Have the average Indians been in a panic?

Sovereign Man’s Simon Black says current indicators point to a yes:

For the last 24-hours, banker and fund manager friends of mine have been telling me stories about oil refinery deals in North Korea, their crazy investments in Myanmar, and the utter exodus of global wealth that is finding its way to Singapore.My colleagues reported that in the last few weeks they’ve begun seeing two new groups moving serious money into Singapore– customers from Japan and India.Both are very clear-cut cases of people who need to get their money out of dodge ASAP.In Japan, the government has indebted itself to the tune of 230% of GDP… a total exceeding ONE QUADRILLION yen. That’s a “1″ with 15 zerooooooooooooooos after it.And according to the Japanese government’s own figures, they spent a mind-boggling 24.3% of their entire national tax revenue just to pay interest on the debt last year!Apparently somewhere between this untenable fiscal position and the radiation leak at Fukishima, a few Japanese people realized that their confidence in the system was misguided.So they came to Singapore. Or at least, they sent some funds here.Now, if the government defaults on its debts or ignites a currency crisis (both likely scenarios given the raw numbers), then those folks will at least preserve a portion of their savings in-tact.But if nothing happens and Japan limps along, they won’t be worse off for having some cash in a strong, stable, well-capitalized banking jurisdiction like Singapore.India, however, is an entirely different story. It’s already melting down.My colleagues tell me that Indian nationals are coming here by the planeful trying to move their money to Singapore.Over the last three months, markets in India have gone haywire, and the currency (rupee) has dropped 20%. This is an astounding move for a currency, especially for such a large economy.As a result, the government in India has imposed severe capital controls. They’ve locked people’s funds down, restricted foreign accounts, and curbed gold imports.People are panicking. They’ve already lost confidence in the system… and as the rupee plummets, they’re taking whatever they can to Singapore.As one of my bankers put it, “They’re getting killed on the exchange rates. But even with the rupee as low as it is, they’re still changing their money and bringing it here.”Many of them are taking serious risks to do so. I’ve been told that some wealthy Indians are trying to smuggle in diamonds… anything they can do to skirt the controls.(This doesn’t exactly please the regulators here who have been trying to put a more compliant face on Singapore’s once-cowboy banking system…)The contrast is very interesting. From Japan, people who see the writing on the wall just want to be prepared with a sensible solution. They’re taking action before anything happens.From India, though, people are in a panicked frenzy. They waited until AFTER the crisis began to start taking any of these steps. As a result, they’re suffering heavy losses and taking substantial risks.

Indian’s financial markets have been in a terrible mess.

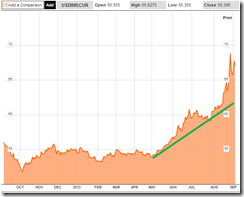

The rupee has been taking it to the chin down by 21.6% year to date and counting.

Yields of the Indian government’s 10 year bonds has touched US crisis 2007 highs but has retraced.

If the panic in the rupee escalates, India’s bonds will take more damage.

India’s equity markets the Sensex has been under pressure but has not encroached into the bear market yet, unlike ASEAN peers

The run in the rupee comes amidst India’s huge forex reserves. Another proof that reserves alone are not enough to prevent a run.

The reason for the rupee’s fall, desperate government unwilling to undertake reforms but has instead turned the tables on the private sector via gold sales prohibition and expanded capital controls. Thus the panic.

With free market champion Raghu Rajan assuming office only in September 4th, media has been optimistic that the new governor will be able to institute reforms. One of the early reforms which will supposedly be undertaken by Mr. Rajan has reportedly been to allow trade settlement in rupees. But mainstream media repeatedly calls for “expansionary policies” which ironically has been one of the main causes of India’s predicament.

Mr. Rajan will be faced with a huge stumbling block as I previously noted.

While it may be true that Mr. Rajan has a magnificent track record of understanding central banks and the entwined interests of the banking system coming from the free market perspective, in my view, it is one thing to operate as an ‘outsider’, and another thing to operate as a political ‘insider’ in command of power.Mr. Rajan will be dealing, not only conflicting interests of deeply entrenched political groups, but any potential radical free market reforms are likely to run in deep contradiction with the existing statutes or legal framework from which promotes the interests of the former.

The other source of media optimism has been in reports that the BRIC will forge a $100 billion currency swap pool. All these arrangements will be futile and only symbolical unless the real sources of India’s economic malaise are dealt with.

But if the panic in rupee will spread and incite major damages in the domestic banking system, where loans from the banking system represents 75% exposure on the economy, a crisis may be in the offing

And considering what appears as skyrocketing bond yields globally led by the US, time may be running out.

No wonder the legendary investor Jim Rogers has been short India.

Yet if the rupee meltdown persist and worsen, such will compound on the gloomy environment for Asia.

Caveat emptor.

James Crabtree of Financial Times reports “Fears are rising for the health of India’s banking system as slowing economic growth and rapid currency depreciation threaten to worsen asset quality and reduce demand for bank credit from large industrial companies. The growing concerns complicate the task facing Raghuram Rajan, who takes over today as head of the Reserve Bank of India, a role that includes responsibility for bank regulation, as he attempts to chart a path through the deepening currency crisis. Non-performing and restructured loan levels in Asia’s third-largest economy have risen steadily over the past year to stand at around 9% of assets and could reach 15.5% over the next two years, according to Morgan Stanley. Indian companies hold around $225bn of US dollar-denominated debt, as much as half of that estimated to be unhedged, while some larger Indian banks including State Bank of India and ICICI have raised money via dollar-denominated bonds in recent years.”

ReplyDelete@theyenguy thanks

ReplyDelete