Weak currency equals strong exports, which has been expected to boost the economy, has been a popular mantra embraced by the consensus. Such popular delusions are really based on the dogma of neo-Mercantilism.

So the orthodoxy of today’s policies have been to devalue directly (monetize debt) or indirectly (inflationary boom)

The article below is an example of how perplexed the consensus has been, when economic reality debunks the popular held myth.

Japan's Abenomics should be a prime example

If you are wondering why Japan’s exports are languishing despite the yen’s weakness, take a quick look at monthly production data released Thursday by top auto makers.Domestic output by Toyota Motor Corp. declined 3.7% from a year earlier in July, while its overseas output rose 9.5%. Rival Nissan Motor Co. said its production volume tumbled 22.5% in Japan but rose 4.8% overseas.Mazda Motor Corp. cut its domestic production by 5.9% but rolled out 69% more vehicles outside of Japan. Bucking the trend was Mitsubishi Motors Corp., whose result was up 1.3% in Japan but was down 3.2% abroad. Hollowing out of Japan’s manufacturing continues unfazed by the yen’s weakness.For decades, policy makers could count on weakening of the yen to push up exports by making Japanese products cheaper and more competitive overseas.This time it hasn’t happened. The volume of Japan’s overall exports declined year-on-year in five of the 12 months through July and rose only modestly in the other months, according to the finance ministry.Weak exports have weighed on growth even as Tokyo took steps to stimulate the economy. And that’s in large part a reflection of the extent to which Japanese auto makers and other companies have moved production offshore, especially China and Southeast Asia.

First of all this statement--For decades, policy makers could count on weakening of the yen to push up exports by making Japanese products cheaper -- isn’t accurate. For decades long, the Yen has been strengthening against the US Dollar. It’s only during Abenomics when the Yen has weakened. So there is hardly "weak yen pushing up exports" during the previous decades. The reporter didn’t even bother to check on the facts before making such an outlandish claim.

Second, the report argues for more interventions and easing by the BoJ, which practically means doubling down on failed policies.

Third, inflationism has never been an isolated political act. In the case of Japan, another policy "arrow" has been to boost government spending via raising tax rates.

So when government disrupts the pricing mechanism massive unsustainable imbalances will emerge.

Here is what I wrote last June: (bold original)

It’s a wonder how the Japanese economy can function normally when the government destabilizes money and consequently the pricing system, and equally undermines the economic calculation or the business climate with massive interventions such as 60% increase in sales tax from 5-8% (yes the government plans to double this by the end of the year to 10%), and never ending fiscal stimulus which again will extrapolate to higher taxes.The mainstream has all been desperately scrambling to look for “green shoots” via statistics. They fail to realize that by obstructing the business and household outlook via manifold and widespread price manipulations, this will only lead to not to real growth but to greater uncertainty which translates to high volatility and bigger risks for a Black Swan event.

And not only has exports been stagnating, the balance of trade has been in a deficit. This has been punctuated by Abenomics.

Again inflationism combined with higher taxes and other interventions has only magnified the adverse economic effects on the Japanese economy.

Today’s series of economic numbers reveals that Japan faces increased risks of a recession. (Note the three charts below are from Zero Hedge)

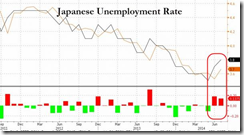

Unemployment rate rose to November 2013 highs.

The rebound from the recent collapse in Japanese household spending has been short-lived.

Japan’s retail sales remains moribund

Industrial production has been flat-lining (chart from investing.com). This comes as inflation continues to be elevated (33.4% in July)

At the end of the day, Japan has been showing incipient signs of stagflation. If sustained then this will put pressure on interest rates, where the latter will serve as the proverbial pin that would prick Japan’s debt bubble.

Also if the BoJ desists from inflating further, those accrued imbalances built from previous inflationism and interventions will unravel.

So Abenomics has only produced a damned if you do, damned if you don’t conditions which alternative means a no way out scenario

Bottom line: all these snake oil fixes has not only kicked the can down the road, for the benefit of vested interest cabal, but has only increased unsustainable imbalances in the system that is bound for a disorderly breakdown.

And we seem to be nearing this critical point.

No comments:

Post a Comment