So the widely anticipated ECB Mario Draghi’s “do whatever it takes” promise of Quantitative Easing has become a € 60 billion a month reality beginning March 2015 until September 2016.

From the European Central Bank’s Press Release: (bold mine)

22 January 2015 - ECB announces expanded asset purchase programme:

-ECB expands purchases to include bonds issued by euro area central governments, agencies and European institutions-Combined monthly asset purchases to amount to €60 billion-Purchases intended to be carried out until at least September 2016Programme designed to fulfil price stability mandateThe Governing Council of the European Central Bank (ECB) today announced an expanded asset purchase programme. Aimed at fulfilling the ECB’s price stability mandate, this programme will see the ECB add the purchase of sovereign bonds to its existing private sector asset purchase programmes in order to address the risks of a too prolonged period of low inflation.The Governing Council took this decision in a situation in which most indicators of actual and expected inflation in the euro area had drifted towards their historical lows. As potential second-round effects on wage and price-setting threatened to adversely affect medium-term price developments, this situation required a forceful monetary policy response.Asset purchases provide monetary stimulus to the economy in a context where key ECB interest rates are at their lower bound. They further ease monetary and financial conditions, making access to finance cheaper for firms and households. This tends to support investment and consumption, and ultimately contributes to a return of inflation rates towards 2%.The programme will encompass the asset-backed securities purchase programme (ABSPP) and the covered bond purchase programme (CBPP3), which were both launched late last year. Combined monthly purchases will amount to €60 billion. They are intended to be carried out until at least September 2016 and in any case until the Governing Council sees a sustained adjustment in the path of inflation that is consistent with its aim of achieving inflation rates below, but close to, 2% over the medium term.The ECB will buy bonds issued by euro area central governments, agencies and European institutions in the secondary market against central bank money, which the institutions that sold the securities can use to buy other assets and extend credit to the real economy. In both cases, this contributes to an easing of financial conditions.The programme signals the Governing Council’s resolve to meet its objective of price stability in an unprecedented economic and financial environment. The instruments deployed are appropriate in the current circumstances and in full compliance with the EU Treaties.As regards the additional asset purchases, the Governing Council retains control over all the design features of the programme and the ECB will coordinate the purchases, thereby safeguarding the singleness of the Eurosystem’s monetary policy. The Eurosystem will make use of decentralised implementation to mobilise its resources.With regard to the sharing of hypothetical losses, the Governing Council decided that purchases of securities of European institutions (which will be 12% of the additional asset purchases, and which will be purchased by NCBs) will be subject to loss sharing. The rest of the NCBs’ additional asset purchases will not be subject to loss sharing. The ECB will hold 8% of the additional asset purchases. This implies that 20% of the additional asset purchases will be subject to a regime of risk sharing.

The press release includes a technical annex.

Here is the official statement issued by ECB president Mario Draghi (bold original)

Based on our regular economic and monetary analyses, we conducted a thorough reassessment of the outlook for price developments and of the monetary stimulus achieved. As a result, the Governing Council took the following decisions:First, it decided to launch an expanded asset purchase programme, encompassing the existing purchase programmes for asset-backed securities and covered bonds. Under this expanded programme, the combined monthly purchases of public and private sector securities will amount to €60 billion. They are intended to be carried out until end-September 2016 and will in any case be conducted until we see a sustained adjustment in the path of inflation which is consistent with our aim of achieving inflation rates below, but close to, 2% over the medium term. In March 2015 the Eurosystem will start to purchase euro-denominated investment-grade securities issued by euro area governments and agencies and European institutions in the secondary market. The purchases of securities issued by euro area governments and agencies will be based on the Eurosystem NCBs’ shares in the ECB’s capital key. Some additional eligibility criteria will be applied in the case of countries under an EU/IMF adjustment programme.Second, the Governing Council decided to change the pricing of the six remaining targeted longer-term refinancing operations (TLTROs). Accordingly , the interest rate applicable to future TLTRO operations will be equal to the rate on the Eurosystem’s main refinancing operations prevailing at the time when each TLTRO is conducted, thereby removing the 10 basis point spread over the MRO rate that applied to the first two TLTROs.Third, in line with our forward guidance, we decided to keep the key ECB interest rates unchanged.As regards the additional asset purchases, the Governing Council retains control over all the design features of the programme and the ECB will coordinate the purchases, thereby safeguarding the singleness of the Eurosystem’s monetary policy. The Eurosystem will make use of decentralised implementation to mobilise its resources. With regard to the sharing of hypothetical losses, the Governing Council decided that purchases of securities of European institutions (which will be 12% of the additional asset purchases, and which will be purchased by NCBs) will be subject to loss sharing. The rest of the NCBs’ additional asset purchases will not be subject to loss sharing. The ECB will hold 8% of the additional asset purchases. This implies that 20% of the additional asset purchases will be subject to a regime of risk sharing.

Read the rest here

In the question and answer portion, asked whether Greek debt and bonds with negative yields will be included in the program?

