It will be a truncated work week due to the Pope’s visit to the Philippines.

The Philippine bond markets closed the week with marginal improvements.

This comes in the light of the recent $ 2 billion fund raising by the Philippine government in the international bond markets as discussed last weekend.

Given the new funds injected, signs of liquidity strains should have materially eased.

Well it hasn’t. Maybe in the coming weeks but so far the pace of improvements hasn’t been substantial.

For now, only yields of 3 month bills have markedly eased. But it remains at June 2013 levels. Yields of 6 months and 1 year has moderated marginally.

Interestingly, not only has the inversion between yields the 5 year and 4 year deepened, the 5 year has also inverted with its 3 year treasury counterpart!!!

In short, 3 year yields have closed the week higher than 5 year. Why???

Overall, a glimpse at the spreads between 10 and 20 year vis-à-vis the shorter maturities, namely 6 months, 1 year and 2 years have hardly made any significant change this week.

Yet if we compare the effects of the latest borrowing by neighbor Indonesia which also raised $ 4 billion last week, the rally in Philippine bonds at the long end has been dwarfed by the Indonesian counterpart whether seen in both the yields of 10 or 20 year bonds (charts from investing.com)

All these are based on today’s actions.

The rally in Indonesian bonds is the scale of what I initially expected to happen here.

So everything hunky dory for Philippine bonds eh?

I have said this weekend that deflation has landed on Philippine shores as seen via crashing M3, negative CPI, the flattening of the yield curve and the spike in CDS.

Well to add to this, here is a more striking development: wholesale prices of construction materials in December has CONTRACTED!

Let me quote the National Statistics Office: (bold mine)

Compared to a year ago level, the Construction Materials Wholesale Price Index (CMWPI) in the National Capital Region (NCR) posted a negative rate of 0.1 percent in December. Last month it was recorded at 0.8 percent and in December 2013, 2.4 percent. The downtrend was due to 14.9 percent decline in fuels and lubricants index. Slower annual increments were also noted in the indices of cement at 2.3 percent and tileworks, 2.7 percent. The rest of the commodity groups either had higher annual mark-ups or retained their last month’s rates with the indices of asphalt and machinery and equipment rental still registering a zero growth...

On a monthly basis, the wholesale prices of selected construction materials in NCR further went down by 0.8 percent in December. This was attributed to the decreases registered in the indices of fuels and lubricants at -7.0 percent and cement, -0.2 percent. Higher monthly growths were, however, seen in the indices of hardware and reinforcing steel at 0.2 percent; plywood, 0.5 percent; plumbing fixtures and accessories, 0.6 percent; and PVC pipes, 0.1 percent. Movements in the other commodity groups either remained at their last month’s rates or had a zero growth. A series of price rollbacks was observed in gasoline, diesel and fuel oil during the month. Likewise, prices of cement were on the downtrend. On the other hand, higher prices were noticed in plywood, steel bars, PVC pipes, plumbing fixtures and accessories like faucet, kitchen sink and angle valves.

One can partly impute to construction deflation to crashing oil prices, but the declining prices of cement, machinery and equipment rentals and the others have likely been more about demand.

In addition, rising prices of plumbing fixtures and other accessories could be about the falling peso, rather than demand based increases.

So why the collapse in construction material prices? Has there been a deluge of imports or production by domestic supply which has not been met by demand? Or has this been an essentially demand slowdown problem?

If this has been a manifestation of diminished demand, then this should be portentous for statistical GDP for the 4Q.

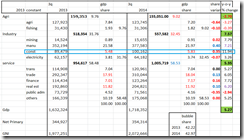

Just to remind you of the contribution of construction industry on 3Q 2014 statistical GDP

From the expenditure side, based on NSCB data, construction grew 12.3% in 3Q 2014 year on year. Construction accounted for 9% of 3Q GDP.

From the industry side, construction expanded 11.94% in 3Q 2014 with the share of the industry to overall GDP at 5.83%.

The 5.3% 3Q GDP owes largely to construction and finance activities as discussed here.

From the expenditure perspective, if statistical CPI on a month-on-month basis, which has SHRANK for two successive months, could most likely be indicative of decreased consumption activities by domestic households (compounded by falling oil prices), if exports hardly picked up and where its gains has been offset by import growth (X-M) and if the above signifies a manifestation of a slowdown in construction, then where will 4Q statistical GDP come from?

It looks as if a big negative surprise for 4Q statistical GDP is in store for the high growth one way street looking consensus. We will know by January 29th.

So what has today’s orgasmic bidding spree to push the Phisix beyond 7,500 all about? The Philippine economy has reached a state of utopia where risks have all vanished?

No comments:

Post a Comment