Add to the carnage in China’s stock markets, it has been a largely bloody Tuesday for global risk assets.

The 4% crash in Europe’s crude oil, the Brent (as of Monday December 8), sent stock markets of major oil producers the Gulf Cooperation Council (GCC) plunging, again

table from ASMA

US oil WTIC rallied mildly today.

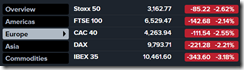

Risk OFF Tuesday hit European stocks pretty hard (from Bloomberg)

Since October, crashes have become real time. Greece’s financial markets cratered!

The Athens General index lost 12.78% in a single day (stockcharts.com)

Today’s meltdown signifies the single biggest crash since 1987. Notes the Zero Hedge: (bold original)

Greek stocks are now down 13% - the biggest single-day drop since (drum roll please) the crash of 1987... led by total carnage in Greek banks (down 15-25% on the day). Greek bond yields exploded, 3YR +183bps to a new post-bailout high at 8.32% (and inverted to 10Y).

Greek bond yields also soared.

The Greek president called for a snap election on December 17 which reportedly may spark “political turmoil”.

The anti-bailout leftist group the Syriza which has been said to “promise everything to everyone” by reneging on deals for bailout, halting austerity, restoring social spending, continue to receive subsidies from the Eurozone, IMF and labor protection reportedly leads in the opinion polls. In short, the popular leftist group wants a bankrupt nation to revive free lunch policies and expect to get a free pass on the economy. So market’s response has been rational.

Interesting to see how a revival of the Greek crisis will impact a vulnerable Europe, in the face of a Japanese recession, a highly fragile Chinese economy and a slowdown in Emerging markets, aside from heightened geopolitical tensions.

Nonetheless US markets bounced backed from the depths of the selling pressure from a recovering USD-yen, buoyant small cap and technology stocks.

No comments:

Post a Comment