Underperformance

of the Top 5 Shows Why PSEi Still Trades Below April 2015 Highs

We

will not have any more crashes in our time.

-

John Maynard Keynes in 1927

There

will be no interruption of our permanent prosperity.

-

Myron E. Forbes, President, Pierce Arrow Motor Car Co., January 12,

1928

Stock

prices have reached what looks like a permanently high plateau. I do

not feel there will be soon if ever a 50 or 60 point break from

present levels, such as (bears) have predicted. I expect to see the

stock market a good deal higher within a few months."

-

Irving Fisher, Ph.D. in economics, Oct. 17, 1929

We

feel that fundamentally Wall Street is sound, and that for people who

can afford to pay for them outright, good stocks are cheap at these

prices."

-

Goodbody and Company market-letter quoted in The New York Times,

Friday, October 25, 1929

Quotes

from Gold-Eagle.com

As

Asia’s markets tumbled over the week to reflect on global

developments, only two bourses were left unscathed. Aside from

Pakistan (+4.97%), the Philippine benchmark, the PSEi, even shined by

advancing 1.5%.

The

Sauve

Qui Peut

Pump and Reversion to the Mean

Given

the breathtaking 1% marking the close pump last Monday, designed to

project the PSEi’s exceptionalism, which was backed by another .36%

end session push on Tuesday, it’s easy to construe that price

fixing has mainly been responsible for this week’s outcome. Note

1.36% marking the close returns relative to the weekly 1.5% equals

91%.

The

Manipulator’s contemporary creed: the PSEi must always rise and

must not be permitted to go down! We have reached NIRVANA! So again,

they will do whatever it takes to pump the index back to the April

2015 record highs even if this should mean even wilder upside

actions.

Since

the banks, Ayala Land and URC have weighed on the PSEi’s thrust to

a new record (based on chart trends), this week’s runup was

primarily focused on them! The banking trio, BDO (+5.02%), BPI

(+2.32%) and MBT (+1.81%) PLUS Ayala Land (+3.37%) along with URC

(+7.2%) were responsible for the gist of this week’s gains!

BDO

BPI

URC

ALI

And

as one would notice, vertical price actions have essentially shifted

to these issues. (see charts above)

It’s

truly depressing, if not revolting, to see how Philippine capital

markets have been totally debauched in order for some segments of the

society to continue to benefit from the invisible redistribution

process channeled through negative real rates policies of the BSP.

Nevertheless,

such represents one of the very essential traits of the boom-bust

cycles which economic historian Charles Kindleberger vehemently

warned

about. Mr Kindleberger admonished that many resort to cheating or

swindling in order to sustain the status quo premised on the motto of

sauve

qui peut (may

he save himself, whoever can).

So

to negate the effects of the recent crash, the frantic vertical

pumping of the PSEi appears emblematic of such progressing malady.

Even

with the massive distortions brought about by actions directed at

sauve

qui peut, the

history price actions indicates that all such collusive efforts will

eventually be in vain. That’s because reversion to the mean has

almost always prevailed. And reversion to the mean won’t happen

only unless ‘this time is different’. Well is it?

As

shown in the above chart, parabolic price spirals or vertical

liftoffs in all four issues over the three years have all FALTERED.

And

the common repercussion from forcible price escalations had been the

Newton’s Third Law of Motion where “For

every action, there is an equal and opposite reaction”. Or to

paraphrase Newton: For every hysteric price pumps, there has been an

almost equal and opposite reaction via price dumps! The obverse side

of every mania is a crash.

PSEi

7,600: Top 5 Relative Underperformance

Let

me further expand this thought with a discussion of relative

performance between PSEi in 2015 and 2016.

First

some notes.

As

of Friday’s close, at 7,622.07 the PSEi remains 6.21% OFF the April

10 2015 high of 8.127.48.

The

PSEi rose to April 2015’s record high in an incremental mode while

today’s action has been from violent

price surges.

The

current 5 month string of price spikes came in reaction to the 2016’s

or New Year’s three week crash.

The

ratio of returns of PSEi issues simply illustrates of the relative

performance of PSEi issues, as of Friday, compared to the runup to

the record high of 8,127.48 in 2015.

