I’m not making any formal writing anymore until 2015.

Anyway here is the weekend update of the Philippine yield curve.

The above represents the entire yield curve based on Friday’s quote for the past 6 weeks.

As one would note, the short end of the curve has been rapidly ascending relative to the long end. This means that the domestic yield curve has been dramatic flattening.

A better expression of the curve would be the spread between the long end and the short end, where I compare the yields of 10 and 20 year minus the 1 year.

Again a dramatic flattening has been in place for the past 6 weeks for either the 10 or the 20 year curves.

There are two ways to look at this. First, why has there been a sharp rise in the short end?

The second is what are the implications?

The fundamental premise is that current highly leveraged firms or institutions who have been starved of cash could be desperately borrowing at higher rates to fund operational financing gaps in order to maintain current projects or positions. And this applies to both stock market speculators/market manipulators and entities which mostly belong to the bubble industries.

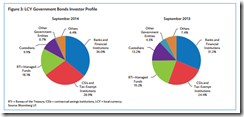

Remember, Philippine treasuries essentially represent a tightly held or controlled markets by the government and the domestic banking system (see above from ADB’s November Bond Monitor at ASIAN Bonds Online).

As argued before, this is why both have used the bond markets to drive down rates towards a convergence with US treasury yields. I called this the “convergence trade”.

Financial repression policies led to the corralling of resources of depositors enrolled in the formal banks through zero bound rates. Most importantly, such invisible transfer also covered the currency holders or mostly the informal economy.

Thus, these policies represented subsidies to both banks (and their clients) and the government at the expense of the average resident.

This has been a wonderful example of what inflationism does: By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. (JMKeynes)

Resources, intermediated by the banking system, have been funneled to the real economy via a “pump” on bubble industries to mostly firms of elites where G-R-O-W-T-H happened.

The subsidy to the banks and their clients inflated tax revenues that bankrolled ballooning government spending, thus an indirect subsidy to government.

Additionally by repressing interest rates, maintaining government liabilities had been below market rates. Thus the two-pronged subsidies in favor of the government.

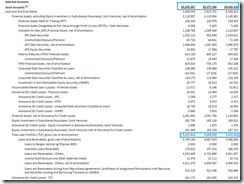

The above represents the insatiable spending appetite by the Philippine government as exhibited by the 2015 budget, which was recently passed.

The second chart signifies the historical revenues, expenditures and deficits as of 2013.

Despite the boom deficits continue, wait until the slowdown occurs and deficits and public debt will swell!

There is a third non-financial or political benefit: high public approval ratings. This allows the incumbent to impose more populist political whims.

Just think of all the recent colossal bond issuance from major companies that practically returned nearly zero (or even negative) to investors, net of inflation and taxes. Those surreptitious transfers not only meant free money for banks, bubble industries and the government, they also translated to a massive transfer of risk.

This implies that a substantial segment of depositor’s resources have now been exposed to various risk factors: interest rate, market, and credit. For foreign based loans, currency risks.

In a nutshell, for any strains in Philippine treasuries to emerge means that some formal economy institutions, perhaps in the financial sector, have already been feeling pressures.

So despite all the hallelujahs from government statistics, the bond market has been implying of developing cracks in the credit driven phony boom.

I also wrote of the possible implications: higher short term financing costs, a symptom of liquidity squeeze and could even signify seminal indications of a developing credit crunch!

Yet there is more: pressure on banking system’s balance sheets.

A flattening yield curve discourages borrowing short and lending long or the maturity transformation or profits from asset-liability mismatch arbitrages. A flattening of the yield curve may squeeze on interest rate margins. This means that credit expansion will slow or at worst, could even grind to a halt.

Since the Philippine G-R-O-W-T-H story has been one pillared by credit expansion (as previously discussed), any slowing of the credit boom extrapolates to a slowdown in statistical G-R-O-W-T-H.

And as the credit expansion fades, credit risk rises. If statistical G-R-O-W-T-H slows where will levered firms get money to pay for newly acquired loans? Here’s a guess: by borrowing more.

This could already be happening which is why short term bond yields have spiked.

Look at the Philippine banking system’s income statement from BSP data. Domestic banks are heavily dependent on interest rate income which accounts for about 2/3 of the banking system’s income.

A flattening of the yield curve may likely put a squeeze on domestic bank’s interest rate margins. So slowing credit growth and prospective decline in interest income will eventually hurt bank’s profits.

Additionally even if we are to look at the banking system’s non –interest income; fees and commissions almost accounts for half. So the banking system’s non-interest income indirectly depends on the sustained G-R-O-W-T-H in bubble industries and in asset markets (specifically stock markets) which ironically depends on credit growth!

So the yield curve says that credit growth will slow, thereby affecting G-R-O-W-T-H and increasing risks of banking system’s loan portfolio which accounts for half of banking system’s total assets!

Take away the illusions from credit growth, the entire house of cards crumbles

So unless there will be material improvements in the yield curve soon, the one way trade mentality held by the consensus will get another sting!

But if the yield curve continues to materially flatten or even exhibit inversion, then big big big trouble lies ahead.

Don’t worry be happy. Perhaps when economic Typhoon Yolanda arrives, affected banks may be bailed out by the government financed by the average citizenry through higher taxes and inflations. So stocks will rise forever!

But as the great Austrian economist Ludwig von Mises warned

But the boom cannot continue indefinitely. There are two alternatives. Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever-growing orgy of speculation, which, as in all other cases of unlimited inflation, ends in a “crack-up boom” and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion and thus bring about the crisis. The depression follows in both instances.

Have a great weekend!

No comments:

Post a Comment