“The most disgraceful thing in the world, they think, is to tell a lie; the next worst, to owe a debt: because, among other reasons, the debtor is obliged to tell lies.”—Herodotus: On The Customs of the Persians

In this issue:

Phisix: First Quarter GDP Drop to 5.7% has hardly been about Typhoon Yolanda

-Differentiating Primary from Secondary Cause

-The Link between Typhoon Yolanda and Economic Growth? Coconuts!

-Fishing for Truth

-Construction Slump Amidst a Bank Lending Boom??? Yikes!

Phisix: First Quarter GDP Drop to 5.7% has hardly been about Typhoon Yolanda

Sorry but I have to play again the role of the unpopular spoiler.

I am not supposed to write this weekend but recent developments have been compelling enough for me to deliver a shorter than usual outlook.

Differentiating Primary from Secondary Cause

In the realization of what seems as widespread misinformation that has been unquestioningly accepted and imbued by the public as ‘fact’, such requires some counterbalancing.

Let me state my position clearly. I do NOT deny that Typhoon (Haiyan) Yolanda has contributed to the economic decline.

However my position is that the embedded imputation that the deadly and costly storm accounts for as the main source of the unexpected slowdown in the statistical economy or “The relatively slow growth is expected given the magnitude of destruction by typhoon “Yolanda” to agriculture as proposed by Philippine officials has been patently misguided.

Secondary causes or aggravating factors are not the same as the primary driver.

Of course, officials can be slippery enough to deny such association as shown by this newspaper narrative “while provinces directly affected by Yolanda accounted for a relatively small part of the economy, the damage in those areas disrupted supply chains nationwide, dragging down the entire country”

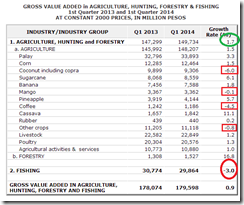

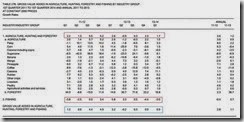

The following table is from the National Statistical Coordination Board (NSCB) is a reconstruction of the 1st quarter GDP intended to reveal the relationship between two important factors: the share contribution and the growth rates of each sector, subsector and the GDP-GNI. Since my concern is of the risks from the supply side, I will focus on the statistical data based on the industrial origin of the GDP methodology. All data in this discussion will be based on 2000 constant prices.

The last column represents the growth data as shown in media: 5.7% GDP growth, .9% growth in Agriculture, 5.5% expansion in industry and the 6.8% outperformance of the service sector which lifted the statistical data.

The prior column shows the difference in the context of the distributional share of sectoral performance of the economic pie. The reason I’d like to exhibit the distribution is to examine whether alleged growth has been inclusive or exclusive. Put differently, to know whether growth has been broad based or concentrated.

The blue colored numbers represent the significant gainers, while the red numbers have been the decliners whereas the black numbers are industries that posted marginal changes.

Let me further clarify that a loss in the share means either that the sector suffered losses or other sectors have outweighed the growth performance of the given industry.

We will have to revert back to the table once in a while.

The faithful crowd will likely construe the following as needless caviling. But remember movements in the stock markets have been anchored in the entrenched conviction that the stock market performance equals economic growth. Even more important is the deeply held misperception that the Philippine economy has reached an immutable and irreversible new paradigm.

So a balanced perspective has to be presented to guide the mature audience why the boom should not only be questioned or doubted, but also to show that such has been founded on an unsustainable model that has been destined to crumble.

The Link between Typhoon Yolanda and Economic Growth? Coconuts!

Mainstream media associates the following figures as related to the claim of “disrupted supply chains nationwide”; “Slowdowns were noted in several key sectors. For instance, agricultural output growth slowed to 0.9 percent in the first quarter from 3.2 percent in the same period last year. The manufacturing industry also suffered, growing by just 6.8 percent from last year’s 9.5 percent. In construction, growth slowed to 0.9 percent from 31.1 percent in 2013, dragged down mainly by the private sector.”

Yet media and domestic officials hardly even exerted any effort to explain HOW this supposed association or supply chain links ever occurred. The connection had simply just been presumed or rationalized.

Let us take on Agriculture first.

Agriculture has been reported to have slowed by .9%. Looking at the table, as a share to the overall economy the industry has declined from 11.15% to 10.64% for year on year even when this sector posted a positive growth. The implication is that growth in the other industries outshined agriculture that resulted to its loss of share.

Meanwhile, fishing represents the only subsector of the agricultural industry. Fishing accounts for 16.63% of the agricultural pie in the 1st quarter data down from 17.3% during the first quarter of 2013.

The reason for this quarter’s share reduction has been because y-o-y fishing economic activity has posted a substantial loss of 3% that virtually chipped away the 1.7% gain of the land based agriculture industry.