Further

note: The above are calculated from a year to specific week

baseline—weekly close of April 10 2015 as against the weekly close

as of June 17, 2016. A ratio of 1 means equal performance. A ratio of

less than 1 equates to underperformance by the issue in 2016 relative

to 2015. Whereas the ratio of over 1 means outperformance.

Five

issues of the top 15 have massively outperformed in 2016, namely JGS,

AEV, BPI, JFC and MPI. These are the issues that have mainly

catapulted the headline index to the current levels.

With

the exception of JGS, because these issues have mostly been from the

latter half of the top 15 PSEi weighting scale, the impact of their

record high prices have been insufficient

to have pushed the headline index to a new high.

In

the meantime, 5 issues have significant deficits (<.6%) but still

positive returns, specifically GTCAP, BDO, MBT, ALI and SM. One issue

has had a negative ratio: PLDT (which showed of negative returns for

2016).

Considering

that the biggest two market cap issues have underperformed, this

explains the gist of the distance between April 2016 record highs and

the current levels.

Yet

the biggest drag has been the fifth rank PLDT, which so far has

delivered a negative year to date return (despite a three week 22.34%

ramp!)

So

the subpar comparative results of 3 of the 5 biggest market caps has

contributed to the below record Phisix.

This comes even if SM has reached record highs last May 2016.

This

can be expanded when viewed from the aggregates

The

scorecard of returns of the top 5, as of Friday’s close, at 10.44%

relative to their returns in 2015 at 15.196% or the difference of

4.8% again reveals why the PSEi has still been below the April 2015

record.

Note

that the top 5 issues carry a cumulative market weight of 38.41% as

of Friday.

Considering

that the biggest outperformance comes from the below the top 5

ranking but still within the top 15, the relative returns for the top

10 and 15 has narrowed—when seen from 2015 and today.

Yet

in spite of the towering gains by SMC, PCOR and BLOOM, the average

gains of the lower 15 of the PSEi index has been marginally inferior

today at 9.48% relative to 9.66% in 2015. That’s because such

biggest surplus returns, which came from the lowest rung, has only a

combined weighting of only 2.15%. Whereas the underperformance of

bigger weight issues from the lower half of the PSEi index, as EDC,

ICT, MEG, AGI and DMC, has neutralized those gains.

Nonetheless,

the market cap weight of the last 15 issues have accounted for only

19.06%. This

tells why the performance of these issues has hardly contributed

meaningfully to the overall conditions of the PSEi

Yet

the PSEi average and weighted average returns has stark

differences.

Seen

on the average returns for the overall PSEi issues, there has been

little difference (-.71%), at 10.52% year to last week (2016)

relative to 11.232% in April 10 2015.

So

if the PSEi climbs higher where average returns of the broader issues

continue to escalate then average returns may exceed the 2015 highs

returns even if PSEi remains below

the watermark levels.

But

seen from the market cap weighted returns of the PSEi based on year

to the week ending April 10 2015 at 12.4% as against year to date of

9.64% (as of Friday) the underpeformance of the top 5, has become a

lot more pronounced. Again that’s because of the top 5 subpar

returns.

In

short, the

current seeming concerted thrust to violently inflate prices of TEL,

ALI, the banks, and URC seems part of the covert exercise designed

for the PSEi to forcibly reach its April 2015 record.

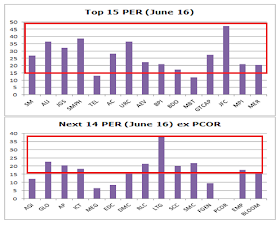

Yet

as price pumps to bolster the headline index continues, the more

prices have become dissociated or detached with reality. As one can

see above, massive pumping has lifted PERs to 30,40 and even close to

50 levels!

As

of Friday’s close, the average PER of the PSEi risen to 19 whereas

the weighted PER was at 24.8%!

Who

will be Right: Falling Peso Rising PSEi?

Finally

the sauve

qui peut

pump has led to a bizarre convergence of the usually divergent USD

php and the PSEi.

Gains

accrued by the peso the other week was neutralized when the USD Php

advanced .7% this week to Php 46.445

The

USDphp usually moves in the opposite direction relative to the PSEi.

Again the latter’s peculiar convergence must have likely been from

the concerted pumping on the PSEi. Or has previous divergence now

transformed into a convergence? From what grounds?

Again

Newton’s Law: The obverse side of every mania is a crash!

No comments:

Post a Comment