The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved. Ludwig von Mises

Phisix breaks 5,000!

As I previously wrote[1], we should expect this soon. But this happened much sooner than I expected. I was looking at 2 weeks to a month as my window for this projection to materialize.

I am hardly indulgent towards crafting short term predictions, however the slew of events combined with momentum seemed too compelling, as the popular idiom goes, “The writing was on the wall”.

Nevertheless Friday’s breach of the psychological threshold signifies as another fulfilment or “I told you so moment”.

I even thought that I might be operating with overconfidence such that Monday turned sharply in the opposite direction from my expectations—the Phisix fell nearly 2%!

However with lady luck on my side, what I thought could be signs of falsification of my thesis turned out to be a springboard instead. The local benchmark expunged the one-day loss and carved a hefty 2.52% gain over the week to close at 5,016.3! That’s a full 4.5% swing.

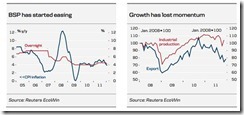

Well, riding on a bullish momentum, market participants have palpably been looking for some events to nudge them into a buying spree. And they found one in BSP’s [Bangko Sentral ng Pilipinas] lowering of key policy rates, the second time this year.

Misleading Focus to Justify Low Policy Rates

Local central bank authorities justified their actions based on the crisis in the Eurozone.

From the Inquirer.net[2]

“Global economic conditions are expected to stay subdued as fiscal and banking sector headwinds in advanced economies affect global output growth and as market confidence remains fragile,” BSP Governor Amando Tetangco Jr. said in a statement Thursday.

The unfavorable global factors Tetangco was referring to included the prolonged debt crisis in the eurozone that would likely to continue dragging export earnings of the Philippines and other countries that have been exporting goods to the Western region. The crisis is also seen dampening outlook on the global economy, thereby dragging appetite for investments even in countries outside the eurozone.

Apparently many mainstream institutions also see events in the lens of political authorities as the chart above from Danske Bank showed[3]

But how valid has this view been?

The problem that haunts the mainstream is the same problem that plagues political authorities. In behavioural finance, this is called as the focusing effect. People tend to focus on some aspects which they construe as a generalized phenomenon. This is really a fallacy of composition.

Why?

Outside the Eurozone crisis, global events don’t support this view.

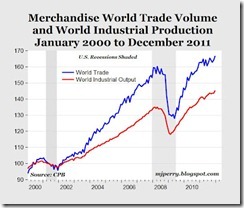

The CPB Netherlands Bureau for Economic Policy Analysis in its recent monthly report indicates that both world trade volume and world industrial output ended last year or December 2011 at record highs[4].

In reality, in spite of the Eurozone crisis, world industrial production and exports soared to new record highs which should hardly have been a drag on local exports or the local economy.

This means that whatever slowdown that has afflicted Philippine exports has little to do with global DEMAND but has been mostly about relative competitiveness and relative productivity.

As always what is available and visible will be used as cover, or in this case, the Eurocrisis has been used as scapegoat to justify the redistributionist policies via interest rates interventions.

Psychological Disorientation from Low Interest Policies

The local inquirer article continues

“Cut in interest rates is seen boosting demand for loans, which in turn support increase in consumption and investments. However, since lower rates spur demand, it has the tendency to accelerate inflation.”

In reality what the lowering of interest rates below market levels does is to increase people’s time preferences or magnifies people’s time orientation towards present consumption activities than of the future.

Again to quote Professor Roger W. Garrison[5],

Time preference is simply a summary term that refers to people's preferred pattern of consumption over time. A reduction in time preferences means an increased future-orientation. People willingly save more in the present to increase the level of future consumption. Their increased saving lowers the natural rate of interest and releases resources from the final and late stages of production. Simultaneously, the lower natural rate, which translates directly into reduced borrowing costs, makes early stage production activities more profitable. With the reallocation of resources from late to early stages of production, the preferred temporal pattern of consumption gets translated into an accommodating adjustment of the economy's structure of production.

This means, yes, consumption activities will increase, enhanced by more borrowings (credit cards, home, car chattel loans and personal loans etc…), but this will also reflect on a shift in the balance of people’s savings and investment patterns with a bias for consumption.

Borrowings accrued from artificially lowered interest rates does not distinguish between productive and consumption demand. They are seen as homogenous when they are not. This is misleading. That’s because consumption activities are not growth inducing for the simple reason that they are not productive.

As Dr. Frank Shostak explains[6],

We suggest that an individual's effective demand is constrained by his ability to produce goods. Demand cannot stand by itself and be independent — it is limited by production. Hence what drives the economy is not demand as such but the production of goods and services. The more goods an individual produces, the more of other goods he can secure for himself.

In short, an individual's effective demand is constrained by his production of goods. Demand, therefore, cannot stand by itself and be an independent driving force.

