So the rumored railroad stimulus has become official.

From Bloomberg:

Chinese Premier Li Keqiang said the nation will speed railway construction, especially in central and western regions, adding support for an economy that’s set to expand at the slowest pace in 23 years.The State Council also yesterday approved tax breaks for small companies and reduced fees for exporters, according to a statement after a meeting led by Li. China plans a railway development fund, the government said.Additional spending would help the world’s second-largest economy, after the government signaled this week it will protect its 7.5 percent growth target for this year following a second straight quarterly slowdown…China had planned to invest 520 billion yuan ($85 billion) in railway construction this year, according to a rail-bond prospectus published July 19. Total fixed-asset investment by the railroads, which also includes train purchases and maintenance, will be 650 billion yuan.

The report didn’t say that the Chinese government embarked on a massive US $586 billion fiscal stimulus program in 2008-9 as shield against the global US epicenter based crisis.

Yet, Chinese economic growth has been faltering, that’s after a short period of “traction” from such policies (chart from tradingeconomics.com).

This means that stimulus work only for the “short term”. Also if $586 billion didn't do the job, then why would $85 billion of 'targeted' spending work?

Adding railroads to what seems as faltering railway activities (chart from Business Insider), not only reflects on an ongoing downshift of economic activities, but importantly such would translate to surpluses or wastages of capital—where losses of public companies will be passed on to taxpayers.

So the Chinese government appears to be buying time by providing a short term statistical boost to a floundering economy.

Of course, another thing the report didn’t mention is that much of the 2008-2009 stimulus has been funded heavily by debt.

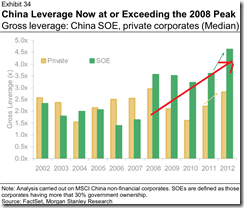

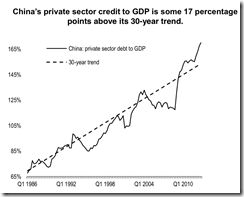

Debt of State Owned Enterprises (SoE) have now been estimated at an eye-popping 4.5x leverage. Private sector debt has also ballooned. One shouldn’t forget that a lot of private sector companies are tied to or related to the government, a lot of of them as vehicles for the local government.

The outcome of the 2008-2009 stimulus has been a colossal credit bubble that has fueled a runaway property bubble.

So the freshly installed Chinese government essentially will implement the same policies as the former administration. The more things change the more they stay the same…

The thrust towards public works means that Chinese stimulus program will be channeled via SoEs, which transfers economic opportunities to the political class and to the politically connected firms.

Public works also heightens credit risks on both the public and the private sector, as these $85 billion projects would be funded by more debt.

Such would further magnify bubble conditions, despite the cosmetic measures to curtail the shadow banking.

Unfortunately for taxpayers, $85 billion spending means higher taxes overtime.

While it may be true that part of Li’s program would be to cut taxes for small businesses which should be good news…

Resolutions passed at yesterday’s cabinet meeting included the exemption of companies with monthly sales of less than 20,000 yuan from value-added and business taxes starting Aug. 1, according to the statement. The move will benefit more than 6 million small businesses and affect jobs and income of tens of millions of people, the government said.

…such is likely a superficial attempt or effort.

The hope is that China’s economy would grow enough to pick up the public spending tab seems as wishful thinking as the 2008-2009 stimulus has shown.

Japan has had the same post-bubble fiscal and monetary stimulus experience through the 90s into the new millennium, or the lost decade, a failed practice which have been repackaged today as “Abenomics”, or differently put, doing the same things over and over again (but at a bigger and more audacious scale) and expecting different results—insanity.

Also the Chinese government’s grand 2008-2009 stimulus program has a growing list of public work disasters.

Politicization of economic activities means lower “real” economic growth as resources are allocated on non-market preferences and to vote or approval generating political pet projects, thus compounding on imbalances (bubbles), increasing waste and losses, higher taxes overtime, redistribution to the political class which implies greater inequality and cronyism, capital consumption and a lowered standards of living.

No comments:

Post a Comment