Aside from geothermal industries and the “two of the country’s top dollar earners: the Philippine Phosphate Fertilizer Corporation (PHILPHOS) and the Philippine Associated Smelting and Refinery Corporation (PASAR)” according to the NSCB Eastern Visayas Region branch, Region 8 “is rich in natural resources, including vast agricultural lands with fertile soil, abundant water and wet climate. Among its major crops are palay, coconut, banana, camote, corn, abaca and sugarcane. It is the country’s second largest producer of coconut and abaca among the 17 regions. It is also rich in freshwater fish and other marine resources.” (bold mine)

Let us see how Typhoon Yolanda’s impact on Region 8’s major produce affected the national growth during 1st quarter by looking at the national performance.

Palay grew by 3.3%, coconut suffered a setback of a considerable 6%, banana gained 1.8%, camote and abaca (perhaps under other crops fell by .8%), corn advanced 1.5% and also sugarcane which jumped by 6.1%.

If there has been any major impact on agriculture, it has mainly been conspicuous in the coconut sector. This is understandable given that Region 8 has been “the country’s second largest producer of coconut”.

Yet with national agricultural data suggesting that losses from the Typhoon have been neutralized for MOST of the crops, then this leaves the fishing industry as the possible other link.

Now let us put into context whether the decline in the agricultural industry has been an aberration. If there is one then this would reveal the extent of the damage from the typhoon.

Typhoon Haiyan slammed the Philippines on November 3-11, 2013, that’s about halfway the fourth quarter period.

Yet agriculture ironically posted gains of 2.3% despite the steep decline in the fishing industry at -4.4% at the last quarter of 2013. So from day zero of the storm’s impact going into the end of the quarter from the impact, the last quarter 2013’s growth rate still posted a positive .9% (blue rectangle). Apparently, the 1st quarter performance seems like carryover of the last quarter performance. So this hardly looks like a deviation.

Notice too that agricultural-fishing industry has been very volatile.

Even BEFORE to the storm, specifically during the second and third quarter of 2013, the main agricultural sector posted marginal loss (-.9%) and a very much slower (+.3%) than the 1st quarter 2014 gains (1.7%). This has also been reflected on the gross value added -.2 and .3, respectively as against +.9%.

The crowd may blame it on Typhoon “Bopha” Pablo that struck in November 25-December 9, 2012, which Wikipedia.org considers as the most destructive. But this wouldn’t square with robust 3.2% annualized gains during the first quarter of 2013.

So the post Typhoon Yolanda performance has even been STRONGER than the two quarters of output preceding the advent of the calamity.

In short, except for the coconuts, most of the attributions to Typhoon Yolanda as the main source of slowdown in the agricultural sector looks more like a post hoc ergo propter hoc fallacy.

Fishing for Truth

Let us proceed to fishing.

Based on the data from Philippine Fisheries Development Authority, commercial fishing volume of fish unloading in the first quarter on major fish ports* has shown an 8% growth in terms of metric tons (left pane). Note there has been no major port from Region 8.

Metro Manila’s Navotas Fish Port Complex (NFPC), which posted a decline of 5%, has been toe to toe with General Santos Fish Port Complex (GSFPC) whose growth offset the loss in Navotas, as the leader for the largest drop off point for commercial fishing.

This is in contrast to processed products which posted a sharp a decline. The reduction of output in Zamboanga can be traced to the three month fish ban on sardines and red herring.

*Navotas Fish Port Complex (NFPC), Sual Fish Port, Lucena Fish Port Complex (LFPC), Camaligan Fish Port, Iloilo Fish Port Complex (IFPC), Davao Fish Port Complex (DFPC), Zamboanga Fish Port Complex (ZFPC) and General Santos Fish Port Complex (GSFPC)

There are two other categories in fishing; this is the field of municipal fisheries and aquaculture. The latter seems the most likely candidate for Region 8’s potential given the description of “rich in freshwater fish”. Unfortunately I don’t have access to the other data to determine the depth of link between Region’s 8 contributions to the national economy in the context of these areas.

But such data would not be necessary. The region’s GDP would be enough.

If we look at Region’s GDP based on NSCB data, in 2011, the fishing sector contributed to only 4% of the region’s output. Region 8’s fishing output represented about 4.6% of the national fishing industry (see page 9 of the link) for the same period. So it would be difficult to explain how 4.6% will have a material spillover effect on the 95.4%.

If the far larger agricultural sector, where Region 8’s share of the national has been at 5.67% based on 2011 data, has been outweighed by the national performance, then the same dynamics should apply to the much smaller fishing industry. Therefore the decline in the fishing industry must have been less likely from Region 8 but from elsewhere.

Meanwhile, the manufacturing sector accounts for the largest share of the region’s economy at 26.8% in 2011. From the national level, the sector’s contribution has been a puny 3%! So I am also at a loss to see or comprehend how 3% would have “disrupted supply chains nationwide”.

The same holds true with construction industry where in 2011, the sector generated 5.3% of the region’s output. In the context of the national level, the region’s construction activity only accounted for 2.63% level in 2011. So to assume that 2.63% would have a significant supply chain drag on the national level would seem quite perplexing for me.

