What a day!

Today’s market volatility has been fantastically a rare event!

First, yields of Philippine short term treasuries continue to spike!

It’s a second day of the week where yields of 3 month, 6 month (above charts) and 1 year (below left, 1 month included but not in charts) Philippine treasuries have moved sharply upwards. Current two day gains add to the previous two weeks of yield expansion.

Surging yields effectively translates to higher short term financing costs, a symptom of liquidity squeeze and could even signify seminal indications of a developing credit crunch!

As one would note, yield levels of short term government papers have breached June 2013 taper tantrum highs. Then, the spike in yield signaled a contagion from a mostly emerging market selloff. This time, it has been a domestic affair.

Additionally, with short term yields increasing more than the longer spectrum, there has been a dramatic flattening of the Philippine yield curve. Yield of 10 year Philippine peso bonds even declined today (right window).

And even from a mainstream perspective, I previously noted that flattening yield curves have been precursor to an economic growth slowdown.

Even more, if the current rate of the yield increases will be sustained, then this could lead to a yield curve inversion—where short term rates will be higher than the longer term—a reliable indicator of recessions.

Yesterday I wrote of how this could be reached.

The fundamental premise is that current highly leveraged firms or institutions who have been starved of cash could be desperately borrowing at higher rates to fund operational financing gaps in order to maintain current projects or positions. And this applies to both stock market speculators/market manipulators and entities which mostly belong to the bubble industries.

If my suspicions are right, then not only will stock market manipulators have impaired balance sheets, but they will be NET sellers of stocks (at vastly lower prices)!The same liquidations will be resorted to by cash strapped bubble industries (keep an eye on casinos, and the property industry)So the populist G-R-O-W-T-H theme will transmogrify into LOSSES and eventual LIQUIDATIONS.Yet the feedback loop between accruing losses and increasing credit strains will extrapolate to higher demand for short term loans which should drive short term yields to even higher levels relative to the longer end.If such dynamic is sustained then this will eventually lead to a yield curve inversion. The inversion will now signal a recession, if not a crisis!

So current Philippine yield curve conditions have likely been signaling emerging perils in the real economy.

Even more exciting today has been the activities in the domestic stock market.

The Philippine Stock Exchange today experienced a really wild rollercoaster ride which may be one for the books.

Today’s session had been marked by two roundtrips (see right window from technistock.net) and the spectacular return of the market riggers!

Following last night’s Fed chair Janet Yellen sponsored stock market party, where US stocks surged to its “best session of the year as investors celebrated…the Federal Reserve's pledge to be patient in raising interest rates” (CNBC) the Phisix gapped up to an early morning peak with gains of 111.04 points or 1.6%!

About a little more than an hour’s time, the entire 1.6% of gains shockingly evaporated! This marks the first roundtrip.

Not only has gains dissipated, the Phisix broke the 6,950 and 6,900 levels in the late morning dump! The dump translated to a maximum loss of 84 points or a 1.2% decline!

Yet following lunch break, the “afternoon delight” aspect of OPLAN Phisix 7,400 went on stream. Operators coupled with domestic bulls went on a bidding mania, where the 84 points or 1.2% morning loss had been entirely recovered through the last minute. This marks the second roundtrip.

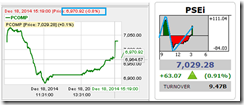

A minute towards the run off, the Phisix was up by only 4.71 points. (see left window from colfinancial) Yet at the closing bell, the Phisix surged by 63.07 points or .91%!

What an incredible day. The two roundtrips meant that the Phisix moved by 453 points or a staggering 6.5%!!! Importantly, almost the entire of the gains of the day, specifically 92.5% of the .91%, was due to the marking the close!

Given the wild pendulum swings, volume was relatively heavy at Php 9.47 billion. With special block sales this expanded to Php 10.98 billion. (PSE Quote)

Foreigners sold a sizeable net Php 1.095 billion worth of shares.

Decliners beat advancers by almost 2:1 or by 121 to 68. This signifies another sign that the Phisix wanted to correct but which the desperate market manipulators will not permit.

Today’s index manipulation has basically been a three industry rendition.

While all 5 sectoral indices posted pumps at different degrees, the biggest came from the holdings, the all-time favorite property, and the services sector (see above)

And the bulk of those last minute panic buying came from SM, AEV and SMPH.

Last minute pumps are hardly about profits. Rather they are about setting impressions.

Yet market manipulators continue to accumulate severely overvalued securities at record prices or near record high prices in the hope that some “greater fools” would buy what they will sell.

The problem is what happens if the markets go down? These operators function with no margin for errors.

Former Morgan Stanley analyst and now hedge fund manager Stephen Jen recently warned of a coming emerging market crisis. He says that today’s experts have little knowledge of 1990s.

From Bloomberg,

If the 48-year-old native of Taiwan, with a PhD from Massachusetts Institute of Technology, sounds a little jaded now, it’s not without some reason. He says he worries that many emerging-market analysts are too young to remember the late 1990s. Instead they learned the ropes in an era dominated by the rise of Brazil, Russia, India and China -- a supposed one-way bet to prosperity.“Many became EM specialists after the term ‘BRIC’ was coined in 2001 and don’t know any serious crisis,’’ says Jen, who now runs the London-based hedge fund SLJ Macro Partners LLP.The youngsters are about to be schooled. Jen says echoes of 1997-1998 may be at hand.

I believe that his warnings will also apply to the “youngsters” of the Philippine markets, who may be part of team OPLAN Phisix 7,400 or if not the lemmings enamored with easy money or those who merely find comfort by running with horde and prioritize social signaling (particularly those in the internet circles).

A lot of them will also get "schooled".

No comments:

Post a Comment