The Philippine peso was clobbered this week by 1.06% for the fifth consecutive week of losses. The USD phpclosed at 48.50 for the week.

The peso presently owns the tiara as Asia’s worst performing currency on a week on week (top) basis, as well as, year to date basis.

Malaysia’s ringgit has been the second runner-up for the week, while the peso has supplanted the Chinese yuan as tailender on a year to date basis.

In my view, the sharp vertical uptick of the USD php has now reached severely overbought levels and could be bound for material contraction or Newton’s law.

But since the currency markets have the tendency to be more volatile, thus Newton’s law may not be as effective as they apply to stocks. But they still apply.

History shows the way.

Over the past three years or since 2013, the USD php has spiked FOUR times.

The biggest vertical move occurred during the taper tantrum where the USD peso soared 7.4% in one monthand two weeks. Newton’s law has not appeared here.

The second leg of the USD php run had another 5.5% vertical run (on top of the 7.4%). It was here where Newton’s law emerged to erase all the gains of the second leg

But the gains from the first leg had virtually been unscathed or untouched.

Newton’s law only took the froth off the second leg but maintained the gains of the first leg which served as a staging point for the third leg.

The third leg was during the 3Q of 2015 where the USD php surged by 4%. Newton’s law reemerged but didn’t take back all of the gains.

That’s because the USD php crawled back to hit a high of 47.995 last January 26 in harmony with the downturn in global markets.

When global central banks went on a full-scale rescue of the stock market via the Shanghai accord where negative rates were implemented, this coincided with the BSP’s unleashing of the stimulus, so along with local stocks, the peso rallied.

But unlike stocks which rebounded furiously, the peso’s ascent had virtually been capped.

As I have noted here, the inverse correlation between the peso and stocks seem to have been broken. It’s only recently where the correlation seems to have been resurrected.

Present events signify as the fourth leg of the USD php upside trend. As of Friday’s close at Php 48.5, this serves as a BREAKAWAY run from the January 26 high.

Such breakaway run makes the USD php at 50 (November 2008 high) a visible horizon.

That’s most likely a target AFTER the USD corrects or sloughs off some of its overbought conditions.

Interestingly, from the close of 2012, the USD php has delivered 18.1% in returns, over the same period the Phisix generated 31.2%.

So the Phisix massively outclassed the USD php. But if I am right those fortunes will soon reverse.

Prices of exchange rates are fundamentally a product of demand and supply.

The surge in USD php has presently been from greater demand for the USD than the peso.

As I have previously observed, this may be a knee-jerk reaction, there may be a real run on the peso, and finally, the peso has been used as a political weapon by geopolitical forces.

Yet this has been happening ironically in the face of reported record GIRs

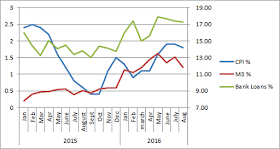

The BSP also reported its August banking system’s loan conditions as well as the liquidity conditions last week. While the bank loan growth remains substantially elevated (at 4Q 2014 levels), fascinatingly, money supply M3 has sharply decelerated to 11.8% from 13.1%.

It is as if lots of bank borrowers have stopped spending. So the funds that they have borrowed may have been used to hoard cash, pay down debt or buy USD.

And a sustained fall in M3 will likely translate to a downside trajectory for NGDP and nominal sales.

Yet even at 11.8% money supply growth remains a rapid clip. This shows the longer term supply influence of the peso to the exchange rate

Another curiosity, growth of government’s external debt plunged to 2.68% last August from the 6-8% range it registered during the past 9 months. Has the government raised sufficient taxes, as well as USD dollars last August enough to cover its deficits last July?

Or has the present improvement been part of the PR campaign to embellish statistics to bolster the peso and the economy’s conditions?

Lastly, not everything will be about the domestic conditions. Global factors will increasingly come into the picture.

The unfolding banking crisis in Europe will also play a big role.

So as with the surging LIBOR and TED spreads in the US (largely blamed to 2a7 reforms), the untamed China’s interbank rate Shibor, and the still ongoing problems Japan’s banking system, as well as, Saudi Arabia’s liquidity problems

It took rumors that Deutsche Bank reached a settlement with the US justice department worth $5.4 billion in fines which have been far lower than the original $14 billion to stem the collapse in share prices last week.

Because of the massive short positions on Deutsche Bank’s shares, the rumor impelled for an intense short covering which lifted global stocks on Friday. DB soared 14.02% last Friday where the market cap was last at $17.7 billion (yahoo Finance).

And because of a holiday in Germany in Monday, regulators have become so sensitive to any potential liquidity squeezes for them to float temporary responses.

Like Wells Fargo, several employees at the Deutsche Bank have also been charged by the Italian government for creating false accounts. So aside from financial woes, impropriety will partly play a role in the coming sessions.

Rumors have been floated that DB will be rescued, but German’s media says that the German governmentwon’t do this. A bailout by the German government would set a precedent for Italian government to bailout its besieged banks, which the German government has stridently opposed. In my view, further stress in the market will force their hands. But whether the bailouts or bailins will be successful is another matter.

And anent the lingering bank and financial concerns, it’s not just DB, Germany’s second-largest bank Commerzbank announced that it would cut dividends and slash 9,600 jobs. Netherland’s largest lender, theING will also announce job cuts this week. So even banks in creditor nations of Europe are being affected.

Incidentally, USD liquidity conditions have been stretched out at the money markets in Europe such that the cost to borrow USD via cross currency swaps has risen to 2012 levels. And it’s not just in Europe, hedging cost for the USD yen also via cross currency swaps have experienced a “blowout”. These are signs of USD shortages.

The ongoing liquidity shortages have become apparent such that the Saudi Arabian government had to inject $5.3 billion into the banking system to tame surging interest rates and contain stress in her currency, the riyal.

As the chart from the Alhambra Partners shows, the surge in US TED spread has mirrored (inverse) DB’s share prices (along with many other price signals including treasury fails) way back to 2014.

As the prolific analyst and research manager Jeffrey Snider wrote:

While attention is rightly focused on Deutsche Bank it is only so because the bank is the most visible symptom being the most vulnerable participant in this “something.” DB is just an outbreak so prominent that the mainstream can no longer pretend there is nothing worth reporting – but they can still obscure why that might be, focusing on the canard about the DOJ settlement. This is a systemic issue, one that is as plain as Deutsche’s stock price.

Liquidity risk is indicated pretty much everywhere, a direct assault not just on mainstream conventions about monetary policy but monetary competency itself.

Use any weakness in the USD to accumulate.

No comments:

Post a Comment