I hope officials can enlighten us on this supposed causal chain of flows. But I suspect that they won’t.

I am even more confused to see how construction has not taken off in the region despite the reported whopping 34 billion peso worth of donations which accounts for 22% of the 2011 regional GDP.

What happened to all those contributions?

Construction Slump Amidst a Bank Lending Boom??? Yikes!

Both media and officials have sparsely treated the unforeseen plunge in the construction industry which obviously has been meant to downplay the message.

The construction activity on the national level has shriveled to a still positive but miniscule .9% growth. The public’s sector’s substantial 22.3% gains have barely lifted the industry from an evolving slump! This is because of the astonishing 6% dive by private sector spending which provided the heft of construction activities at 77% share in April.

Yet with buzzing of the construction activities going on here in the metropolis, how can this be?

Has government construction spending been ‘crowding out’ private sector spending or has government been using resources at the expense of the private sector?

Viewed from annualized q-o-q changes from 2012, each time private sector grew, the public sector contracted and vice versa (left pane).

Such are signs of the tradeoff between the competing use of resources by the private and the public sector.

Nonetheless, what seems troubling is that the deterioration of private sector spending seems to have been mirrored in the in the decline in the gross value added in the construction industry, which apparently peaked in Q4 2012. This reveals an ongoing loss of productivity coming in the face of a supposed boom.

Even more baffling has been the still blistering pace of bank lending growth to the construction and real estate sectors.

The drop in construction activities has been rationalized as government tightening.

Media quotes Philippine officials as saying that “prudential measures implemented by the Bangko Sentral ng Pilipinas (BSP) aimed at keeping banks’ exposure to the sensitive real estate sector could have constrained lending to property companies”

Perhaps they are right.

Bank lending to the construction industry fell from an average of 51.82% [FIFTY ONE PERCENT] in the 1st quarter of 2013 to an average of 46.64 [FORTY SIX PERCENT] in the first quarter of 2014 (right window)! Despite the 5% drop, FORTY SIX percent would still be about SEVEN times the economic growth rate of the 1st quarter! Some constrain huh?

And this juggernaut in bank credit expansion to both the real estate sector and construction industry has still been apparent based on the latest April BSP lending data.

Bank lending to the real estate industry still hovers at 20% (20.18% in April; see left pane) while construction loans have fallen to 40.53% (FORTY Percent).

This comes even AFTER the April 4th implementation of the first series of the twin One Percent increases in the banking system’s reserve requirements.

As a side note: I told you so (!), reserve requirements under the modern central banking system will barely constrain bank lending. General loans even climbed to 18.8% in April (y-o-y) from 18.07% last March. The BSP and the government will not tolerate the end of the subsidies to the government from financial repression policies. They have been incredibly HOOKED to it.

This validates my view of the bluff pulled by the BSP which has been embraced by the clueless and gullible public.

Well folks, that’s how the government defines “macro prudential” or “keeping banks’ exposure to the sensitive real estate sector” constrained.

But don’t worry, the public or the crowd so agrees with them.

Yet despite the FOURTY SIX percent bank issued loans to the construction industry and TWENTY percent loans to REAL ESTATE companies, PRIVATE sector construction output FELL SIX percent???

Huge loans producing negative growth, why? What’s been going on??!!

Not only has bank lending been roaring as output have been in a sharp decline in the construction industry, money supply as of April continues to stagnate(!), as shown by the chart above, thereby galvanizing my suspicions of a fast expanding use of debt in-debt out.

No systemic risk eh?

Let me tell you that the recent downturn in the construction industry may represent the initial signs of fissure from stagnating money supply growth. If these events persist, as stated last week, then this will mark the process reversing this illusory boom where the new paradigm will be faced with gravity from planet earth.

Going back to the GDP table, it has been notable that the drop in the share of the construction sector has more been covered by the gains of the real estate sector. Notice too that the share of the bubble sectors (excluding the hotel) have gained from 38.27% to 38.38% as the share of agriculture, electricity, and others have shrunk.

This again translates to a growing concentration of risks.

Watch it though, the trade (wholesale and retail) sector seem to be showing signs of fracture! While y-o-y growth posted 5.5%, the share of trade has contracted along with the construction industry.

Hmmmm…

At the end of the day, massaging of data would hardly bring about the relevance or connection between the partialities of Typhoon Yolanda—bank ending “macro prudential measures” rationalization against the slowing economic growth.

Oh, the Phisix fell 2.4% this week for its first official correction.

Eyes on money supply growth now!

Expect euphoria to segue into a deep acrimonious denial phase. This means that IF the statistical economic slowdown persists, then finger pointing will become the du jour talking point. There will clarion calls by the public for the government to do more and more interventions that will only deepen the predicament.

Let me end with a quote from English enlightenment writer François Marie Arouet or more popularly known by his nom de plume “Voltaire” (1694-1778)

"Prejudices are what fools use for reason."

Enjoy the weekend!

No comments:

Post a Comment