At her inaugural news conference as the head of the US central bank, the US Federal Reserve, Ms. Janet Yellen uttered something that has largely been considered a “taboo” in the financial world.

What did she say? From Reuters:

The U.S. Federal Reserve will probably end its massive bond-buying program this fall, and could start raising interest rates around six months later, Fed Chair Janet Yellen said on Wednesday, in a comment which sent stocks and bonds tumbling…

Ms. Yellen's market shaking statement:

"I -- I, you know, this is the kind of term it's hard to define, but, you know, it probably means something on the order of around six months or that type of thing. But, you know, it depends -- what the statement is saying is it depends what conditions are like."

Why should the higher interest rates suffer the markets? Well the simple answer is DEBT.

So how did ASEAN financial markets react?

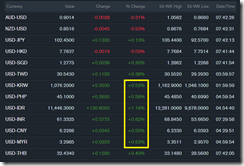

Let us first check on Asia’s currency markets.

The Bloomberg data shows that the US dollar soared by over .5% against 5 Asian currencies, the Indonesian rupiah (1.16%), Indian rupee (+.62%), the Philippine Peso (+.58%), the Chinese yuan (+.55%) and the Korean won (+.52%). The US dollar even firmed against the New Zealand and Aussie dollars.

It was an all US dollar show for today for the rest of Asia.

For the Peso, the USD-Peso has now breached the 45 level (45.1) and is within striking distance at the 52-week high of 45.48. Today’s sharp losses by the Peso essentially piggybacks on the declines of the early week.

Now let us move to the bonds.

ASEAN bonds crumbled today. This has been led by…guess who?…the Philippines whose yields has spiked by 31.3 bps!

Yields of 10 year Philippine bonds have now surpassed the July 2013 “taper tremor” highs.

Didn’t Moody’s just recently blessed the Philippines saying the she won’t be hurt by a sudden stop? Then why today’s violent reaction?

Most Asian stocks as shown by the Bloomberg had been hit pretty hard. The Nikkei plunged 1.65%, the Shanghai Index 1.4%, Australia’s S&P/ASX 200 1.15% and Taiwan 1.06%.

Except of Indonesia’s JKSE, ASEAN stocks were the least relatively damaged.

Indonesia’s JKSE was hammered down by 2.54%. Today's loss which adds to this week’s earlier declines has nearly erased Friday’s dramatic 3.23% advance.

ASEAN’s stock market still remains very complacent. So far stock markets of Malaysia, Philippines and Thailand appear to be implying that falling currencies and higher yields won’t impact earnings.

They seem to also forget that once monetary policies of US and other developed economies tightens, emerging markets including emerging Asia will need to align with them. And such policy adjustments will expose on her unsustainable debt levels accrued during zero bound days. Thus the likelihood of more market earthquakes as I previously discussed.

Well good luck to the staunch worshipers of bubbles who believe that they are immune to the growing variety of risks.

Perhaps Ben Bernanke could be asking Asian-ASEAN markets: "Miss me yet?" (hat tip zero hedge)

No comments:

Post a Comment