``Political risk is no respecter of boundaries, and First World country politics could get increasingly ugly in the coming years as demagogues come to power and Western welfare regimes implode. That means we'll have to absorb some volatile swings… but it won't stop us from making good money.”- Justice Litle

I made my case in my previous edition, Should You Invest in the Phisix Today? (See Oct 23 to 27 edition), where I believe today’s bullish interim cycle is close to its maturity, subject to risks of correction from the market cycle’s mean reverting tendencies, aside from risks of arrant complacency and a murkier economic outlook for 2007.

However, global liquidity remains an insuperable force for the global financial markets, which means, what we want to watch is how global financial markets react to liquidity flows while global economies rollover following 4 years of exceptional performances.

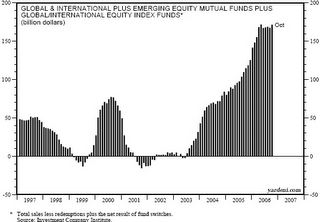

So far global liquidity remains unblemished. ``While US commercial banks continue to provide lots of liquidity to the domestic economy, US mutual fund investors continue to do the same for both the US and overseas stock markets. These investors poured $592 billion into mutual funds over the past 36 months through October. They've done very well for themselves. The net asset value of US mutual funds increased $2,232 billion over the past three years to $5,670 billion. So, net capital gains totaled $1,641 billion over this period. Over the past 36 months, $333 billion, or 56%, of the inflows into US mutual funds poured into funds that invest overseas”, comments the ever Panglossian Dr. Ed Yardeni of Oak Associates Ltd.

Figure 5: Yardeni.com: Massive Fund Flows into Global and Emerging Mutual FundsFigure 5 shows of the massive liquidity spilling over into the world and emerging market equity mutual funds.

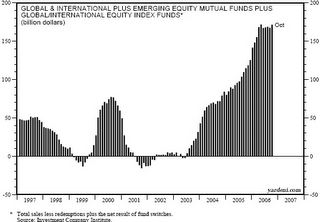

Figure 6: BCA Research: Emerging Markets Preparing for a breakout

An even more bullish liquidity based outlook from the widely respected independent research agency, BCA Research, as shown in Figure 6.

Let me quote BCA (emphasis mine), ``Emerging equity prices have yawned lately at weakening growth numbers out of the U.S., China and emerging Asia, even amid technically overbought market conditions. This is an indication that the structural forces of multiple expansion are at work, which will diminish the ability of decelerating growth to inflict substantial damage. Hence, while a near-term correction in prices cannot be ruled out, it will be very mild and possibly even lateral. Meanwhile, other factors remain positives for emerging market stocks. Our measure of global excess liquidity, which typically leads trends in emerging market stocks, points to their outperformance over the next 18 months. Bottom line: investors should start boosting their exposure to emerging market equities on any softness.”

Of course, the assumption from BCA and Dr. Yardeni is that the US would manage to successfully “soft land” its economy or attain the “Goldilocks” (not too hot, not too cold) scenario in the face of a sizably decelerating real estate industry. Aside, they likewise expect that the FED would effectively steer clear from a recession through its monetary policies. In short, they both trust the bureaucracy to succeed at their mission. I don’t.

I am a skeptic of governments. One, a soft landing in the US has been a statistical outlier. And most importantly, the recent admission of Fed’s Bank of Dallas President Richard Fisher of their recent policy “shortcomings” reveals of the “comforting odds of their policy successes”, Doug Noland quotes Dow Jones newswires (emphasis mine), ``If the U.S. Federal Reserve had been aware of actual inflation prior to its recent tightening cycle, policy would probably have been more restrictive sooner, the Fed’s Bank of Dallas President Richard Fisher said… If we had had the correct figures at the time, we probably wouldn’t have kept interest rates so low, for so long,’ Fisher is quoted as saying by the German daily Handelsblatt newspaper… ‘In hindsight, one is always the wiser,’ he said, noting inflation at the time was higher than was visible from the then-available data.” Well, in hindsight, yes. But tomorrow is another matter.

While I agree with both that the Fed and global central banks would strive to keep liquidity ample and maintain loose environment conducive for the furtherance of asset inflation, and being bullish over the long-term over emerging market assets, I wouldn’t dare underestimate the potential risks arising from a paroxysmal unwind from a greater than expected economic slowdown (recession) or a prospective credit crunch from debt overload.

No comments:

Post a Comment