In the latest (2012) tally of the Financial Stability Board on their recent Global Shadow Banking Monitoring Report 2013, Global Shadow Banks—”or credit intermediation involving entities and activities outside the regular banking system”—jumped by $5 trillion (7.5%) to $71 trillion in 2012.

The FSB estimates that Shadow Banks now account for “80% of global GDP and 90% of global financial system assets”

Here are some of the major findings by the FSB: (bold mine)

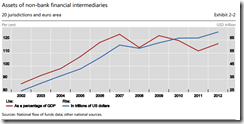

-According to the ‘macro-mapping’ measure, based on ‘Other Financial Intermediaries’ (OFIs), non-bank financial intermediation grew by $5 trillion in 2012 to reach $71 trillion. This provides a conservative proxy of the global shadow banking system, which can be further narrowed down.-By absolute size, advanced economies remain the ones with the largest non-bank financial systems. Globally OFI assets represent on average about 24% of total financial assets, about half of banking system assets and 117% of GDP. These patterns have been relatively stable since the crisis.-OFI assets grew by +8.1% in 2012, helped by a general increase in valuation of global financial markets, while bank assets were relatively stable as valuation effects were counterbalanced by shrinking balance sheets. The global growth trend of OFI assets masks considerable differences across jurisdictions, with growth rates ranging from -11% in Spain to +42% in China.-Emerging market jurisdictions showed the most rapid increases in non-bank financial systems. Four emerging market jurisdictions had 2012 growth rates for non-financial bank intermediation above 20%. However this rapid growth is from a relatively small base. While the non-financial banking system may contribute to the financial deepening in these jurisdictions, careful monitoring is still required to detect any increases in risk factors (e.g. maturity transformation or leverage) that could arise from the rapid expansion of credit provided by the non-bank sector.-Among the OFI sub-sectors that showed the most rapid growth in 2012 are real estate investment trusts (REITs) and funds (+30%), other investment funds (+16%) and hedge funds (+11%). Of note that the growth rate for hedge funds should be interpreted with caution as the FSB macro-mapping exercise significantly underestimates the size of the hedge fund sector. The results of the recent IOSCO hedge fund survey provide a more accurate picture of the size of the hedge fund sector (see below and Section 4) but do not provide an estimate of its growth.

My comments:

1. The above figures are conservative estimates. It means shadow banking could even be larger.

2. Asset bubbles have played a role in increasing OFI asset values.

3. Emerging markets led by China Argentina India and South Africa have accounted for the largest increases in 2012

4. While the FSB cautions that EM figures may reflect on a “low base effect” for emerging markets, this excludes China whose shadow banks assets have been fast catching up with the assets of the formal banking system.

5. Sectoral asset growth patterns by OFIs have been mostly in the real estate and the financial sectors, very much like the growth patterns in the formal banking system of the Philippines.

The other way to look at this is that shadow banks have played a significant role in the blowing of global asset bubbles while doing little to finance the real economy.

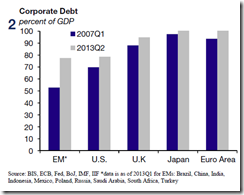

The FSB’s report squares with the corporate debt growth figures shown by the Institute of International Finance.

This shows that exploding credit has not just been in the formal banking sector but likewise in the informal banking sector.

This shows that exploding credit has not just been in the formal banking sector but likewise in the informal banking sector.

No comments:

Post a Comment