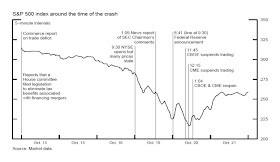

Was the plunge in the US markets, which allegedly had been due to "unusual trading activity" or from a rumored Citigroup Trader instigated 'quant' program selling, reminiscent of Black Monday October 19th 1987?

Intraday, the US markets fell by about 9% before recovering much of the losses but still suffered from a huge decline, a 3.2% for both the Dow Jones Industrials and the S&P 500. (chart from Bloomberg)

Intraday, the US markets fell by about 9% before recovering much of the losses but still suffered from a huge decline, a 3.2% for both the Dow Jones Industrials and the S&P 500. (chart from Bloomberg)

Intraday, the US markets fell by about 9% before recovering much of the losses but still suffered from a huge decline, a 3.2% for both the Dow Jones Industrials and the S&P 500. (chart from Bloomberg)

Intraday, the US markets fell by about 9% before recovering much of the losses but still suffered from a huge decline, a 3.2% for both the Dow Jones Industrials and the S&P 500. (chart from Bloomberg) Well opposite to the rising tide, we have most issues suffering, with only 28% of S&P 500 companies trading above their 50-day moving averages (courtesy of Bespoke)

Well opposite to the rising tide, we have most issues suffering, with only 28% of S&P 500 companies trading above their 50-day moving averages (courtesy of Bespoke)Of course, perhaps one major difference is that as the market fell out of "fear" (VIX index spiked beyond the February high) along with a crumbling Euro (XEU), gold surged!

And its also hardly about a sovereign contagion when US treasuries (TNX) were among the biggest gainers, via falling yields!

And its also hardly about a sovereign contagion when US treasuries (TNX) were among the biggest gainers, via falling yields!

No comments:

Post a Comment