The mainstream apparently gets into the Abe-Kuroda pantomime.

At the Bloomberg, Asian columnist William Pesek asks whether BoJ’s inflation of the world’s greatest bond bubble is an act of a genius or a madman? (bold mine)

Ten years from now, will Bank of Japan Governor Haruhiko Kuroda be regarded as a genius or a madman?Kuroda's shock-and-awe stimulus move on Oct. 31 delighted markets and won him plaudits as a monetary virtuoso. Japan, the conventional wisdom tells us, has finally gotten serious about ending deflation, and isn't it wonderful. But what happens when a central bank buys up an entire bond market? We're about to find out as Kuroda, like some feverish hedge fund manager, corners Japan's. Neglected in all the celebrating: To reach a 2 percent inflation goal that's both arbitrary and meaningless, the BOJ is destroying Japan's standing as a market economy.

Now to the world’s biggest bond bubble…

In announcing that it will boost purchases of government bonds to a record annual pace of $709 billion, the central bank has just added further fuel to the most obvious bond bubble in modern history -- and helped create a fresh one on stocks. Once the laws of finance, and gravity, reassert themselves, Japan's debt market could crash in ways that make the 2008 collapse of Lehman Brothers look like a warm-up. Worse, because Japan's interest-rate environment is so warped, investors won't have the usual warning signs of market distress. Even before Friday's bond-buying move, Japan had lost its last honest tool of price discovery. When a nation that needs 16 digits in yen terms to express its national debt (it reached 1,000,000,000,000,000 yen in August 2013) sees benchmark yields falling, you've entered the financial Twilight Zone. Good luck fairly pricing corporate, asset-backed or mortgage-backed securities.Considered in relation to gross domestic product, Kuroda's purchases make the U.S. Federal Reserve's quantitative-easing program look quaint. The Fed, of course, is already ending its QE experiment, while Japan is doubling down on one that dates back to 2001. Kuroda's latest move means Japan's QE scheme could last forever. The BOJ has willingly become the Ministry of Finance's ATM; reversing the arrangement will be no small task.

The wish that Japan's QE scheme "could last forever" represents Kuroda’s Hail Mary Pass.

However as the April 2013 initial doubling of monetary base reveals, there is no such thing as a free lunch. The failure of the first phase (QE 1.0) thus leads to the second wave (QE 2.0)…

As I recently wrote

There you go: the BoJ’s ¥50 trillion a year down the drain. Now if one fails with ¥50 trillion, perhaps will 60% more or ¥80 trillion serve as a magic number and do the trick?

I believe that 2% inflation signifies as the headline objective presented by Mr. Kuroda, however the real goal must be to monetize Japan’s gargantuan unsustainable debt problems…

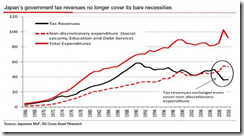

…and this includes the financing of the government’s reckless fiscal activities which has all been supported by debt (charts above from Zero Hedge).

Runaway government spending can't be funded by stagnating tax revenues as the fiscal deficit gap continues to widen (top). This comes as the share of interest rate and debt servicing (bottom) continues to grab a bigger piece of the tax revenue pie. So there is no way Japan's economy can pay back all those loans under current political economic conditions except to monetize them (inflate the debt away!).

Again I as commented,

So the BoJ may have expanded her QE to accommodate more monetization of fiscal deficits aside from possibly including the possible shift by GPIF out of domestic bonds. Of course the latter could function as a decoy as to shield the Japanese government from revealing its anxieties.

Back to the money illusion…

All this liquidity has made for surreal events in Tokyo. Take the news that Japan's $1.2 trillion Government Pension Investment Fund will dramatically rebalance its portfolio away from bonds. Japan has enormous public debt and a fast-aging population, and now the world's biggest pension pool is shifting to stocks. Yet somehow, 10-year yields are just 0.43 percent. The explanation, of course, is that the parts of the market the BOJ doesn't already own are sedated by its overwhelming liquidity. The BOJ is now on a financial treadmill that's bound to accelerate, demanding ever more multi-trillion-dollar infusions to keep the market in line.To Japan bulls, the end justifies the means. If Kuroda changes the deflationary mindset that's stalked Japan for 17 years now, then his gambit was worth it. One problem with this argument is that deflation isn't the cause of Japan's malaise, but a side-effect. Consumer prices rising at 2 percent or more will be a big problem if Prime Minister Shinzo Abe doesn’t push ahead with plans to deregulate the economy and prod companies to raise wages. That's doubly true as Tokyo mulls another growth-denting rise in the consumption tax.

