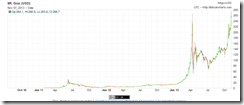

Bitcoin surged to its highest level ever

Nick Colas of ConvergEx via the Zero Hedge explains Bitcoin’s creative myth and appeal. (bold original)

Creation myths are great anchors for a belief system, but there have to be other parts to the narrative; bitcoin is safely into its own “Exodus” – the second book of the Old Testament. That fall from the highs was just the beginning of its problems.The U.S. government made it clear that they expect all currencies and their users to adhere to anti-money-laundering laws, including know-your-customer statutes which eliminate the notional secrecy of bitcoin.The Feds also went after the druggies, shutting down Silk Road – a widely known website for the purchase of illicit substances.In an odd twist of fate, the U.S. government now owns about 174,000 bitcoins, with a current value of $42 million thanks to the Silk Road bust and other actions.If bitcoin were a company, the class action lawyers would be circling, fighting for air with the bankruptcy experts. There is simply no way so much legal action, let alone several ongoing problems with security in the system, would have left Satoshi Nakamoto’s creation as anything but roadkill on the world’s economic superhighway.But here’s the beauty part: bitcoin is making a new high this week, breaking through the spiky bubble levels of April in a pretty controlled and orderly manner. What gives? A few points:The biggest bitcoin exchange is now in China, displacing Japanese, American and European sources of demand. That enterprise is called BTC China, and its CEO Bobby Lee hails from Yahoo! and Walmart China. Oh, and he graduated from Stanford with a degree in Computer Science. In short, an apparently pretty clever fellow.Our sources in the bitcoin community also agree that Second Market, the New York based business best known for trading pre-IPO company stock, has become a major player in demand for bitcoin. Earlier this year they started the Bitcoin Investment Trust, an open ended product to buy and hold bitcoins. There’s no way to know how much Second Market has purchased on behalf of its clients, but it must be a popular offering – the banner ad on their site for the trust occupied the top third of their front page.It’s not all been roses for bitcoin, even in this recent run-up. Back in September computer science researchers from UC – San Diego showed that it was actually fairly easy to track individual transactions in the bitcoin transaction ledger. Just this week, academics at Cornell proposed that bitcoin could eventually be coopted by a handful of “Miners” who could hijack the system.So why is bitcoin seemingly minted on Teflon? Limited supply, for one reason. There will never be more than 21 million bitcoins, and there are only 12.0 million currently. In the 4-ish minutes it has taken you to read this far, the most new bitcoins that might have been issued is 25, or $6,250. In the same timeframe, the Federal Reserve has pushed another $7.8 million into the financial system with Quantitative Easing. And then there is the undeniable creation-story appeal – a technology based sort-of-secret store of value. If James Bond, Sergey Brin and Paul Volcker all got together and designed their ideal currency, it might look a lot like bitcoin.At the same time, the story isn’t over yet. If the “Exodus” analogy is to fit at all, then bitcoin is still in the wilderness. It has clearly withstood many challenges, and there are probably more to come. The end of the journey actually has little to do with how much bitcoin is worth, but what it might be good for.That’s the piece some investors – many made quite wealthy by the incredible increase in bitcoin’s value – are working on now. A few final thoughts here:Bitcoin is a more efficient method of transferring money than the current global banking system. The transaction ledger is essentially kept for free by the mining community. Want to send $100 to someone in England and have them redeem British pounds? It will likely cost you $5 or more. A bitcoin transfer is essentially free.Merchants can accept bitcoin payments without paying the typical credit card fees of 1-5%. That’s one reason for the growing acceptance of bitcoin in China – online merchants are starting to accept this online currency.Bitcoin could become a country’s ‘Second currency’. One of the more interesting conversations with one of our industry sources is the thought that one or more sovereign nations would entertain making bitcoin a parallel currency to their existing monetary system. Keep in mind that our source owns a lot of bitcoin personally…. But it is an intriguing thought nonetheless

In my view, bitcoin and other forms of cryptocurrencies represent one of the major manifestations of the deepening evolution to the information age which 20th century political systems have been vehemently resisting.

No comments:

Post a Comment