1Q 2014 US GDP was first reported to have grown by a pittance of .1%, then adjusted to a contraction of –1% and eventually changed to an even deeper contraction of 2.9%

From Bloomberg:

The U.S. economy contracted in the first quarter by the most since the depths of the last recession as consumer spending cooled.Gross domestic product fell at a 2.9 percent annualized rate, more than forecast and the worst reading since the same three months in 2009, after a previously reported 1 percent drop, the Commerce Department said today in Washington. It marked the biggest downward revision from the agency’s second GDP estimate since records began in 1976. The revision reflected a slowdown in health care spending.

The 2.96% contraction represents the 17th worst quarterly decline by the US economy in history (see table here via zero hedge)

Yet despite the deepening contraction, US stocks continues with its fabulous record run.

Record stocks in the face of contracting economy, so what’s the connection? Who says stocks are about the economy?

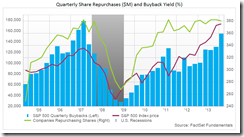

Aside from retail investors driving record stocks, and the just off the record in margin debt, a bigger factor has been corporate buybacks.

Chart from Factset

Notes Sigmund Holmes: (bold mine)

According to Reuters, 1st quarter share weighted earnings amounted to $258.8 billion. So companies in the S&P 500 spent 93% of their earnings on buybacks and dividends. It’s been all the rage in this cycle to look at “shareholder yield” which is a combination of buybacks and dividends, something I find too clever by half considering the past track record of management led buybacks. But if you think that is a useful metric, you have to ask yourself, is a 93% payout ratio sustainable? I guess we do have the answer to one question though. We know why capital spending has been so punk.

How have these record rate of buybacks been funded? Naturally by debt. David Stockman explains: (bold mine)

And on the business side of the peak debt story, the picture is now even worse. Non-financial business debt has grown from $11 trillion on the eve of the financial crisis to nearly $14 trillion at present. But this staggering gain of $3 trillion or 25% has not gone into incremental investment in plant and equipment—that is, the building blocks of future productivity and sustainable economic growth. Instead, and just like during the prior Greenspan housing bubble, it has gone into financial engineering and rank speculation.That is the explanation for record stock buybacks and the resurgence of mindless M&A deals (globally we just had the first $1 trillion M&A quarter since Q3 2007). These deals are overwhelmingly nothing more than a vast expansion of cheap leverage being used to liquidate target company stock, and which are so lacking in business logic that they will surely be unwound to the tune of vast “one-time” write-offs in the years ahead.What is at record 2007 peak levels is not loans to main street businesses—most of which do not need funding or are not credit worthy. Instead, the recently heralded growth in bank lending has gone into leveraged buyouts and dividend recaps.Indeed, credit is flowing every which-way into the Wall Street casino including sub-prime auto junk funds, double-leveraged CLOs, massive junk bond issuance at the lowest rates and spreads ever and “cov lite” loan issuance at rates even higher than 2007. But according to Yellen, “our models” show no indications of bubbles or over-valuation.Yes, with the Russell 2000 at 85X reported earnings there is no over-valuation. Likewise, S&P 500 reported LTM earnings in Q1 clocked in a $105 per share, meaning the broad market was trading at 18.7X as she spoke. Incidentally, that multiple of the kind of GAAP earnings that they put you in jail for lying about is higher than 86% of the monthly observations in in modern history, and actually higher than 95% if you take out the years of Greenspan’s lunatic dot-com bubble.Worse still, those $105 of earnings have crept up by only 5% annually since later 2011— during a period in which the stock index has risen by nearly 60%. Yet the current $105 earnings number is also bloated with unsustainable interest subsidies on upwards of $3 trillion of S&P company debt owing to the Fed’s financial repression which is eventually to end; is festooned with tax rate gimmickry that is finally stimulating a Washington revulsion; and is flattered with earnings translation gains that are going to reverse as the ECB puts the kibosh on the Euro.

Some debt graphs supporting these buybacks from the International Institute of Finance (IIF)

Collateralized Loan Obligations (CLOs)—a type of collateralized debt obligation that pools medium and big business loans

Junk bonds

Leveraged loans

Awesome accumulation of leverage!

Stock buyback is a form of financial engineering because this signifies a massaging of earnings. Buybacks shrinks the denominator of Earnings per share (EPS) which amplifies the numerator. In short, US stocks are at record levels because of credit financed accounting based manipulation of earnings via buybacks, courtesy of the FED.

Also notice the source of disconnect; borrowings at near record or at record pace in different credit markets have hardly been used for real business investments (or productive undertakings) but has been mainly redirected to manipulate earnings in order to justify record stocks, thus the wonderful DIVERGENCE or PARALLEL UNIVERSE.

Again who says stocks are about the economy?

No comments:

Post a Comment