Last night, the yield of 10 year US treasury spiked to the highest level in 16 months.

The recent streak of bond losses/ yield gains has been amazing, according to the Bloomberg:

Yields on 10-year U.S. Treasuries have advanced for six weeks, the longest stretch in four years.

Yields of US treasuries have been climbing almost across the maturity spectrum. This is with the exception of the 3 and 6 month T-Bills. The increase in the longer end has been in double digits over the month.

The ensuing response: a tumult in Emerging Market stock and bond markets

Example today: Singaporean bonds has been reportedly getting slammed. From the same article:

The price of Singapore’s 3.125 percent note due in September 2022 tumbled to S$110.42 as of 2:41 p.m. local time from S$110.98 June 7, based on data compiled by Bloomberg and supplied by the Monetary Authority of Singapore. The yield rose six basis points, or 0.06 percentage point, to 1.89 percent. It was the highest level since Aug. 2, 2011, based on the MAS data.

And so with the ongoing carnage of ASEAN equity markets as of this writing.

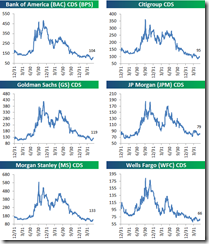

The Bespoke invest notes that there has been increases in US default risks of major US banks and brokers. But they downplay this as “still very low relative to where they've been trading over the past couple of years.” Of course reference point matters. But what may seem as relatively “very low” could also become “very high” in the future. Such observation can be called the anchoring bias.

As I pointed out last Sunday, underneath the surging US stock markets and aside from the tremors being experienced by most emerging markets, some segments of the US financial markets has also been adversely impacted by recent turmoil in the US (and global) bond markets.

Media has been awash with the adverse ramifications of the rioting bond markets. High yields funds has posted the biggest record outflows, US credit default swaps rises to a two month high along with deepening losses from junk-bond exchange-traded funds and carry trades endures from deepening losses.

The US financial markets appear to be in a Wile E. Coyote moment: buoyant stocks amidst as the seeming deterioration in interest rate sensitive industries or sectors and of the narrowing positive market breadth of world markets.

It is also important to point out that a sustained rise in yields in the bond markets will bring to fore counterparty and market risks from the interest rate sensitive derivatives markets as I explained last month.

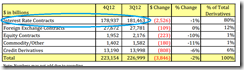

IN the US, according to the US OCC, 80% of the $223 trillion notional derivatives markets have been concentrated in interest rate products as of the fourth quarter of 2012

So the humongous derivatives markets would seem as highly vulnerable to the ongoing bedlam in the interest rate markets.

Money Market’s Mike Larson eloquently summarized of the the risks of the implosion of the US bond bubble last January.

To understand how huge this is, let’s first add up the value of all the stocks of all the listed companies on all the exchanges in the United States: That’s $25.8 trillion, according to the Fed.Plus, to make sure we’re not missing anything, let’s also add up the value of stock futures, stock options and other stock instruments: According to the U.S. Comptroller of the Currency, that’s another $2 trillion.Total equities in America: $27.8 trillion.Now, let’s do the same for bonds and other debt instruments:The total outstanding debt right now is $55.3 trillion. And that’s already twice as big as all the stock markets combined.But it’s just the tip of the iceberg. Because in addition, U.S. banks hold a whopping $179 trillion in derivatives that are based on bonds and the like. Grand total of bonds and debt instruments: $234.3 trillion.That’s 8.4 times the size of all U.S. stock markets combined!The plain truth is that today’s debt bubble dwarfs the bubble in tech stocks and the bubble in housing stocks combined.At the peak of the tech stock bubble in 2000, the entire Nasdaq index was worth $5 trillion.At the peak of the housing bubble in 2007, the entire real estate and financial sectors were worth $8 trillion.But today’s market in actual debt instruments is $55.3 trillion: That’s FOUR times larger than the tech stock bubble and the housing bubble COMBINED!

Rising rates signifies lethal mix with, or a contradiction to, low interest rate dependent asset bubbles: elevated asset markets which has been edificed around a colossally leveraged system.

Again it is important to reiterate that a persistence or an intensification of this trend magnifies the risks of a Wile E. Coyote moment: a devastating financial market accident.

Caveat emptor.

No comments:

Post a Comment