``The precipitous drop in the dollar shows how investors around the globe are very concerned about American deficits and debt. When government policies in a fiat system are the sole measure of a currency’s worth, the currency markets act as a reliable barometer of how those policies are viewed around the world. Politicians often manage to fool voters and the media, but they rarely fool the financial markets over time. When investors lack faith in the U.S. dollar, they really lack faith in the economic policies of the U.S. government.”-Congressman Ron Paul, Texas

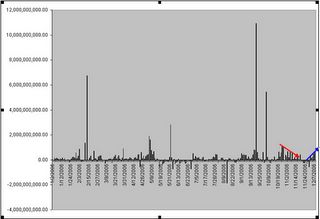

In a rather buoyant climate for world equities, upbeat sentiment levitated our Phisix, alongside most equity benchmarks, to a remarkable 1.54% advance over the week to regain most of its losses following the two consecutive weeks of retreat, as shown in figure 1.

Figure 1: stockcharts.com: Phisix and Dow Jones World Index

Bullish action in global equities has once again provided the stimulus to pump up the Phisix to possibly test its interim resistance at the 2,850 levels.

For this week, let’s talk market action. Market action measures the breadth of activities within the market, which gives us an insight about the prevailing investor’s sentiment. A favorable market action implies signals of either a continued strength from a previous upside momentum or a positive reversal from previous declines and vice versa.

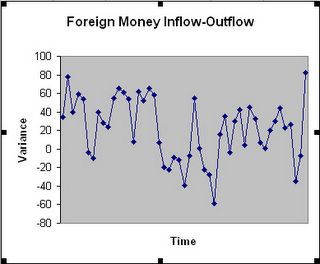

For instance, even as the Phisix has been consolidating since it hit its high at 2,853 last November 10th; the advance-decline ratio has been decelerating or has markedly downshifted since mid-October as shown in Figure 2.

Figure 2: Declining Advance-Decline Ratio

The shift to lower gears (red arrow), which is a representation of divergence from a sturdy uptrend of the Phisix, could have been a signal of the recent correction.

Even with the week’s hearty gains, the advance-decline spread has notably been in favor of decliners all throughout the week. This suggests of a noteworthy deterioration of bullish activities in the general market, but apparently confined to LOCAL investors.

How can we say so?

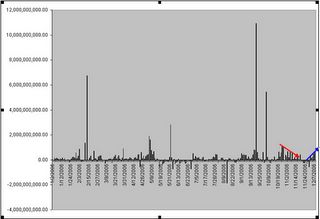

Figure 3: Year-to Date Interim trends of foreign money activitiesAs much as the declining advance-ratio seemingly presaged the recent correction, the declining trend of foreign inflows over the same period of time, see Figure 3 (red arrow), conspired to send the Phsix to its present state.

However, last week ostensibly marked a reversal, foreign inflows made a pronounced comeback (blue arrow)! Representing 54.67% of the cumulative output, foreign money poured Php 1.876 billion into the Philippine Stock Exchange!

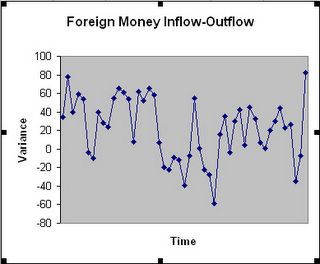

Figure 4: Year-to-date Inflow-Outflow DifferentialsFigure 4 shows of the number of issues that posted foreign inflows minus outflows. Not only have these [buying activities] been limited to mostly Phisix issues, the widening spread indicates that the foreign accumulation had been broad-based, and at its highest level for the year! So what you have here is not only factual growth in terms of foreign fund inflows in nominal aggregates but manifested on a broad market based too!

If you ask me why locals have been bearish lately, I wouldn’t exactly know. Needless to say, mainstream analysts would easily impute them to current events, especially to politics. Maybe so or maybe not.

If there is any reason why the local investors have lagged behind in terms of market performance, it is unlikely that locals know more than foreigners do (if they do, they haven’t been proven right since 2003), but rather locals have been obsessed with misplaced priorities.

The local’s proclivity for politically based solutions has mainly ignored the prism of growing interlinkages of the world economies and finance. Where the economic wellbeing of the populace is determined by the dictates of politicians and not by market forces, we are likely to be condemned to repeat the past mistakes.

The developments in the Philippine Stock Exchange serve as a prominent example. Illiquid by global standards, foreign money flows have been the structural drivers of the PHISIX’s turnaround since 2003. Illiquidity translates to volatility, where illiquid issues tend to outperform in bullish cycles and vice versa. The outstanding gains by Philippine financial instruments, aside from stocks, in the debt markets have also been driven by immense portfolio flows. The Peso’s advance has been, at the margins, likewise a manifestation of these massive fund inflows.

Yet, local investors perceive that the advancing Phisix as mostly an offshoot to recent “micro” economic or “corporate” developments or of political “reforms”. Little of our investors have come to understand the dynamics of macro-based liquidity spillovers or of global trends that would naturally uplift the Philippines’ economic and financial state provided it lives up with its unique or “specialized” role in the global marketplace. For instance, the ongoing wealth transfer (as manifested by the declining USD) and economic makeover among emerging markets have resulted to higher commodity prices and investor’s taking up “illiquid” assets as mainstream investment themes, themes practically unheard of one or two decades ago.

Notwithstanding, the colossal revolution in the financial markets arena appended by technological innovations have deepened global capital markets which has facilitated more “real-time” fund flows.

Mainstream economic analysis in the local arena has largely omitted the influences of the global financial realm to our economy as they mostly deal with tangential issues. To consider, what has been ignored is that today’s world economic construct has been largely “finance” based rather than “real” based.

And naturally, tangential issues revolve around politics. Because it is the nature of people to want the order of things simplified, tangential issues, which are frequently symptoms of an underlying malady, are in many instances misidentified as causes, heavily amplified by media. And the easy way out have been always political-based solutions which without ever having second thoughts about the laws of unintended consequences, ignores the fact that history has been littered with its baneful effects.

And who pays for it? Of course us, the belabored tax paying public. No amount of statistical charade by any government instituted index can shield policy and regulatory failures as manifested through the reduction of the domestic currency’s purchasing power. While governments can manipulate markets, these cannot be done so with real purchasing power. Not in the US, Europe, Asia or elsewhere in the world. Ultimately, real purchasing power reflects on accrued government policies!

Now going back to the stock market, since local investors have largely lagged behind on the activities of foreign investors, any provisional follow-through activities by foreign money on the local market will likely lead to ‘bearish” local investors to join the “bullish” fray (habitual apostasy?) to buttress the broader market, over the interim.

No comments:

Post a Comment