Back to my JGB-Japan debt crisis watch.

JGB yields have traded mixed today in what seems as relative composed markets.

JGB 30 year yields modestly rose as 10 year yields marginally declined.

Foreigners reportedly reduced their JGB holdings which now accounts for 8.4% of total outstanding debt from 8.7% last December.

Today, Bank of Japan’s Governor Haruhiko Kuroda announced that “he will do the utmost to avoid sharp rises in long-term interest rates helped the market slightly - but not to an extent that it offset selling in superlong bonds” (Reuters)

One day of calm markets does not a trend make. Good luck to Mr. Kuroda on what seems as wishful thinking.

The relatively tranquil JGB markets allowed Japan’s stock markets to regain some grounds. Today the Nikkei 225 bounced by 1.83%

Yet the propaganda to promote Abenomics continues.

Some of mainstream media continues to mislead the public on the supposed impact of Abenomics.

Early today, Japan's updated merchandise trade data was announced. Interestingly here are two contrasting reports

From Bloomberg:

Japan’s exports surged by the most since 2010 as the yen weakened and shipments to the U.S. jumped, boosting Prime Minister Shinzo Abe’s campaign to revive the world’s third-largest economyToday’s data may help to sustain confidence in Abe’s efforts to jump-start the economy with fiscal and monetary stimulus and a rollback of regulations restricting business. Volatility in stocks and bonds has threatened to damp sentiment as Abe and central bank Governor Haruhiko Kuroda seek to pull the nation out of a 15-year deflationary malaise.

Yes exports surged alright, but that’s only half of the picture.

From US news:

Japan's trade deficit rose nearly 10 percent in May to 993.9 billion yen (nearly $10.5 billion) as rising costs for imports due to the cheaper yen matched a rebound in exports, the Ministry of Finance reported Wednesday.Exports rose 10.1 percent in May over a year earlier to 5.77 trillion yen ($60.7 billion) while imports also surged 10 percent, to 6.76 trillion yen ($71.1 billion), the ministry said. Japan's trade deficit in May 2012 was 907.93 billion yen.

So whatever gains from exports has been effectively neutralized by imports. The result: the widening of trade deficits.

Add to the bulging trade deficit the substantial deterioration of Japan’s fiscal balance, this means that the Japanese will have to dip into their rapidly depleting savings or increase on their colossal debt burden just to finance such deficits.

So deteriorating fiscal, trade and price instability in Japan’s economy will hardly “help to sustain confidence” in Abenomics.

Why is this important? Because media’s framing of the above event exposes on the bias for reckless policies. Some media outfit clearly serves as PR outfits of politicians.

In the same context, people are being conditioned to believe that FED’s convening 'later' (Philippine PM time) will be critical the financial markets.

I have repeatedly been pointing out that US treasury yields have been ascendant since July 2012. This happened despite the FED’s QE 3.0 last September which had only a 3-month effect of lowering of UST yields.

Abenomics and ECB’s interest rate cut last May likewise failed to suppress coupon rates of the UST and of their respective bond markets.

French 10 year yields has been rising prior to the supposed Bernanke “Taper talk”.

And so with 10 year JGBs

The point is that yields have been rising even before the so-called Bernanke Taper Talk and will continue to rise regardless of the outcome of today’s FED meeting overtime.

The difference will be on the immediate effects from today’s policy actions.

If the FED will unexpectedly expands QE, then this may have temporarily dampen yields which should spike the stock markets for a short time. But given the diminishing marginal efficiencies of such easing programs, rates will continue to advance later.

Yet if the FED leaves the current program unchanged, then yields will likewise trend higher.

A Fed "taper" will accelerate the current uptrend.

As pointed out yesterday, US president Obama has hinted on Bernanke’s exit

If this will hold true, even if another money printer will replace Mr. Bernanke, uncertainty over a regime transition may compound on the pressure to drive yields higher.

