The consensus wins this round. No US recession.

From the Bloomberg:

Gains in consumer spending and business investment helped the U.S. economy rebound more than forecast in the second quarter following a slump in the prior three months that was smaller than previously estimated.Gross domestic product rose at a 4 percent annualized rate, the most since the third quarter of 2013, after shrinking 2.1 percent from January through March, Commerce Department figures showed today in Washington. The median forecast of 80 economists surveyed by Bloomberg called for a 3 percent advance. Consumer spending, the biggest part of the economy, rose 2.5 percent, reflecting the biggest gain in purchases of durable goods such as autos in almost five years.

The Zero Hedge has the breakdown.

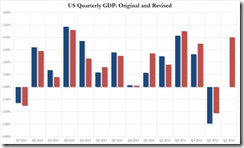

What is interesting is that the Commerce Department announced that as a result of incomplete June data, the biggest components of the GDP beat, Inventories and Trade, were estimated. In other words, assume that future revisions of Q2 GDP will be lower, not higher, as the actual data comes in, and especially as the CapEx data, which contrary to the GDP report, has not rebounded. Speaking of revisions, today the BEA also released its annual revision of all data from 1999 to Q1 2014, which made last quarter's -2.9% print a more palatable -2.1%, in the process throwing everyone's trendline calculations off as yet another GDP redefinition was implemented.The chart of the original and revised data is shown below.We are currently combing through the years of revisions and will provide a snapshot shortly but for the time being here is Bloomberg's take:

- 2Q personal consumption up 2.5% vs est. up 1.9% (range 1.5%-2.9%); prior revised to 1.2% from 1%

- Core PCE q/q 2% vs est. 1.9% (range 1.4%-2.3%)

- Gross private investment up 17% in 2Q after falling 6.9% in 1Q

- Residential up 7.5% after falling 5.3%

- Purchases of durable goods jumped 14%, most since 3Q 2009

- Corporate spending up 5.9% vs little changed q/q

- Inventory accumulation added 1.7ppts to GDP

This only means that the US inflationary boom appears to be picking up steam, which will likely be reflected on interest rates expressed via yields of US treasuries. This also means that the Team Yellen will most likely proceed with winding up of the QE.

So for the meantime, the bubble in US stocks will likely continue to inflate.

No comments:

Post a Comment