Just awhile ago I wrote:

"Ever since, "marking the close" has become a frequent, if not a regular occurrence…The incentives for such actions suggests of non-profit activities, which implies activities by non-profit symbol conscious participant/s."

Well it didn’t take so long for “marking the close" to reappear to prove this point.

Today signifies another fantastic massaging of the Philippine equity benchmark, the Phisix.

Some entities has been so desperate as to manage the index price levels in order to attain certain target levels, as I recently wrote:

"Bulls are by nature territorial. Having lost their grip on the 7,000 levels during the past few days which has apparently wounded the their ego may have prompted for today’s vicious and desperate thrust to retake the said threshold levels. Domestic bulls have essentially dismissed risks in order to attain a superficial goal."

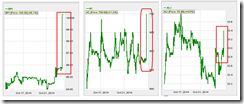

The left intraday chart, from technistock.net, exhibits the amazingly low volume from which the supposed “bullishness” has been anchored from, while the right chart, from colfinancial.com, reveals of the degree of the “pump”—54.5% of today’s relatively low volume gains emanated the “marking the close” pump!

Today’s end of the session massaging of the Phisix have been a mainly a three sector affair. The bulk of the activities are revealed by the gains from mainly the property and financial sector. The holding sector has been the third, but has been less conspicuous because the rally came from what seems as early losses (table from the PSE. intraday charts from colfinancials)

Incidentally, the three sector “pump” has been concentrated to companies owned by the Ayalas, Bank of the Philippine Islands (BPI), Ayala Corp (AC) and Ayala Land (ALI), charts arranged from left to right.

The 3 Ayala companies has a combined market cap weight of 19.17% as of today’s close. Yet only two of the three companies has been among the top 20 traded for the day. The gains of the 2 of the 3 has been remarkable; ALI +4.07%, AC +1.16% and BPI +6.14% (not in table).

While Ayala owned telecom Globe has been up 2.32%, today's advances hasn’t been anomalous as its peers.

Yet based on PE ratios from PSE’s quote BPI has a PE ratio of 19.33 as of October 21st, ALI 34.1 and AC 34.1. All three have been trading at absurdly expensive levels.

Yet today’s actions seem to suggest these prices will soar to the firmament soon with again little appreciation of risks!

I would like to re-quote the BSP governor who in recent speeches has apparently exhibited heightened signs of anxiousness with the current marketplace actions. Yet the BSP governor hasn’t just saying they (the BSP) has been doing, the BSP moved seven times in the last 6 months! (This week the BSP acted again!!!)

So in a period of low volatility such as what we have been experiencing, practice the discipline of setting limits. This discipline will not only help you to avoid the pitfalls of “chasing the market”.

Why the need to manage the index by session end pumps which represents “chasing the market”?

the BSP remains cognizant that keeping rates low for too long could result in mis-appreciation of risks in certain segments of the market, including the real estate sector and the stock market as markets search for yield.

Pumping up overpriced issues and managing price levels of overvalued securities signify as mis-appreciation of risks--to the said sectors.

The lesson being: The obverse side of every mania (aside from market manipulations) is a crash.

Nice chart there Benson. By reading that intraday chart alone, investors should really look at what will happen the next day after that up move. If the move reverses, best to protect your gains/capital.

ReplyDeleteThere's mania going on there in the Phil market. Investors will buy now and hold because technically the PSEi is acting "stronger" than the S&P 500. What they don't understand is that there are variations of topping actions from different markets. PSEi is no exception in this topping phase.

ReplyDelete