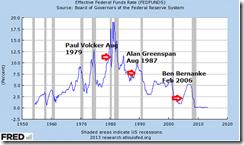

For every transition of the FED chairmanship since William Miller in March 1978, increases in FED Fund rates occurred.

10 year yields also reflect on the same pattern, as Bob Wenzel at the EPJ noted

As Federal Reserve chairman Paul Volcker left the Fed chairmanship in August 1987, the interest rate on the 10 year note climbed from 8.2% to 9.2% between June 1987 and September 1987. This was followed, of course by the October 1987 stock market crash.As Federal Reserve chairman Alan Greenspan left the Fed chairmanship at the end of January 2006, the interest rate on the 10 year note climbed from 4.35% to 4.65%. It then climbed above 5%.

The current environment seems like the proverbial calm before the bond market storm.

You mention the Bob Wenzel post, "As Federal Reserve chairman Paul Volcker left the Fed chairmanship in August 1987, the interest rate on the 10 year note climbed from 8.2% to 9.2% between June 1987 and September 1987. This was followed, of course by the October 1987 stock market crash."

ReplyDeleteWell, these days, a sharp rise in the Interest Rate on US Treasury Bond to 2.01%, on May 24, 2013, caused the death of credit, currencies, and money, that is wealth.

Zero Hedge reports 200,000 take to Brazil's streets in largest protest in two decades; this as Bloomberg reports Brazilian currency touches four year low.

The death of Liberalism’s credit and currencies is seen in the sharp drop seen in the Google Finance Chart of Aggregate Credit, AGG, together with the Indian Rupe, ICN, the Brazilian Real, BZF, the Australian Dollar, FXA, and the Emerging Market Currencies, CEW.

And the death of Liberalism’s money is seen in the ongoing combined Google Finance Chart of World Stocks, VT, and Nation Investment, EFA, in India, INP, Brazil, EWZ, as well as Australia, EWA.

Debt deflation, that is currency deflation, has finally come of age, through the failure of the world central bank policies of Global ZIRP and ongoing debt monetization, with the result that Liberalism’s Milton Friedman Free To Choose floating currency Banker regime no longer provides seigniorage of investment choice.

Jesus Christ is at the helm of the economy of God, Ephesians, 1:10, terminating the fiat money system and introducing the Beast regime’s diktat money system, which is first being developed through the mandates of Eurozone regional governance.

The diktat money system was conceived by Herman van Rompuy acting together with the EU Finance Minsters, in early May 2010 with the provision of Greek Bailout I, as well as the more recent Greek Bailouts II and III, and the Cyprus Bank Bailin.

The diktat money system was unleashed onto the entire world by the bond vigilantes calling the Interest Rates on the US Ten Year Note, ^TNX, higher, and the currency carry traders calling the Yen, FXY, higher, on May 24, 2013, inducing investors out of currency carry-trade, yield bearing investments, such as Electric Utilities, XLU, Mortgage REITS, Global Real Estate, DRW, and sending the Emerging Markets, EEM, Emerging market Bonds, EMB, Emerging market Currencies, CEW, such as the Brazilian Real, BZF, and nation investment, EFA, in the country of Brazil, EWZ, tumbling in value, being led lower by its banks BBD, ITUB, BBD, and BSBR

With the failure of Liberalism’s fiat money, there be many Angry Byrds, protesting all over the place, as the diktat of sovereign regional nannycrats, replaces democratic national governance.

In the Eurozone, the sovereign nannycrats include Klaus Regling, Jeroen Dijsselbloem, and Michel Barnier, and sovereign regional bodies such as the ECB, where governance is based upon the word, will and way of whoever rises, biting, ripping and tearing others apart, to become the top dog leader and top dog banker, to provide diktat schemes, such as bank deposits bailins, additional taxes, privatizations, sale of a country’s central bank’s gold reserves, capital controls, statist public private partnership oversigtht and management of government services as well as the factors of production, and the economy in general, and measures of debt servitude, all with the aim of enforcing austerity.