Mr. Draghi’s reply:

Second question, the answer is yes. And to the first question, let me say one thing here. We don't have any special rule for Greece. We have basically rules that apply to everybody. There are obviously some conditions before we can buy Greek bonds. As you know, there is a waiver that has to remain in place, has to be a program. And then there is this 33% issuer limit, which means that, if all the other conditions are in place, we could buy bonds in, I believe, July, because by then there will be some large redemptions of SMP bonds and therefore we would be within the limit.And by the way, let me add, if there is a problem, if there is a waiver, all these are not exceptional rules. They were rules that were already in place before. So we're not creating.

It’s important to point out here that the ECB's buying of negative yields will mean that as part of the program, the ECB will be absorbing losses.

In addition, as noted above the ECB has a risk sharing provision; the

risk sharing component essentially attempts downplay the politics of

redistribution from the ECB program. But at the end of the day, the

burden of transfer will fall on the shoulders of the productive nations.

And this is why the ECB’s 60 billion QE has hardly been unanimous, as again German representatives reportedly expressed opposition. From the Wall Street Journal: The 25-member governing council’s wasn’t unanimously in favor of the new program. While the vote breakdown will not be published, it’s likely the decision was opposed by the two German members, and possibly others. German policy makers don’t believe there is a risk of deflation in the eurozone, while Germans also worry that QE is a form of central bank financing of government deficits, a taboo in the eurozone’s largest members. German policy makers also fear it will ease pressure on governments to press ahead with painful economic reforms.

Yet today’s ECB action represents a product of a series of previous actions that has not worked but has not deterred seemingly desperate central banks, along with the BoJ, from trying.

As I wrote last November,

Yet the ECB has been easing since 2008. The ECB has pared down interest rate from 4.25% in 2008 to merely .05% today. The ECB cut the Eurozone’s interest rate twice this year.Not only that, the ECB has imposed negative deposit rates on banks last June in order to “stimulate lending”. Along with the negative deposit rates, the ECB likewise pumped liquidity to the banking system to promote loans to small and medium enterprises via the Targeted Long Term Re-financing Operations (TLTRO). The ECB expected at least €100 billion to be availed of by the banking system. Unfortunately, last September the first tranche of TLTRO only induced €82.6 billion worth of borrowings from 255 banks.Obviously all these hasn’t worked, so despite interest rate cuts, negative deposit rates and the TLTRO, the ECB finally embarked on asset purchases initially involving covered bonds and asset backed securities (ABS) during the height of October’s selloff. In realization that that markets has been unsatisfied, the ECB floated the idea to include corporate bonds.With Thursday’s unpalatable data comprising a contraction or stagnation in the Eurozone’s largest economies, specifically the shriveling of French manufacturing PMI and services PMI, the flat lining of Germany’s manufacturing PMI while services PMI was sharply lower than expected, such has been manifested on the Eurozone’s manufacturing PMI which hardly grew, while the services PMI came below consensus expectations. These may have prompted Mr. Draghi to unleash the bazooka—implicit promises to buy of government debt.

So today’s actions have merely doing the same things over and over again, expecting different results. Some people call this “insanity”. Yet today, insanity has been embraced as economic policies.

The reason why this won’t work? Simple it represents invisible redistribution. Growth comes from addition not subtraction and one can’t print the real economy.

Even the mainstream’s idol John Maynard Keynes clearly recognized this:

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Let me repeat: There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency.

The euro-usd has been collapsing along with consensus expectation of the Eurozone’s gdp.(chart from zero hedge)

And who will be the lucky enriched some from the stealth transfer or the “hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose”?

Well of course the establishment, via the direct beneficiaries or biggest owners of European debt ranging mostly from foreign governments, domestic banks and domestic non banks (chart from Wall Street Journal) and indirectly the domestic government through subsidized debt via suppressed interest rates.

QE is part of Financial repression policies. Financial repression introduced in 1973 by Edward Shaw and Ronald McKinnon as per Wikipedia.org states of "policies that result in savers earning returns below the rate of inflation" in order to allow banks to "provide cheap loans to companies and governments, reducing the burden of repayments”

Of course the financial markets love this, that’s because these surreptitious transfers have been channeled through financial assets which artificially boosts the balance sheets of these beneficiaries and which has been sold to the public as to benefit the economy via the “wealth effect” transmission.

Unfortunately, speculative activities represent unproductive activities therefore are temporal and unsustainable. Such activities instead signify capital consumption process which leads to depression.

Those previous actions have already been showing this, why change today because the bailout is bigger?

Stock markets celebrated Draghi’s “best way to destroy the capitalist system” by debauching the currency (from Bloomberg)

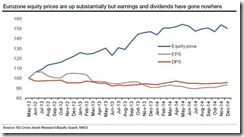

Yet milestone highs of European equities have hardly been accompanied by earnings and dividend growth (chart above from zero hedge). On the contrary, as shown by the second chart below from Yardeni.com, annual and forward estimates of earnings and revenues per share of Europe ex-UK MSCI have been collapsing!

This means that European stock markets have become Frankensteins of the ECB, whose false confidence has been entirely based on inflation subsidies (ECB’s liquidity) that has only led to massive multiple expansions, ergo a bubble.

At the end of the day, these booms will morph into busts. And the bust will confirm the ECB’s actions that “the best way to destroy the capitalist system” is by debauching the currency.

No comments:

Post a Comment