filers pay for help with their returns. The cost of all this is equivalent to 15% of the tax raised says the Taxpayer Advocate, an ombudsman. Yet change may be a long time coming. Politicians usually balk at taking on the myriad vested interests which all ferociously defend their favourite tax breaks, says Bill Gale of the Brookings Institution, a think-tank. For that reason, he argues, “tax reform is always the bridesmaid and never the bride”

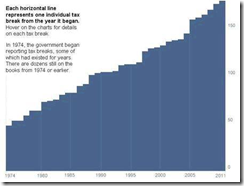

To give a better picture of what the bold highlights mean

Here is the basic 1040 tax form

More tax laws equals more tax breaks which serves as rewards to the politically favorite vested interest groups.

Cato’s Dan Mitchell tells us more “why the IRS bureaucracy deserves scorn”.

- It has thieving employees.

- It has incompetent employees.

- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

The power to tax is the power to destroy.

No comments:

Post a Comment