Here is the Philippine Stock Exchange’s press release on Phisix 7,500+ (bold mine)

"With the moderate slowdown in China's economy, coupled with Japan's economic recession and Europe’s debt crisis, and notwithstanding the US economic resurgence, emerging markets such as the Philippines will stand out due to its strong macro-economic fundamentals and sustainable growth story. The positive sentiments by the market as regards the European Central Bank quantitative easing program further propelled our market to an all-time high," said PSE COO Roel A. Refran.

"I believe that our stock market will remain resilient amidst the global realities buoyed by investors’ continued confidence in our economy," Refran added.

Year-to-date, the PSEi is already up by 4.4 percent.

Let us put in to perspective this week’s record run.

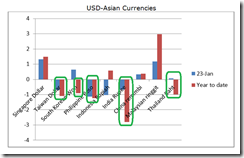

Asian stocks flew this week with the Philippine Phisix registering one of the (surprise!) underperformers ex-China on a weekly basis. The domestic benchmark rose by only .77% week on week.

With the exception of a few bourses, weekly gains of other Asian national benchmarks have been at a stunning 3% and above!!!

Yet the best performers year to date as of Friday posted over 6% returns. The topnotch position have been shared by Vietnam (+6.74%), Thailand (+6.72%), and India (+6.47%) (see green rectangles).

Yet despite the relative underpeformances, bourses of New Zealand, Indonesia and the Philippines set record highs (with stars, see also above).

India’s Sensex stole the limelight by outclassing the rest this week PLUS a record high. Or stated differently, record high has been a product of a carryover from last week’s gains PLUS this week’s fiery performance

Equity bellwethers of Pakistan, Singapore and Taiwan have now been just off record highs.

Meanwhile Thailand’s bellwether has completely recovered the steep December losses and seems as headed for a landmark high.

Ironically, Thailand’s dazzling performance comes with a stagnating statistical economy whose GDP in 2014 has been less 1% as of 3Q. As I earlier pointed out, Thailand’s stocks reported record stock market trading volume in 2014 as abundant liquidity fueled a massive bidding spree on stocks and real estate than on investments on the real economy plagued by overleverage and political uncertainty.

The Malaysian KLCE, on the other hand, maybe far off the record levels, but has rallied strongly this week. This comes even as the Malaysia’s PM went on air this week to talk about and deny a crisis!!!

Underperformance of Chinese stocks hasn’t been what it seems.

The Shanghai index crashed 7.7% last Monday due to a crackdown by the Regulatory Commission on margin trades.

Apparently shaken by the market’s reaction, the Regulatory Commission backed off in the succeeding days. And helped by PBoC’s injection of funds to troubled companies, the Shanghai Index recovered almost entirely Monday’s crash through the weekend.

And if one glimpses at the chart of the Shanghai index the Chinese bellwether currently drifts at a milestone 2009 high! So despite a “moderate slow down in China’s economy”, Chinese stocks are at watermark highs. So how has the growth story been consistent with record stocks?

It’s been noted too that Japan has been in a recession. So what explains soaring stocks in a recession?

And in the order of year-to-date performance of Asian bourses, the Phisix ranks fifth in the region after 4th placer Hong Kong.

The bottom line is that there has been little to do about being a “stand out due to its strong macro-economic fundamentals and sustainable growth story” but about a massive and indiscriminate regional pump which characterizes a risk ON environment in expectations of abundance of liquidity from the ECB operations.

The recognition that there have been problems with China, Japan and Europe aside from oil and commodity producing emerging markets suggest that “strong macro-economic fundamentals and sustainable growth story” represents a fantasia unless the Philippines is a closed economy.

The fact that there are trade, capital and investment and remittance links means that a slowdown from these major economies will have relative impact depending on the transmission linkages to an economy with exposure to them. The impact will be (again) relative to the specifics of the industries involved. Writing off risks by stereotyping only begs the question.

Draghi’s Bazooka has pumped up European stocks to record levels even when corporate fundamentals have been sluggish or even collapsing in terms of estimates of annual and forward earnings (via MSCI ex-UK)

The Nikkei Asia quotes an expert on the record highs of Indonesia and the Philippines: "The ECB decision will definitely ease liquidity pressure" on Association of Southeast Asian Nations markets, said Mixo Das, a Singapore-based equity strategist at Nomura.

And this has exactly been what the region’s stock market pump has been about: expectations of a plethora of liquidity from the ECB’s action. The ECB repeated pronouncements during the last quarter of 2014 has paved way for most of the region’s pump from the onset of 2015.

Feel good rationalization is the order of the day

Just take a look at the headlines from yesterday’s business section of the Inquirer: Market Seen to Hit 8,000 Mark, Corporate Earnings May Grow By 16% in 2015 from last year’s 6%

Corporate earnings grew by only 6% in 2014??? Huh? The market returned or paid 22.76% last year for only 6% growth??? Said differently, punters paid nearly THREE times more than the actual growth rates!

And this has been why the Phisix has reached absurd valuation levels via multiple expansions.

Let us extend mainstream logic. 2014 performance translates to 3.79% gains for every 1% earnings growth. If the past should extend to the future, then at 16% growth, the Phisix should return 61% or be way past 10,000 (11,640)! So why stop at 8,000? Because the target looks more rational than the logical basis of its premises?

Now what happens if the 16% growth does NOT emerge? PERs will jump from the current 30,40,50 to 60,70,80? And this is sensible or normal?

