I have been posting here how the Chinese government has been attempting to stoke a stock market bubble (directly or indirectly) in order to camouflage the ongoing deterioration of her overleveraged domestic real economy.

The Chinese government has launched “targeted easing” last June, has resorted to selective bailouts of firms which almost defaulted last July, imposed price controls on stock market IPOs last August, injected $125 billion over the last two months and yesterday announced the definite schedule of the Hong Kong-Shanghai stock market link.

From the Nikkei Asia:

With the debut of the Shanghai-Hong Kong stock exchange link next week, China is expected to see inflows of money from investors across the globe -- retail and institutional alike.Chinese securities regulators said Monday that foreign investors will be given access to Shanghai-listed stocks via Hong Kong, starting Nov. 17. Also, investors in mainland China will be allowed to invest in issues listed in Hong Kong. Limits will be placed on daily and total trading volumes between the two markets.The Shanghai-Hong Kong link marks an important step for China's efforts to make the yuan a key global currency and open up its capital markets.China has until now strictly limited cross-border trading for the sake of market stability, giving exceptions only to financial institutions designated under its qualified foreign institutional investor program. But obtaining this status is difficult, and foreign investors have long bought Chinese stocks that are listed in both Hong Kong and the mainland.

Let me say that I am in FAVOR of cross listings. That’s because in theory this allows savings to finance investments or simply connects capital with economic opportunities regardless of state defined boundaries.

But with the way central banks across the globe has been distorting capital markets, cross listing (part of financial globalization) has become conduits of bubbles. Therefore I am suspicious of the timing of such liberalization.

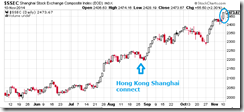

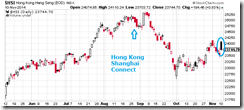

The "Hong Kong-Shanghai connect" was initially announced late August. Yet this has benefited China’s Shanghai index more than Hong Kong’s HSI as the latter has been influenced by the October meltdown. As shown above, despite the risk ON environment, HK's HSI continues to substantially underperform. This is an oxymoron given the HK dollar's peg to the US dollar.

There has been a similar stock market "liberalization" story of late.

Last July, Saudi Arabia's government announced of the opening of her stock market to foreigners in 2015. The outcome had been a miniature boom-bust cycle. Whatever gains from the “liberalization”, as seen from Saudi’s Tadawul index, has now been completely erased in the face of collapsing oil prices.

Given the short term nature of government pump, the Chinese government would need more gimmicks to keep the stock market bubble inflating.

Yet here is prediction: when this global bubble blows up, the blame will go to foreign money flows or the liberalization that accommodated the bubble rather than central bank policies.

Even the Philippine central bank, the Bangko Sentral ng Pilipinas, has been conditioning the public on this, as I recently wrote “foreigners are being conditioned publicly as scapegoats to what truly has been an internal imbalance problem only camouflaged by inflated statistics.”

Oh, as a side note, the underperformance of Hong Kong stocks may be due to concerns of property bubbles. The current fad: prices of prison cells condos running amok!

From another Nikkei Asia article: (bold mine)

Cramped condominiums are increasingly hot properties in Hong Kong, prompting pundits to sound the alarm about an overheating real estate market.Large apartments, not to mention single-family homes, are beyond the reach of many in the city, where 7.2 million people reside in an area half the size of Tokyo. But condo buyers are showing a willingness to compromise on space, and major developers are moving to cash in.Cheung Kong Holdings has drawn attention with its Mont Vert condominium. The smallest studio starts at 1.77 million Hong Kong dollars ($232,861), exceptionally low for the local market. The catch: It measures 16 sq. meters. When the company announced the project, a Hong Kong newspaper compared the studio to a typical solitary-confinement prison cell, which measures 7.4 sq. meters…The government's index for private-sector housing prices testifies to the popularity of small apartments.In August, the most recent month with available data, the index hit 260, with 1999 used as a baseline of 100. Look at only condos of less than 40 sq. meters and the index comes to 283; for the 40- to 160-sq.-meter range it registers at 240 to 250.Flats of less than 40 sq. meters have logged the steepest price increases since the beginning of the year. New highs were set in the four months through August.Much of the activity stems from speculation. Investors, fed up with prolonged low interest rates, are treating small condos as readily accessible investment tools. Chinese Estates said 80% to 90% of its small flats have been purchased for that purpose.A senior official at Midland Realty, a leading real estate agency, said investors account for more than 50% of buyers of small flats over the past several months. Up until the middle of last year, the ratio was around 10%…Some experts worry all of this could spell trouble, since monetary policy in Hong Kong tends to mirror that in the U.S.

Easy money leads to malinvestments, which has been spreading and intensifying everywhere.

No comments:

Post a Comment