So the law of one price prevailed.

The pressures from the accrued heavy losses by other ASEAN markets during the last 3 days had eventually been vented on the Phisix in just a day. That’s because Philippine financial markets had been suspended on Monday and Tuesday due to massive floods, while Wednesday was a public holiday.

The 5.96% crash by the Phisix almost reflected on the cumulative 3 day loss by its foreign traded proxy, the iShares MSCI Philippines (EPHE), which fell by 6.6% over the same period.

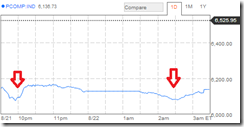

Intraday, the Phisix reached losses of up to 6.8% twice before local bulls (government agencies?) pushed back.

Today’s market carnage essentially falsified the minor reverse head and shoulder pattern (not included in the chart) shaped during the June lows which the bulls heavily banked on.

Instead, with today’s slump, the recent (also) minor head and shoulder reversal formation (light blue) has been fulfilled. Today’s action further reinforces the larger head and shoulders (red arrows).

The public has largely been mesmerized and misled by propaganda over “strong” fundamentals particularly so-called current account surpluses, “low” external debt and record Gross International Reserves.

But today’s sharp losses have been mainly due to foreigners stampeding out. Net foreign sales accounted for Php 4.7 billion (US 107 million based on 44.17 today’s closing)

The Peso fell by 1.19% to 44.17. The USD-Peso surged to a 20 month high. These are hardly signs of ‘confidence’ from so-called strong fundamentals.

Remember such high intensity selling represents the second incident in 3 months.

Yet should domestic equity markets remain under pressure, then this will likely be reflected on the Peso.

It is interesting to note that yesterday’s lackadaisical relief rally in the Indonesia’s equity markets, as represented by the JCI, had been neutralized by the growing dominance of bear market forces.

Despite climbing off the intraday lows, the JCI closed slightly below Monday’s session closing price.

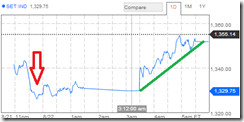

More interesting developing event in Thailand’s SET.

At one point in today’s session, the SET came close (1,325) to knocking on the door of the bear market (1,310 levels) only to be repulsed by renegade bulls.

The SET closed marginally lower by .25% after nearly a 2% fall.

Malaysia’s KLCI has also been feeling the heat and was down 1.4% today.

Mainstream media has now been looking to rationalize the losses on Malaysia’s financial assets imputing deteriorating current account, growing debt and a large exposure by foreigners in the bond markets. There hardly has been any notice of Malaysia’s bubble from which all three are symptoms.

Of course, hardly any trend is a one way street, which means given the recent sharp losses, we should expect some bounce. But it would be misplaced to deem such as ‘recovery’

Yet for as long the bond vigilantes prevail, debt financed markets will be susceptible to higher bond yields and interest rates. Yields of 10 year US notes have been drifting a new highs as of this writing.

Caveat emptor.

No comments:

Post a Comment