Last week, I reasoned that changes in US monetary policies and changes in the interest rate signals in the US will naturally force adjustments based on “yield spreads” which eventually will be transmitted (whether you like it or not) as emerging market monetary policies. I stated that such alterations will expose (bold original) “on the distinct vulnerabilities of these economies thereby leading to massive outflows.”[1]

I did not go further. However, one mainstream report seems to have picked up where I left off. And they came with a gala performance

As a side note, signs are that the mainstream has increasingly been recognizing that the problem of emerging markets has not been due to demons or bogeymen of current accounts, exchange rate mechanism or Non Performing loans but rather on debt, debt and debt.

The following quote is from Kermal Dervis former Minister of Economic Affairs of Turkey and Vice President of the Brookings Institution[2] (bold mine)

Unfortunately, the real vulnerability of some countries is rooted in private-sector balance sheets, with high leverage accumulating in both the household sector and among non-financial firms. Moreover, in many cases, the corporate sector, having grown accustomed to taking advantage of cheap funds from abroad to finance domestic activities, has significant foreign-currency exposure.Where that is the case, steep currency depreciation would bring with it serious balance-sheet problems, which, if large enough, would undermine the banking sector, despite strong capital cushions. Banking-sector problems would, in turn, require state intervention, causing the public-debt burden to rise.

Mr. Dervis’ observation “taking advantage of cheap funds” and my theory “ expose on the distinct vulnerabilities that leads to massive outflows” brings into light the missing factor: the US$ 2 trillion EMERGING MARKET CARRY TRADE

In a report by Bank of America Merrill Lynch (BofAML), the troika of authors Ajay Singh Kapur, Ritesh Samadhiya,and Umesha de Silva wrote that the Fed motivated an Emerging market credit bubble and called this “the Pig in the Python”[3].

The QE channel worked through Emerging Markets too. By lowering the US government bond yields to a bare minimum, and zero—ish at the short end, a search for yield ensued globally. Emerging market banks and corporates have gone on an international leverage binge, yet another carry trade, the third in 20 years. The first one was driven by European banks, financing East Asian capex –that ended in 1997. The second one was global banks and equity-FDI supporting mainly capex in the BRICs. That ended in 2008. This time, it is increasingly non-equity flows: commercial banks and, more importantly, the bond market –undercounted in the BoP and external debt statistics that conventional analysis looks at.

Like me, the authors question on the accuracy of statistics where they delve deeper only to discover many unreported debt. They write of the difference between resident borrowing from a foreign bank branch in a country as loans issued by residence that is counted in the Balance of Payment (BoP) and from borrowing by the same resident in the offshore bond and inter-bank markets which they consider as loans by nationality, which appear to be unaccounted for in the BoP calculations. The difference according to them have been substantial.

For externally-issued bonds, USD1042bn has been raised by the nationality of the EM borrower since 2009, USD724bn by residence of the borrower – a gap of USD318bn, or 44%. This undercount is USD165bn in China, USD100bn in Brazil, and USD62bn in Russia. There is evidence that this bond borrowing overseas by EM non-financial corporates is part of a carry trade, with these corporates acting like financial intermediaries. EM banks have also been busy issuing bonds overseas, a part of this carry trade. We do not have the breakdown for international bank loans by residence and nationality

Oh I noted that contra cheerleaders who think that by shouting “forex reserve!” “forex reserve!” “forex reserve!” they can drive away EM demons[4], the authors like me also note how forex reserves have been manifestations of the ‘sins’ of the credit inflation binge rather than as signs of strength.

Since 3Q2008, the US Federal Reserve QE has unleashed a massive USD2tn debt-driven carry trade into emerging markets, disproportionately increasing their forex reserves (by USD2. 7tn from end-3Q2008), their monetary bases (by USD3.2tn), their credit and monetary aggregates (M2 up by USD14.9tn), consequently boosting economic growth and asset prices (mainly property and bonds). As the Fed continues to taper its heterodox policy, we believe these large carry trades are likely to diminish, or be unwound

And here is where it gets more interesting.

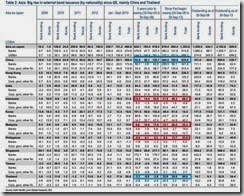

In Asia, the authors worry about the explosive external debt growth from time period of 2008 and 2013 (blue rectangles), mainly from China and Thailand in terms of bank lending and bonds. The red rectangles are the other ASEAN debt position acquired from the FED sponsored EM carry trade.

While the Philippines have the least exposure in nominal US dollar based loans, at 4.34x (!) the Philippines has the 2nd biggest growth rate after Thailand.

This report seems consistent with the Deutsche Bank report I earlier noted which showed how the companies from the Philippines ramped up on US dollar loans in the global corporate bond markets in 2013.

And it would be natural to see a limited but concentrated bond market growth in the Philippines for one simple reason as I noted[5]

The small size of bond markets fit exactly with the low penetration level of households in the banking and financial system. This means that the dearth of savings being intermediated into investments via the banking sector or via the capital markets have hardly been signs of real growth.Importantly, because of the small size of the corporate bond market, the top 10 share in terms of % to the total is at 90.8%. Said differently, the benefits and risks of Philippine corporate bonds have been concentrated to these top 10 issuers.

So should the BofAML’s fear of the risks from the unwinding of the massive EM carry trade materialize, it would seem unfortunate that based on the data from both Bank of America Merrill Lynch and Deutsche Bank, the Philippines or ASEAN major hardly be immune from a contagion.

Don’t forget we seem to be seeing accelerating signs of bank runs in emerging markets. Over the past one and a half weeks, Kazakhstan following the massive devaluation endured three bank runs[6], Ukraine suffered a bank run[7] and our neighbor Thailand just had a bank run on a state-owned bank[8]!

And while China hasn’t had a bank run yet, they seem to have undertaken a series of bailouts of delinquent financial institutions.

Sharp volatility in EM financial markets, stock markets fighting off bear markets, rising rates amidst spiraling debt loads, risk of unwinding of carry trades and bank runs, great moment for stocks right?

A final comment on the pig in the python EM carry trade, the above charts seem to suggest that there has been some correlation between US stocks as measured by the S&P 500 (yellow), the USDollar Yen (orange) and Emerging Markets stocks (EEM green) where all three seem to be moving in a synchronous fashion.

While correlation isn’t causation, could such synchronicity be a function of the carry trade in motion? Are performances of stocks based on ‘fundamentals’ or based on the carry trade anchored on US Federal Reserve policies?

Interesting.

[1] See Emerging Markets: Why Adjustments For Relative Yield Spreads has been Disorderly February 17, 2014

[2] Kermal Dervis Tailspin or Turbulence? Project Syndicate February 17, 2014

[3] Ajay Singh Kapur, Ritesh Samadhiya,and Umesha de Silva Pig in the Python –the EM carry trade unwind Bank of America Merrill Lynch February 18, 2014

[4] See Emerging Market Turmoil: The Fallacy of Foreign Currency Reserves as Talisman February 3, 2014

[5] See Phisix: Will the Global Risk OFF Environment Intensify? February 3, 2014

[6] See Kazakhstan’s Devaluation Triggers Bank Runs February 20, 2014

[7] See Behind Ukraine’s Bank Run February 22, 2014

[8] See EM Crisis Over? Thailand Hit by a Bank Run February 19, 2014

No comments:

Post a Comment