Could the Philippine Peso Be Part of the Yuan Basket?

China unexpectedly revealed a parcel of its currency configuration last week to announce that the US dollar, the Euro€, Japanese Yen¥ and the South Korean won taking up the largest share of the modified basket since it reformed its currency construct last July 21st from entirely a US-dollar peg.

It also disclosed that other countries with significant trade relationship with China were also incorporated to its ‘managed float regime’ such as Singapore, UK, Malaysia, Russia, Australia, Canada and Thailand and hinted that currencies of more countries could be included provided that such countries, to quote People’s Bank of China Governor Zhou Xiaochuan speech, ``has a prominent exposure in terms of foreign trade, external debt (interest repayment) and foreign direct investment (dividend).” The revered Governor Xiaochuan explicitly added, ``Generally speaking, annual bilateral trade volume in excess of US$10 billion is not negligible in weight assignment, whereas that exceeding US$5 billion should also be considered as a significant factor in currency weight deliberation.”

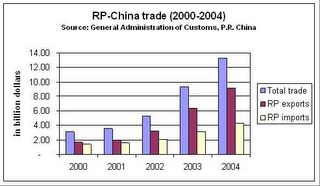

It struck me to note that the Philippine bilateral trade with

According to the Philippine Embassy in Beijing whose chart above I included, ``In 2004, bilateral trade volume reached US$13.33 billion, representing a growth rate of 41.8 percent over the figure of US$9.4 billion in 2003. In the past five years, bilateral trade volume grew at a healthy annual average of 43.78 per cent, with the

It appears that China’s thrust is to veer away from exclusively utilizing the US dollar, which it considers as “unstable”, as a medium of exchange for its trading transactions with other countries as can be gleaned from the statement of the Governor, ``When you look at currencies used in trade settlement, although some countries and regions prefer US dollar as the currency for trade settlement with China, this situation is changing gradually and trade settlement in local currencies are increasingly the choice of trading partners…it can better reflect the competitiveness of RMB against major currencies, better absorb the impact generated by an unstable US dollar.” (emphasis mine) The statement could also imply that

Going back to the Philippine Peso, as per the defined parameter of the PBoC’s governor, the volume of trade which is in the excess of the $10 billion threshold level qualifies the Philippines as a peripheral currency to China’s basket, and most importantly, with conspicuous joint efforts to expand bilateral trading relationship to about US$20 billion to US$30 billion in the next 5 years! To quote, the Joint Statement of the Philippines and China following the state visit of Chinese President Hu Jintao (April 28, 2005) ``The two sides should give full play to the existing economic cooperation and trade mechanisms, tap into their economic complementarity and potential for cooperation, broaden and diversify trade structure, further expand trade and investment and make efforts to raise bilateral trade to over USD 30 billion within the next 5 years.”

This means that

Remember, what is SMALL for

If I am right about the Peso’s inclusion to the

No comments:

Post a Comment