Actions in the JGB markets today has generally been benign today with yields falling across the curve.

This plus buoyant equities in the US and the subdued financial markets in China may have contributed to today’s surge in the Japan’s equity markets.

The Nikkei 225 posted its biggest gain in 2 1/2 weeks.

Well, it turns out that contrary again to the expectations of the officials pushing for more investments via “Abenomics”, Japanese institutions have been net sellers.

From Bloomberg:

Japan’s biggest quarterly rally in 25 years did little to entice institutional investors, whose stock holdings fell to the lowest proportion of overall holdings ever in March.The country’s insurers, lenders and trust banks pared their Japanese shares to 28 percent of total market value, the lowest ever, as of March 31, according to Japan Exchange Group Inc. (8697) Holdings have fallen from a peak of 44.1 percent in 1988. Fukoku Mutual Life Insurance Co. and Sompo Japan Nipponkoa Asset Management Co. are betting Prime Minister Shinzo Abe’s policies will fail to defeat deflation or restore sustainable growth.The Bank of Japan is doubling the monetary base and Abe has pledged public spending, tax reform and freer markets to kickstart the economy and encourage investment after 15 years of deflation made it profitable to hoard cash. Institutions have been net sellers of shares every week since mid-November, unloading 6.2 trillion yen ($63.4 billion) through June 21, according to data compiled by Bloomberg.

Well the Kuroda version of Abenomics started in April so we will see if this changes. But signs are it hasn't.

Yet if Japanese institutions has consistently been net sellers, who has been responsible for the actions of Japan’s equity markets?

Partly foreigners.

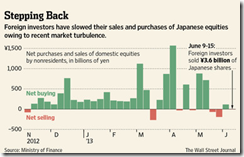

But the demand for Japanese equities by foreigners has sobered from what has originally been a frenzy.

Last week, foreign money had been marginal net sellers.

According to the Wall Street Journal:

Investors based abroad sold a net ¥3.6 billion ($37 million) of Japanese shares last week, but the gross amounts of selling and buying were both down more than 25% from record highs in the week of May 19-25, according to Ministry of Finance data.

This week the Dow Jones commodities via tradingcharts.com says that foreigners Bought Net Y171.2B of Japanese stocks.

The more important force has been the “Mr. Watanabes” or the highly leveraged retail investors.

From Bloomberg: (bold mine)

Stringing together 20 or 30 similar trades each day, Murakami said he’s almost doubled his money to $750,000 this year. He calls himself the smallest player in a group of seven day traders who chat with each other online, vacation together, and cumulatively buy and sell almost $100 million in stocks each day, using leverage to increase the size of their bets.Day trading helps explain why Japanese individuals now account for more than 40 percent of the nation’s equity volume, or about as much as the overseas institutions that once were the biggest traders. They’ve also helped make Japan the most volatile developed market, which is good for some and bad for others…The number of shares traded by individuals rose to a record in May, some 43 percent of Japan’s total equity volume, up from 27 percent before the rally started in November, according to the Tokyo Stock Exchange.

Growing number of retail trades theoretically should be a good development. But there is big difference, apparently Abenomics has encouraged rampant retail speculation via massive leverage:

Dramatic price movements aren’t the only thing that’s made Japan a day trader’s paradise. Deregulation of margin trading opened the flood gates, Murakami said. After rules were relaxed in January, investors can borrow three times as much as their brokerage account balances and turn loans over the instant they exit a trading position…One of Murakami’s friends, who goes by the blog name Tesuta, said looser rules let him leverage $4.5 million in cash into as much as $67 million in daily stock bets. He held up a hand-written ledger and showed his account balance at SBI Holdings Inc. as proof. He asked that his name not be cited for privacy reasons.

$67m out of $4.5 m represents about 14x leverage. That’s excess of the 3x allowed. Wow.

A 6.7% price swing can mean doubling of profits or a total wipeout. This partly explains the ongoing volatility in Japanese stocks.

Such dramatic use of leverage by retail participants only increases credit risks of the many Mr. Watanabes and the financial institutions financing them. Moreover, this shifts the public's incentives from productive undertaking towards speculative activities. The short term orientation implicitly promoted by such policies will not only dissipate savings, it will erode people's moral fiber who will see easy money rather than work and savings as virtues.

It is disheartening to see that many of the average Japanese have been converted into chronic gamblers due to reckless inflationist policies.

Abenomics seems to have transformed Japan's financial markets into a grand casino.

You write, The short term orientation implicitly promoted by such policies will not only dissipate savings, it will erode people's moral fiber who will see easy money rather than work and savings as virtues. It is disheartening to see that many of the average Japanese have been converted into chronic gamblers due to reckless inflationist policies.

ReplyDeleteI respond excellent post on investing as an entire gambling lifestyle.I live in Bellingham, WA, and spend some time in Mt. Vernon, WA.

Casino Gambling has been a growing part of an expanding economy, which has come from US Fed Easing as well as from Asians moving to Vancouver, Canada, which use to have a "little Asia" community; but now has large numbers of Asians who commute south on the Expressway to gamble at the casinos, but to buy gasoline at Costo, groceries at Fred Meyer-Costco, and clothing at Bellis Fair Mall and General Growth Properties enclosed retail shopping center.