US stocks partied Wednesday when the Fed minutes hinted that they would go slow on rate hikes and at the same time talked down the US dollar.

But Asian markets responded tepidly to US stock market ebullience, Japan’s Nikkei even fell .75% yesterday.

What’s more surprising has been that European stocks, which has been battered during the past few days, opened strongly—evidently carried over by US sentiment—but gains of which just evaporated going into the close of the session.

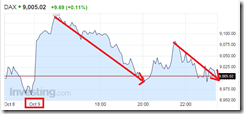

Here is the intraday chart of the German DAX which closed with marginal gains.

UK’s FTSE 100 which got clobbered down by .78%.

Europe’s largest 50 companies via the Stoxx 50 likewise exhibiting the same glee to dour sentiment. Most of Europe’s major benchmarks closed markedly down

And what has been even more fascinating has been the twist of fate in US stocks. Whatever one day gains acquired during the verbal easing has been more than erased…as yesterday’s broad based losses exceeded the other day’s gains!

The S&P 500 two day chart exhibits the magnificent roller coaster ride!

Bloody Thursday for US stocks in general led by the small caps. (from stockcharts.com)…

One more revealing chart has been the collapse of oil prices specifically the WTIC (-3.84%) as well as the Brent (-1.46%) yesterday.

The commodity benchmark the CRB has also been on a downtrend.

The meltdown of oil prices have significant impact to the welfare states of major oil producers. It also serves as an indicator to the state of the global economy and global liquidity.

Has Fed (as well as her cohorts) lost their potency to stimulate risk assets?

Is this the start of the breakdown?

No comments:

Post a Comment