``The euro will survive, the shorties won't. A sound analysis of the fundamentals clearly shows that the euro's external position does not warrant its demise. The eurozone has no current account deficit and no net external debt and the global competitive position of many euro countries is strong. Even more so: the highly indebted "Club Med" countries along with Ireland have implemented the measures to get clean. This by itself is a global rarity.”-Antony P. Mueller, Euro Shorties Take Care

Coming from oversold levels, I believe that the Euro is ripe for a major bounce. And this should have a tremendous impact on global asset classes.

First of all let me point out that that I’m no fan of the Euro or for that matter any paper currency, including the Chinese Yuan or Philippine Peso. Like the fate of all previous paper currencies throughout man’s existence, they are all destined to meet their eventual doom.

That’s because the Fiat currency system functions as principal instruments of governments, through central banks, to advance on political goals of the political leadership which are mostly incompatible or clash with the universal economic laws.

As Friedrich Hayek wrote[1], (italics his)

What we should have learned is that monetary policy is much more likely to be a cause than a cure of depressions, because it is much easier, by giving in to the clamour for cheap money, to cause those misdirections of production that make a later reaction inevitable, than to assist the economy in extricating itself from the consequences of overdeveloping in particular directions. The past instability of the market economy is the consequence of the exclusion of the most important regulator of the market mechanism, money, from itself being regulated by the market process.

Hence most of the collapse of politically mangled currencies had been due to war or hyperinflation[2].

Reasons Why Euro Isn’t Going To Collapse, For Now

Having said so, this brings us to the next point; the allegations of the imminence of the death of the Euro, which in my view, seem highly exaggerated and representative of extreme pessimism.

Yes the Euro is bound to meet its inevitable demise, along with the US dollar and the others, somewhere down the road, but I don’t see it unravelling soon-not this year, or the next.

The fundamental reason is that interest rates globally remain at very low levels, from which allows governments to conduct inflationist rescue packages such as the recent nearly $1 trillion bailout of the Euro[3].

And low interest rates are emblematic of mitigated effects of inflation, for the time being.

Moreover, as we have earlier discussed, today’s globalization trends have NOT been restricted to trade, investment and financial, and labor flows, but such trend also incorporates monetary policies and government collaborative actions[4]. An example would be the recently reactivated currency swap arrangements and multilateral loans extended as part of the Euro rescue deal.

The point is, for as long as governments have the leeway to cross finance or accommodate each other, any talk of currency dissolution seems like wishful thinking.

In other words, what will immobilize governments from the present collaborative stance will be the series of dramatic interest rate responses to an accelerating rate of increases in inflation.

Under this scenario, the debt burdens of the financial system of those economies that are highly leveraged would be amplified and this effectively reduces the space for policy collaboration among governments and significantly lessens the accommodation for domestic government financing.

And it is under such juncture, where governments fighting their own domestic demons would forcibly either resort to the reglementary strictures of fiscal discipline (default or restructuring, a.k.a. partial default) or to hyperinflate. And the death knell or the survival of any currency will be determined by the accompanying critical policies made, when faced under such circumstances. Yes, we have long called this the Mises Moment.

International Uniformity Of Inflation

Yet if you read the many expert opinions, the above risks are simply ignored for the simple reasons of having too much blind faith on the efficaciousness of printing money, with less consideration of the unintended consequences from such actions, and too much reliance on short-term goals.

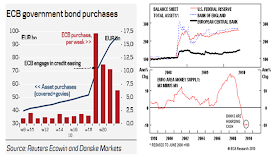

Figure 1: Danske Bank/BCA Research: ECB Quantitative Easing

For instance, one can find the excessive fixation to deflation by the mainstream as a pretext to advancing the cause of turning stones into bread by inflationism.

This from BCA Research[5],

``In our opinion, deflation is a much greater threat, especially if the central bank moves too slowly to limit contagion within the region. We sympathize with the concern that monetary policy in the euro area is set for the region as a whole and efforts to set interest rates to support the weakest members will over-stimulate the Germany economy. Unfortunately, relatively low trade-openness in the weaker nations means that currency depreciation will provide disproportionate support to the stronger regional members. As a result, the only way to stimulate the Med-4 successfully is to quantitative ease and ramp up asset purchases.”

Never mind the reality that the Eurozone isn’t being plagued by consumer price deflation in spite of the enormous debt problems because inflation has remained positive and has been climbing.

In May of 2010, according to news reports, Eurozone posted a positive 1.5% inflation rate[6]. While it is true that the Eurozone did experience a short bout of slight or marginal CPI deflation in June to October 2009, inflation has been more of the dominant story in this crisis.

Moreover, the deflation scare mongering is a matter of “data mining” or using selective statistics to rationalize a bias, such as in the right window of Figure 1.

The general idea is; since the European Central Bank’s (ECB) balance sheet have shown to be less engaged in activist policymaking via quantitative easing, the recommendation, hence, is to match the degree of aggressiveness employed by the US and UK.

