Wow

that was quick.The

Phisix crashed 4.37% today just when my ink has hardly dried. I wrote last night that grizzly bears would be the story for 2016.

Beyond

my expectations, sellers had apparently been in a frenzied rush out of

the Philippine equities today. Sellers frantically smashed into the

ramparts that bordered the bears and bulls to lead them straight into

the bear’s lairs.

At

least during the August 24 crash, price fixers had the temerity to

mitigate the 7+% intraday losses to only 6.7% at the close, through end session

pump.

While

today’s crash was much less than August 24, price fixers had

seemingly been absent or even perhaps joined the dumping session.

There was even a mini “marking the closing” today. But instead of a pump it was a dump that amplified the losses

for the day! (intraday chart and quote from Bloomberg) Karma?

Remember

that the Phisix plummeted 5.42% last week. So today’s tailspin PLUS

last week’s losses adds up to a shocking 9.79% loss in just SIX

days of trade for the year 2016!!!

And

instead of the best among ASEAN equities, the Phisix was the worst performer

with last week’s 5.24% slump

What

a foreboding start!!!

But

why or what’s the hurry to sell? Has the domestic market suddenly unearthed something so

distressing, which media and the establishment has concealed, as to

incite such violent reaction?

Has

the market come to realize that the PSEi 8,127.48 was a Potemkim

Village?

I

understand that the mainstream will pin the blame on external factors

for today’s bloodbath.

While

it may be true that most of Asia was in the red today, the Reuters

quote above reveals that only the Shanghai index, with another 5.29% crash,

topped the Phisix in scale. All the rest suffered losses below 3%.

In short, there has been more than meets the eye. There must be a significant domestic influence for today's violent reaction.

Sellers

were so fixated on exiting that all indices were bloodied.

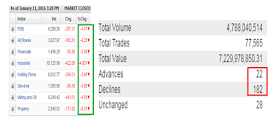

Decliners

trounced advancers by a stunning 8 to 1!!! (my guess is that this margin represents a record of sorts)

Most of the

heavyweights, the headline index sensitive issues, had been massacred.

Today’s

breakdown totaled 22.63% from the April 10 2015 high. Clearly a bear

market.

For

those who may argue that this may look like 2013, pls note of the

difference.

The

5,700+ levels served as a bottom which was hit thrice in 2013. It was a springboard for the 2014 run.

Today

was a complete breakdown!

During

the last August crash, I noted that crashes

have not been an isolated event

Additionally, Monday’s

crash hasn’t been an anomaly.

Crashes are signs of the ventilation of embedded imbalances. There

won’t be crashes without justification on them.

There

have been many developing signs that hinted to this eventuality.

The

market’s shrinking liquidity as expressed by the diminishing Peso

volume, increased deterioration of market breadth and reduced stock

market trading activities had all converge to presage this. I warned:

The

lesson: In

bullmarkets watch the “bid”, in bear markets watch the “ask”.

The conditions underlying the bids or asks—which represents the

investor risk preferences—will determine the direction of momentum.

Remember, the long term represents the sum of short actions.

As an old saw goes, the journey to a thousand miles begins with a

single step (Laozi). Applied to Philippine stocks, once again, the

intensifying decline in the trading volume highlights heightened

clues of dissipating bids….

Said differently, buyers

at current price levels have been erecting less and less barriers

against mounting sellers.

And

all it takes was for a big headline issue to function as trigger.

The

reason why the Philippine assets remain relatively sturdy has been

because sellers

have NOT yet been aggressive since the HEADLINES tell them so.The

establishment believes that the boom can still be maintained even

when the core has been eroding.

They are relying on HOPE. And

this is the reason behind the headline management.They

manage statistics and the markets to keep intact what they see as

‘animal spirits’. The exposé on DBP’s wash sale should be a

wonderful example.

Besides,

headlines shows of no crunch time yet, here or overseas. But no one

can guarantee how long this endures.

But when

reality eventually filters into the headline;

perhaps as in the form of economic numbers or a surprise missed

interest payment by a major company, or the appearance of a major

global event risk, then bids will evaporate.

Bullseye!

Bullseye

Again!

Sure, there will be sharp rallies as characterized by a typical bear market.

But I suggest that given the escalating fear factor, any sucker's rallies should sold into.

No comments:

Post a Comment