So what happened to those “flushing of liquidity into the system”?

And for today, it has been more than just interest rate/ reserve requirement cuts but one of arrest of several personalities (via SCMP’s George Chen)…

Including one from media...

…who probably wrote of something about stocks which regulators didn’t approve of…

…and of a banker…who may have sold or advocated selling shares or has done anything without the approval of authorities (again from Mr. Chen)

Of course, the day wouldn’t have been fun without the fierce battle between the government (perhaps the only remaining bull?) and a stampeding crowd at the exit gates…

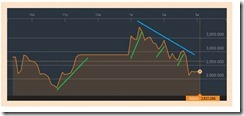

The Shanghai intraday actions (courtesy of Bloomberg) show of the wild swings…down by over 4% at the start of the session to rally by over 1% in the early afternoon trade. This was followed by intense skirmishes as exhibited by the volatility going to the end.

However, finally government bulls succumb to the market bears at the close.

Again government funds led the buying according to Mr. Chen…

Now for the final tally. From Bloomberg:

China’s stocks extended the steepest five-day drop since 1996 in volatile trading as lower interest rates failed to halt a $5 trillion rout.The Shanghai Composite Index fell 1.3 percent to 2,927.29 at the close, after rising as much as 4.3 percent and declining 3.9 percent. The cuts in borrowing costs and lenders’ reserve ratios were announced hours after the benchmark measure closed with a 7.6 percent drop on Tuesday.Chinese equities have lost half their value since mid-June, as margin traders closed out bullish bets and concern deepened that valuations are unjustified by the weak economic outlook. The government has halted intervention in the equity market this week as policy makers debate the merits of an unprecedented rescue, according to people familiar with the situation.

Bottom line: The lesson from George Santayana’s wisdom has clearly been a standout for the day: Those who cannot remember the past are condemned to repeat it.

No comments:

Post a Comment