This has been a fallacy predicated on having “uniform” inflationism, similar to the one exposed by Henry Hazlitt anent the Bretton Woods standard.

Mr. Hazlitt, who accurately predicted the collapse of Bretton Wood, warned[7], (all bold highlights mine)

``A provision for uniform inflation in all major countries would increase the temptation to inflate in each country by removing some immediate penalties. When the currency of a single country begins to sag because of inflationary policies, two embarrassing results follow. One is the immediate loss of gold, unless the Government prohibits its export (which makes the currency sag more); the other is the humiliation of seeing the country's currency quoted at a discount in other nations. A uniform inflation in the world's most important countries would avoid both of these embarrassments.”

And today’s near similar, coordinated and or convergent monetary policy actions seen in most nations and the policy collaboration among governments which have marked the current globalized environment seem to illustrate the same stance in the imposition of inflation on a “uniform” scale.

In addition, the metric commonly used to mount such a scare tactic has been monetary aggregates, which appears to have departed from the actions in the financial markets[8]. Plainly put, where statistics say deflation, real world prices say inflation.

Legendary investor Jim Rogers has a better refutation to this. In an interview, when asked about the effectiveness of monetary aggregates in measuring the risks of inflation or deflation, Mr Rogers replied[9], ``Is M3 something you buy in a shop? M3 can lead to changes in the price structure, but M3 is not price inflation or deflation.”

So it’s all a matter of choice, choose to live in the real world and see inflation or elect to live in a make-believe world which says deflation.

One mustn’t forget that the European integration had been longstanding pet project for European bureaucrats for over 50 years.

Whether the EU’s existence has been meant to achieve the following political goals:

-“Roman Empire” socialist democratic construct of modern Europe, instead of a liberal “Christian Europe”, as asserted by GaveKal’s Charles Gave[10] or

-in Stratfor’s Papic and Zeihan[11] view designed at projecting regional power in the geopolitical sphere where national power has been on a decline and or to reduce the odds of the repeated slant for warfare given the Eurozone’s geographical structures;

...it is important to stress that the European political ideology has been skewed to sustain the EU system at almost all conceivable costs.

Proof?

This from Bloomberg[12],

``European Union President Herman Van Rompuy said the 750 billion-euro ($905 billion) rescue package would be expanded if it doesn’t quell the debt crisis, becoming the first EU leader to float the idea of a larger fund.

``“Currently there isn’t even the hint of a request to put this rescue plan into practice,” Van Rompuy told Belgium’s Trends magazine. “And if the plan were to prove insufficient, my answer is simple: in this case, we’ll do more.”

And so the alleged barriers of the ECB’s purported independence from political influences is being gradually eroded or unravelled as a farce.

Betting On ‘This Time Is NOT Different’

THE weekly purchases by the ECB of financial assets meant to buoy the banking system appear to have slowed (figure 1 left window) as global financial markets appear to have calmed (see figure 2).

Figure 2: Danske Bank: Improving Sentiment

Aside from credit default swaps of the crisis affected PIIGS (right window), signs are showing of a marked broad based improvement in the money market metrics as exhibited by the LIBOR OIS [spread between the LIBOR and overnight swap rates-an indicator of banking health[13]] and FRA/OIS [the spread between future interbank rates and overnight indexed swaps] seen in the right window from Danske Bank Research[14]

The implication is, since there will likely be reduced anxieties over credit risk, we could probably see a resumption of recovery in the credit markets, considering the scope of actions being conducted by the monetary authorities in the EU area and elsewhere (Japan?), combined with continued fiscal spending by many global governments, aside from the steep yield curve which is likely to generate sundry borrow short-lend/invest long “carry” arbitrages.

None of these is meant to suggest that any impending recovery would be sound.

But we have always bear in mind that under a Fiat money standard, the reality is that boom-bust (Austrian Business) cycles have been repeatedly fuelled by the manipulation of interest rates which engenders malinvestments and distorts the production structure of the economy which subsequently leads to volatility from an ensuing market clearing process. And this cycle is further buttressed by moral hazard issues from government intervention even seen by neo-Keynesian Hyman Minsky.

Yet all these money printing and interest rate manipulations are likely to incentivize people to spend, speculate or search for added returns.

And I don’t think this cycle is going to be different. The only difference is likely to be the OBJECT or character of the bubble but not the dynamic that fuels the bubble.

Figure 3: stockcharts.com: Euro led meltdown

Yet when people or experts speak about “this time is different”, mostly represented as “new paradigm” during the electric atmosphere at the peak of a boom, or “death” of an asset in the depression phase, they usually signify as sentiment based or “comfort of the crowd” analysis.

In short, they can serve as manifestations of a major forthcoming inflection point.

So when we read about predictions of the ‘demise’ of the Euro over the next 5 years by a significant number[15] or 48% or 12 out of the 25 economists surveyed (!!), our contrarian reflexes suggests that a turning point for the Euro could be just around the corner.

To reminisce, last year they said that it could have been the death[16] of the US dollar[17], which apparently did NOT take place. On the contrary, the US dollar became one of today’s safehaven!