Realize that the BoJ’s supposed goal to “reach a 2 percent inflation” is diametrically opposite to how inflation influences interest rates. So the BoJ’s incoherent act simply implies that their policies are self defeating; either this leads to boom-bust cycle or to hyperinflation. Kuroda's has adapted policies that has essentially boxed themselves into a corner, there is no middle ground.

In addition, by draining JGB liquidity from the marketplace this would magnify Japan’s risk of financial system’s instability

Now, the BoJ overhauled into a hedge fund…

Another problem is that Kuroda is turning the BOJ into the world's biggest asset-management company. The BOJ won't admit it, but it's monetizing Japan's debt on a massive scale, and probably even retiring large blocks of it -- just as the government did in the 1930s. What happens when the BOJ decides Japan needs a credible and functioning bond market in the years ahead? Kuroda's successors face terrible odds disengaging from a market he's effectively nationalized.

Well, if we are to describe bubble as a product of unsustainable ‘something for nothing’ policies which leads asset pricing to vastly deviate from pricing of market activities outside such (political) interventions then creating the world’s biggest bond bubble isn’t likely a work of a 'genius'.

And there won't be any orderly fixes because of the massive scale of imbalances that has already been built into the system. And this is why Abe-Kuroda has been doubling down in the hope to kick the proverbial can down the road. Hope is now Abe-Kuroda's ONLY strategy.

In addition, the sustained assault on the economy by the government will most likely lead to more disruption in economic activities.

And the path to hyperinflation is the overwhelming destruction of the economy's production capacity through the total distortion of price signals from sustained money printing. Such dynamic will be compounded by other interventions like price controls, raising taxes, currency controls, et. al., in response to the government's desperate recourse to the use of the printing/digital press to finance fiscal requirements or fiscal monetization that leads to a loss of confidence on the currency.

There are real time examples of hyperinflationary governments: Venezuela, Argentina...previously Zimbabwe

Will Japan be next???

For now Japan’s advantage is that they are still open or still have access to the global markets. But this may change.

Media has already been already speculating that the Abe administration will squelch growing opposition to Abe-Kuroda policy in the BoJ by replacing dissidents with pro-administration henchmen.

The next step may be to increase protectionism.

PM Abe’s reluctance to expand trade by the Trans Pacific Partnership as well as the promotion of other policies in favor of vested interest groups gives a hint on PM Abe’s proclivity for protectionism.

A full scale ‘beggar thy neighbor’ currency war would imply protectionism and could be reinforced by other economic warfare policies again through currency and trade controls or more.

For those who think today’s Nikkei ramp from BoJ-GPIF's direct intervention will be sustainable, history gives us a clue.

The first wave of 50 trillion yen had a 7 month euphoric effect after which the Nikkei went rangebound. Yet much of the post 2013 QE 1.0 trading range support has been in anticipation of today’s QE.

The 64 Quintillion Question is: will 80 trillion be the last or will there be more?

If 80 trillion ends, the stock- (greatest) bond market bubble boom will turn out to be a colossal historical bust.

However if 80 trillion will be added or if the "financial treadmill" is bound to accelerate, then the Nikkei, as Dylan Grice puts it, may hit 63,000,000 or may be alot higher than the current levels.

Realize too that all episodes of hyperinflation has been accompanied by soaring stocks which runs alongside domestic currency collapses.

The unfortunate part is that any stock market gains from hyperinflation will have limited purchasing power. In the case of Zimbabwe, thousands of percentage stock market returns can only buy 3 eggs!!!

No comments:

Post a Comment