As I have been saying here, G-R-O-W-T-H has served nothing more than to rationalize or justify outrageous bidding up of risk assets. It’s not about G-R-O-W-T-H, it’s about GAMBLING. Gambling financed by bank credit and liquidity that has been rationalized by G-R-O-W-T-H!

I wrote about Warren Buffett’s favorite stock market indicator the market cap to gdp last September.

Given that the Phisix generated 22.76% in 2014 and has been up 4.4% as of Friday, while say, 2014 GDP will be as what mainstream expects at 6%, here is what I wrote last September which should be relevant today:

Total Market capitalization as % of GDP has reached 105.6 in 2012 as per the World Bank, chart from Tradingeconomics.com. In 2013 since the Phisix yielded only 1.33% as compared to a statistical 7.2% GDP, a back of the envelop calculation posits that the said ratio must have declined to possibly 99.73. However, considering the 1H GDP at 6%, coming amidst a 26.8% return at the end of June, this implies a market cap to GDP at a stunning record of 120.53 way way way past the pre-Asian Crisis!

Yet what happens when mainstream expectations of GDP will be unfulfilled like in 3Q? If the markets don’t make the necessary adjustments then at current price levels, the market cap to GDP will spike to even more ridiculous levels! And if markets continue to rise we get the same outcome—patent mispricing!

And this has been about “strong macro-economic fundamentals”? Or has this been about flagrant misappreciation of risks that signifies as symptoms of financial destabilization in progress?

Every time the mania deepens this warning from Harvard’s Carmen Reinhart and Kenneth Rogoff becomes increasingly relevant:

The essence of the this-time-is-different syndrome is simple. It is rooted in the firmly held belief that financial crisis is something that happens to other people in other countries at other times; crises do not happen here and now to us. We are doing things better, we are smarter, we have learned from past mistakes. The old rules of valuation no longer apply. The current boom, unlike the many previous booms that preceded catastrophic collapses (even in our country), is built on sound fundamentals, structural reforms, technological innovation, and good policy. Or so the story goes …

Or how about the central bank of Central banks, Bank for international Settlement’s General Manager Jaime Carauna’s admonition last November

Credit booms can act as a smokescreen. They tend to mask the sectoral misallocations that I just described, making it difficult to detect and prevent these misallocations in time. Boom times also tend to hide other slow-moving forms of deterioration in real growth potential.

Asian currencies has been less indiscriminate relative to stocks.

But still traces of the Asian Risk ON landscape has been evident. The peso rallied strongly this week, up 1.1%. Year to date the peso has been up 1.2% or about 90% of year to date gains came from last week.

On a year to date basis, aside from India’s rupee, the Thai baht, Taiwan dollar and the South Korean won has been up despite uneven performance this week. This means that the Philippine peso’s rally has been belated or a catch up move.

The Indonesian rupiah rebounded strongly too, but this only shaved off the year to date losses.

Ironically strong stock market performances failed to filter into the Singapore dollar and the Malaysian ringgit. So there has been signs of divergence between the stock market and the currency market. Asymmetric performance suggests of ephemeral conditions—either the currencies of Singapore and Malaysia’s will strengthen or stocks will weaken.

And paradoxically too, Singapore’s near record stocks comes in the light of increasing alarmism by the mainstream over signs of growing cracks in the city state’s credit and housing bubbles.

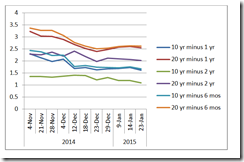

And in the Philippine record stocks hasn’t been transmitted to the bond markets.

Despite the $2 billion of bonds raised from the international markets, and the supposed “seasonality” of the yield curve, Philippine bond markets hardly improved going into the end of January or after 3 weeks.

While the yields of 3 months bills did markedly decline, it still remains at May 2013 levels, yet the (10-25 year) bonds have declined even more. Yields of one month, 6 months and one and 2 year had been marginally higher.

The result has been to aggravate the flattening of the curve. The spread between the 10 and 20 years relative to the 6 months, 1 and 2 years continues to narrow. Some of last week’s seeming marginal improvement seems to have reversed.

And curiously the inversion of yields of the 5 year with 4 and 3 year counterparts has only deepened. Yields of one month bills at 2.379% has inverted with the 3 months at 2.136%. Though these are minor inversions they are symptoms that the tightly controlled bond markets have not been as healthy as what the establishment and media wants the public to believe.

So how can corporations grow at a rate of 16% when a flattening of the yield curve postulates to lesser credit activities for the economy and subsequently lesser profits for the banks?

At the end of the day, all these rationalizations have been no more than pat on the back or feel good self serving bias—attribute success to skills and failures to external factors.

Such rationalizations have been common traits during market tops similar to Japan’s Nikkei when it peaked at 39,000+ in December 29, 1989.

Finally, how has Friday's fresh record closing been attained?

Well by the methods considered as illegitimate but now has become regular: marking the close. About a third of Friday's gains have been etched by the last minute pump!

Index managers have been panic buying and accumulating outrageously valued index issues in thinking that today's world risks has been expunged out of existence.

Sometime soon reality will arrive in the form of a rude awakening.

Index managers have been panic buying and accumulating outrageously valued index issues in thinking that today's world risks has been expunged out of existence.

Sometime soon reality will arrive in the form of a rude awakening.

.bmp)

No comments:

Post a Comment