The lesson is once mainstream begins to sing in chorus on issues with questionable grounds, we tend to take the opposite stand.

Buy The Philippine Peso, Asian Currencies and The Phisix

In Figure 3 the falling Euro (XEU) began only to impact global markets by mid-April, via a convergence, where global stocks (DJW), commodities (CCI), emerging sovereign bonds (JEMDX) synchronically fell (blue vertical line and downward arrow in red).

Earlier, the falling Euro wasn’t much of a factor, as global markets had been indifferent (except commodities).

Yet the kernel of the apprehension seen in the financial markets came about when the Greece bailout was announced which apparently was construed as inadequate.

Now the tide seems to be turning (see blue vertical line guided by the green upside arrow).

It’s been the same dynamic with Asian currencies (see Figure 4).

Figure 4: Bloomberg-JP Morgan Asian Dollar Index[18]: Euro Convergence

The Euro’s decline hasn’t been a factor at the onset of 2010, where Asian currencies rose strongly against the US dollar, especially after the first round appearance of the Greece debt crisis episode last February.

However, the tremors following the “insufficient” Greece bailout turned nasty as Asian currencies fell concomitant with global financial markets.

But this trend appears to be likewise bottoming in conjunction with market activities in the commodities, bonds and stock markets.

Since the negative sentiment over credit risks appear to be abating, the current oversold Euro conditions, technical (chart) considerations, the massive pessimism over the Euro and the apparent bottoming of several asset classes, we are likely to see a significant rebound in Asian currencies as market sentiment improves.

For me, these factors should accrue to a strong buy on ex-US dollar currencies including the Philippine PESO, which last stood at 46.64 based on Friday’s close and other Asian currencies.

Naturally a rallying Peso should add to more levity in the Phisix.

Why? (see figure 5)

Figure 5: Philippine Peso and Net Foreign Trade

A rising Peso has mostly been accompanied by surges in foreign trade activities. This has been evident as the Peso reached its zenith (44.23) at the end of April to early May (see blue oval).

Lately as the Peso fell, it’s been mostly Net foreign outflows. This has been true for most of May until the second week of June, where in 6 weeks, only 2 accounted for inflows.

And as the Peso’s fall is likely to reverse, we could the same phenomenon take place.

Importantly, since foreign funds are likely to deal with Phisix issues, or the 30 component issues that comprise the Phisix benchmark, the prospective re-entry of foreign funds could translate to a big jump on the Phisix.

Although I’m not sure of the precise timing of the Euro reversal play, my suspicion is that it could happen over the coming weeks. But if I am lucky enough, it could even happen by next week.

There is another point I’d like to emphasize, if the relative valuation of a monetary unit is based ``on the relationship between the quantity of, and demand for, money[19]” then the lack of “inflationism” by the ECB relative to the US Federal Reserve and the Bank of England (go back to figure 1) should translate to the ‘quantity’ factor in favour of the Euro.

This leaves us with the demand for money, which is currently being driven by the mostly dour sentiment on the Euro. Therefore, the lack of demand has so far offset the quantity factor advantage. But this is likely to change once the turbulence over European credit markets breezes over.

Bottom line: There is likely to be a tremendous “leash effect” on global financial markets on a Euro rally vis-a-vis the US dollar. And if I am right, the Euro appears to be at an inflection phase of this market cycle.

[1] Hayek, Friedrich August, Denationalisation Of Money p.102

[2] Dollardaze.org, Demonetized Currencies

[3] See $1 Trillion Monster Bailout For The Euro!

[4] See Why The Philippine Phisix Will Climb The Global Wall Of Worries

[5] BCA Research, ECB: Hesitation Is Lethal

[6] Associated Press, Eurozone official inflation edges up to 1.6% in May, May 31,2010

[7] Hazlitt, Henry From Bretton Woods To World Inflation, A Study Of Causes And Consequences p.40

[8] See M3 Not A Valid Measure Of Money

[9] Hera Research, Interview: Jim Rogers on Currencies and Inflation, goldseek.com, June 3, 2010

[10] See Was The Greece Bailout, A Bailout of The Euro System?

[11] See Inflationism And The Bailout Of Greece

[12] Bloomberg, EU to Expand Rescue If Package Fails, Van Rompuy Says, June 10, 2010

[13] Wikipedia,org LIBOR OIS Spread

[14] Danske Bank, Weekly Focus Another week in the shadow of the debt crisis

[15] Conway, Edmund, Euro 'will be dead in five years' Telegraph.co.uk, June 5, 2010

[16] Conway, Edmund Is this the death of the dollar? Telegraph.co.uk, June 20, 2009

[17] Fisk, Robert, The demise of the dollar, independent.co.uk, October 6, 2009

[18] Bloomberg Bloomberg-JP Morgan Asian Dollar Index (ADXY)

[19] Mises, Ludwig von Stabilization Of The Monetary Unit, On The Manipulation of Money And Credit, p.25

No comments:

Post a Comment