We have been repeatedly told that Abenomics or Japan’s version of central bank inflationism will deliver the magic economic growth formula for Japan's seemingly perpetual stagnation.

Lately media, banking on surveys, say that one source of optimism has been in the manufacturing index, which in August rose to 52.2 from 50.7. This has supposedly even risen to 52.5 in September.

And unfortunately like in Europe, what people say and what people actually do have been different.

Contra surveys, real Industrial output DROPPED in August, according to the Wall Street Real Time Economics Blog (bold mine)

In a sign that Prime Minister Shinzo Abe’s aggressive economic stimulus has only produced mixed results at best so far, industrial production dropped a larger-than-expected 0.7% in August from the previous month, according to the Ministry of Economy, Trade and Industry on Monday. Economists were looking for a more modest 0.4% fall…By category, output for consumer durables, such as passenger cars, refrigerators, TV sets and notebook computers, fell an average 2.5%.“Recent data show that a larger portion of household income needs to be spent to pay for basic necessities, leaving much less money for discretionary items,” said the ministry official briefing reporters.The prices of daily necessities, such as energy, have been on the rise recently as businesses started passing on the higher costs of imported goods to consumers amid a sharply weaker yen.Output was also down in the important export sector. Production of capital goods, which are largely for export, fell 1.7%, despite the recent weakness of the yen, which should make Japanese exports more competitive. “Exporters are using a weaker yen to rebuild profit margins rather than cutting prices and boosting exports. We are waiting for them to start cutting prices and boosting output,” the briefer said.The only good news for Mr. Abe in the figures was itself something of a mixed blessing. There was strong demand for cement and other bridge construction materials, on demand from expressway operators. Output was up 1.3% for the fabricated metals category, and up 1.0% for the ceramics and stone category

Media blames the fall in industrial production on Consumer Price Inflation (CPI).

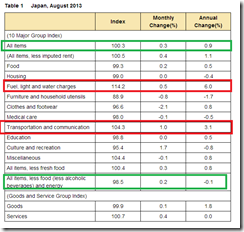

The reality is that the bulk of Japan’s consumer price inflation for August appears to have been largely concentrated on energy and energy related expenditures such as light and transportation (red rectangles). Excluding energy (and food), Japan’s CPI even FELL by .1% annualized (lower green rectangle).

With input prices rising faster, businesses in Japan are having a difficult time passing these costs to the consumers as I explained before. So a squeeze in profits, which are distortions on economic calculation and therefore a drag on economic coordination activities, has been prompting for reduced output; no matter what media and their apologists say.

And the increases in cement and construction materials is a sign of government induced output.

Thus, the industrial data reveals that the private sector has been reluctant to participate in real economic activities, while government activities has been bolstering statistical economic growth. Yet statistical growth is being touted as an excuse to raise taxes.

This fall in industrial output appears have been reinforced by Japan’s joblessness which likewise soared in August. Again from another Wall Street Real Times Economics blog

The main unemployment reading came in at a surprisingly high 4.1% in August, the government said Tuesday, the first rise in six months and an apparent dark cloud on a day of otherwise bright economic data. It was also higher than the 3.8% predicted by economists surveyed by The Wall Street Journal.

Media has been quick to defend this by saying that the August spike has been due to more people entering the workforce.

However, logic tell us that when businesses dithers on investing, so will this be reflected on employment....unless the government goes on a hiring binge.

However, logic tell us that when businesses dithers on investing, so will this be reflected on employment....unless the government goes on a hiring binge.

The reality is that all these extoling or media worship of Abenomics represents a (propaganda) justification for Japan PM Shinzo Abe’s call for higher taxes and more inflationism and interventions—which of course benefits the cronies than the economy.

And today PM Abe raised taxes. From today’s Reuters:

Prime Minister Shinzo Abe took a long-awaited decision to raise Japan's sales tax by 3 percentage points, placing the need to cut the nation's towering debt ahead of any risk to recent economic growth, as he now focuses on crafting a broader package of measures to address both problems further.Mr. Abe on Tuesday promised more stimulus to cushion the impact of the sales-tax rise on the economy, stressing the nation needs both fiscal consolidation and economic growth to end 15 years of debilitating deflation.The stimulus measures total around ¥5 trillion ($51 billion), including cash-handouts to low-income families, Mr. Abe said. On top of that, there will be tax breaks valued at ¥1 trillion for companies making capital investments and wage increases.

The so-called statistical growth of Japan’s debt laden economy has recently been driven by government spending rather than from the private sector. The industrial output data, as noted above, reveals of such disparity.

The implication is that Japan will need more debt to finance all these noble sounding crony benefiting boondoggles which will only extrapolate to increasing debt and consequently the burden of debt servicing.

And it is a mistake to believe that tax hikes will proportionally raise the required revenues for the simple reason that people respond to incentives (whether positive or negative) brought about by such policies.

Café Hayek’s Don Boudreaux explains

The reason for these outcomes is that people respond predictably to incentives – in this case, to incentives created by higher taxes. Obliged, for example, by such a tax to pay a higher price for apples, consumers will not buy as many apples as they bought before the tax hike. Similarly, obliged – because of the tax – to accept a lower take-home price on each pound of apples sold, sellers aren’t willing to sell as many pounds of apples with the tax as they were before the tax was raised.

So Abenomomics runs a greater risks of generating lower rather than higher revenues overtime as real (not statistical) economic growth weakens further.

As I wrote three weeks back:

Raising sales tax or whatever taxes will only accelerate the downside spiral of Japan’s economy. Japanese investors have already been reluctant to invest, how would higher taxes encourage investments and more economic output?

Even a former adviser to billionaire George Soros and now a member of Japan’s upper house of parliament, Takeshi Fujimaki reportedly joined politics because he sees the inevitability of Japan crisis which he sees will occur in 2020.

With Japan’s government’s government intensifying the ponzi financed debt spending spree, I believe that a Japan credit event is likely sooner than later (2020)

Finally, seen from the yen (USD-JPY), the wonders of Abenomics seem to be stalling. This has big implications. A falling yen is a manifestation of the effects of the BoJ’s inflationism. If the yen refuses to fall further then the “inflation” on Consumer Price Index will have hit a wall.

So this means either the current boom will turn into a bust or that PM Abe will have to significantly ante up on Abenomics via an even more aggressive BoJ.

Tick toc tick toc.

No comments:

Post a Comment