Soaring Oil Prices Underscore Upturn In Commodity Cycle

Headlines today bannered that crude oil prices soared to record levels. While it is true that the nominal price of oil is at record levels, the real prices or the inflation adjusted prices of oil is still far from what it was in 1980 at over $90 per barrel.

The chart above courtesy of chartoftheday.com shows you the movement of the price of oil since 1970. It can be noted that recessions in the

However, relative to the price spikes of the 70’s which were primarily ‘event driven’ or OPEC instigated supply shocks, today’s spiraling prices are basically structurally driven; incremental demand arising from the industrialization of China and the rising standards of living around Asia, which equates to more energy usage of consumer durables such as airconditioners, motor vehicles and others.

To quote Dr. Marc Faber, ``In fact, if we look at what happened to per capita oil consumption during phases of industrialization in the US between 1900 and 1970, we see that per capita consumption rose from one barrel per year to around 28 barrels. In the case of

``In the case of

``Therefore, starting from such a low base, oil consumption in Asia will, in my opinion, double in the next ten to 15 years from currently 20 million barrels per day to around 40 million barrels per day.”

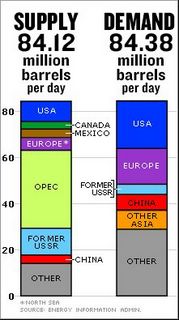

Chart above courtesy of CNN.com

More demand than supply= spiraling oil prices

For example, no gasoline refineries where built after 1976 in the US, such that with oil refineries operating at 95%, wear and tear has resulted to 14 disruptions in US refineries since July 20th according to Bloomberg which prompted gasoline prices to shoot past $2, particularly $2.0048 a gallon after hitting an intraday record high of $2.0145.

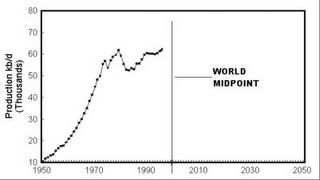

In addition, there has been no major oil field or ‘elephants’ discovery in 35 years. I recall an anonymous analyst at Bloomberg who cited that for every 5 barrels the world consumes only 1 barrel is found as replacement.

Chart courtesy of hubbertpeak.com

Matthew R. Simmons, president of Simmons and Company International, a specialized energy investment banking firm, contends that ``Saudi Arabia's oil fields now are in decline, that the country will not be able to satisfy the world's thirst for oil in coming years and that its capacity will not climb much higher than its current capacity of 10mbd. Considering the growth in demand, this could easily spark a global energy crisis.” writes iargs.org. Care for a $182 bbl oil as Mr. Simmons predicts?

In other words, even if the peak oil advocates are only partially right, it means that the AGE of CHEAP oil is finally over.

Because price is a function of demand and supply, prices determine where allocation would be and would affect fundamentally the lifestyle of people. I recall then in the early 70’s where our family’s car was an 8-cylinder Chevrolet Impala which eventually was replaced by a smaller Toyota Corolla in the early 80’s. Looking at the 30 year chart, I understand now WHY my dad’s decision to the shift the make our car then.

Using the same analogy and premise, I have argued that cheap oil prices begot the current fad of SUVs, not to mention the availability of cheap credit. Do you share the view that SUVs will still be a fad if gasoline prices hit $4-5 per gallon in the

Finally, it is interesting to note that for the week not only crude oil and gasoline was in record territory but also heating oil and natural gas at a 4 year high. Copper prices soared to fresh record levels anew with Gold nearing its 16-year high.

No comments:

Post a Comment