I am supposed to be having my vacation break, but seeing today's activities I can't help but comment.

They did it again! The last time they did this was in October 16.

As I said corrections are now impermissible, Philippine stocks can only go up forever!

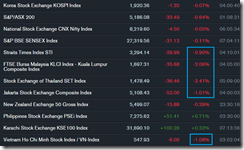

Following Friday’s global stock market rout. ASEAN stocks had been toast today. Thailand SET slumped 2.41%, Malaysia’s KLSE plunged 2.06%, Indonesia’s JKSE tumbled 1.08%, Vietnam’s Ho Chi Minh index dropped 1.08%, Singapore STI slipped .9% and the Korean KOSPI was marginally down by .07%. (Table from Bloomberg)

Team OPLAN 7,400 would have none of this for the Phisix.

Why should there be a panic buying when global markets had been selling off?

Well the likely answer is that team OPLAN 7,400 wanted to project G-R-O-W-T-H by painting the Phisix as immune to global developments. So the stage managed recovery had been conducted from the starting bell to the close. (charts from technistock and colfinancial). Compared to October 16th, today's strain has been more elaborate.

The benefits from higher Phisix should be popular approval ratings, inflated wealth (via inflated asset prices) for the majority owners of listed firms and inflated balance sheets of financial institutions. So motives provide clues of the possible parties involved.

Just look at the fantastic 198 points swing from the open to the close: That’s about a 2.7% move! The Phisix opened down 2% (!!!) and stormed all the way back to end the day with a .71% gain!!! Fantastic!

Yet a full 60.68% of the day’s gains had been through MARKING THE CLOSE! The charts depressed the contributions of “marking the close”” because of the humongous intraday volatility!

Gosh, team OPLAN 7,400 must be so desperate to see their targets met, perhaps by the yearend.

The incredible manipulation of the index has most likely been channeled through 6 issues as shown above.

Peso volume was low at Php 7.6 billion but because of cross trade from mostly Marc, this has swelled to Php 10.794 billion.

Ironically market breadth was in favor of declining issues which edged out advancing issues by 94-81. Again a manifestation that markets wanted to correct. (PSE Quote)

The remarkable rigging of the domestic stock market means that the market’s price discovery mechanism has been severely mangled, thus the gross mispricing of equity securities and demonstrates of the delusions of grandeur and invincibility by stock market operators.

All these confirm or attest to the manic phase of Philippine stock market bubble.

Yet history tell us that the obverse side of every mania (and its attendant manipulations) is a crash.

No comments:

Post a Comment