The IMF recently observed that Emerging Markets have been enduring a broad based and synchronous growth decline that has been expected to worsen.

From the Financial Times: (bold mine)

The Fund’s paper finds that growth is slower across a swath of developing countries, not just the largest economies such as China and India. Expansion rates in more than 90 per cent of emerging markets are lower than before the 2008 turmoil.“The slowdown seems to be quite broad based,” said Mr Faruqee. Such a synchronised deceleration is unique outside of a recession or financial crisis.According to the IMF research, trade links are an important reason for the slowdown, with emerging markets suffering from weaker growth in their trading partners. But there are also signs of deeper problems, with evidence that productivity improvements are contributing less to growth.“The fact that we project some rebound in growth for the advanced economies and are lowering it for the emerging economies is suggestive of something internal among the EMs,” said Mr Faruqee.

At the IMF Direct Blog, IMF’s Sweta Saxena notes of the implication of an EM slowdown to the global economy: (italics original, bold mine)

-Expect lower growth in trading partners: A 1 percentage point slowdown in emerging market economies lowers growth in advanced economies by ¼ percentage point, on average, through reduced trade.-Expect lower commodity prices. Emerging markets account for the bulk of commodity demand globally. A slowdown means a fall in demand which would lead to a fall in prices. Whether it is good or bad for incomes depends on whether a nation mainly consumes (good) or produces (bad) those commodities.-Expect bank losses. A slowdown usually triggers problems in the repayment of loans and could lead to capital losses for banks, including those in advanced economies exposed to Emerging Market borrowers.-Expect slower growth if you live in the same neighborhood. For example, a slowdown in China and Brazil would impact emerging Asia and Southern Cone countries, respectively, through trade. Russia would have an impact on its Central Asian neighbors through remittances, while Venezuela would affect its Central American neighbors through financing and energy cooperation agreements.

The IMF rightly expects a transmission of EM economic growth slowdown to affect advanced economies or Developed Markets (DM). They estimate that DM economies will slow by 1% due to the EM downturn.

Whether the number is accurate or not doesn’t matter.

Unfortunately the IMF team stops there. They did not expand their horizons to include of the subsequent feedback mechanism from DM to EM! If EM growth affects DM, so will there be a causal chain loop, or DM growth will also have an impact to EM growth!

Doing so would extrapolate to a contagion process, as the slowdown feedback mechanism in both EM and DM will self-reinforce the path towards a global recession!

The EM-DM link as I previously noted: (bold original)

Even when the exposure would seem negligible, if the adverse impact of emerging markets to the US and developed economies won’t be offset by growth (exports, bank assets and corporate profits) in developed nations or in frontier nations, then there will be a drag on the growth of developed economies, which would hardly be inconsequential. Why? Because the feedback loop from the sizeable developed economies will magnify on the downside trajectory of emerging market growth which again will ricochet back to developed economies and so forth. Such feedback mechanism is the essence of periphery-to-core dynamics which shows how economic and financial pathologies, like biological contemporaries, operate at the margins or by stages.

What the IMF seems to be suggesting is that the contagion process has been accelerating or intensifying.

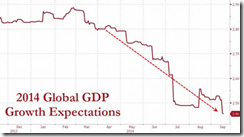

This seem to square with consensus expectations of global economic growth which continues to get marked down as shown by the chart from Zero Hedge

So the IMF has been explaining the symptoms

Let me add to the insights of the IMF.

Whatever “internal” dynamics being experienced by many EM has been about inflating domestic bubbles. Blowing domestic bubbles, which means a massive misallocation of resources, translates to less productivity improvements.

Moreover, by focusing on blowing domestic bubbles, the domestic production process has been directed at focusing on domestic bubble requirements rather than to serve consumer needs around the world, hence the lesser trade.

Both these highlight the “something internal” quirks noted by the IMF.

The bottom line is that EM economies, like their DM counterparts, have indulged in speculative binges more than they have been engaged in production.

The ramification of overleveraging to finance such speculative orgy has been to incite entropy in the real economy, both in EM and DM.

The EM slowdown simply serves as empirical evidence to this decaying bubble dynamic. And this has began to manifest even in growth statistics of Developed economies.

And the intensifying slowdown in EM demonstrates my Periphery to core dynamics theory in motion. And importantly again, this has been indicative of a hissing global bubble in progress!

No comments:

Post a Comment