And as I earlier pointed out[7], bank lending growth in the Philippine has surged by 19% in 2011 according to the BSP. The BSP assumes the categorization of loan disbursement is accurate, I believe it is not. In many occasions loans can be redirected to other uses.

And since savings are penalized from such policies, people will be induced to take on high risks activities in order to generate profits (search for yield), such as intensive speculation and gambling, to sustain their consumption activities.

As I have repeatedly been pointing out[8], negative real rate environment has been instrumental for the record rise of the local stock market.

Local investors has lorded it over foreign investors for this cycle which incepted in 2009. The chart above shows that foreign investor’s share of total trade has been below 50% since 2011. This is in contrast to the 2003-2007 cycle, where foreigners were dominant. This should serve as evidence to the policy impact of a negative real rate environment to the stock market. While today’s actions look pleasant, we must keep in mind that the obverse side of a (inflation driven) boom phase is a (deflation driven) bust.

Euthanasia of the Rentier: The Greatest Ponzi Scheme

Since fixed incomes will also suffer from interest rate manipulations, many will fall victim or get seduced to dabble with Ponzi schemes marketed by scoundrels who would use the current policy induced environment as an opportunity to exploit a gullible public.

In the US, Ponzi schemes skyrocketed as the US Federal Reserve has taken on a zero bound interest rate environment in response to the recent crisis in 2008.

“Bad times” have been attributed as pretext to such incidences[9]. In reality, US Federal Chair Ben Bernanke’s zero bound rates have altered people’s value scales and time preferences such that they became vulnerable to high risks yield chasing actions as exemplified by large accounts of people being duped by fraudsters.

And despite declining incidences, Ponzi schemes remain outrageously high compared to the 2003-2007. Of course, the chart omits one major critical factor: 2003-2007 highlighted the property boom phase that morphed into a worldwide crisis where huge number of Americans (and foreign bankers and financial houses) got sucked into the bubble.

What this means is that Fed policies have transformed many Americans to become inveterate gamblers who jump from the proverbial frying pan to the fire by motivating them to plunge into every unsustainable booms in search of the elusive Holy Grail.

In other words, policies of the US Federal Reserve, which have been embraced or imbued by the central banking class all over the world—including the Philippines—seem to be the grandest Ponzi scheme ever hatched, except that central bank policies have been politically mandated.

Negative interest rate environment will also adversely affect financial companies dependent on fixed income such as life and non life insurance, pre-need, HMOs and pension companies. If their revenues (premiums, fixed income placements and investments) do not grow enough to match the increase in liabilities (where the latter will be affected by price inflation), then these companies will be tempted or motivated to undertake adventurous risk matching portfolios for survival, that may lead to future bankruptcies. So do exercise discretion in selecting your insurer.

Serial Bubble Blowing from Negative Real Rates Policies

Further, below market interest rates will encourage capital intensive “early stage production” ventures.

As I have been pointing out, even the activities in the domestic stock markets have been validating this concept.

This week, the property sector has dominated the field. Led by Ayala Land (+5.21%), the property indiex has risen above the weekly gains of the Phisix, which means that the breach of the 5,000 level has been mostly due to the property index.

Year to date, the property and the financial indices have running nose to nose for the leadership.

And in contrast to what the news article says, demand alone does not accelerate inflation, it is the bank-circulation credit (fiduciary media) and or direct central bank asset purchases which manifested through the expansion money supply that spawns inflation.

Yet the silence of media and political authorities in dealing with the truth has been tainted by political goals.

As the great Ludwig von Mises observed[10],

The hindrance that the monetary or circulation-credit theory had to overcome was not merely theoretical error but also political bias. Public opinion is prone to see in interest nothing but a merely institutional obstacle to the expansion of production. It does not realize that the discount of future goods as against present goods is a necessary and eternal category of human action and cannot be abolished by bank manipulation.

In the eyes of cranks and demagogues, interest is a product of the sinister machinations of rugged exploiters. The age-old disapprobation of interest has been fully revived by modern interventionism. It clings to the dogma that it is one of the foremost duties of good government to lower the rate of interest as far as possible or to abolish it altogether.

All present-day governments are fanatically committed to an easy money policy.

Gosh, how relevant this has been today.

Said differently present day governments are fanatically committed to serially blowing bubbles.

So far, bank lending growth has not yet reached alarming levels in the Philippines and in the region.

So in spite the recent surge in bank lending, the low base of lending growth (relative to the past and relative to the ASEAN peers) seem to have provided BSP authorities the confidence to take the gambit of further lowering interest rates.

Despite the highly visible construction boom, which should serve as empirical evidence, growth in the loan category to the property sector as percentage of total loans has hardly improved over the last three years. Both charts from ADB[11]

We must understand that bubble cycles function as a process which means they develop overtime and undergo several stages.

Thus, it takes constant vigilance to identify or guess estimate on the whereabouts of which particular stage we could be in.

How the Credit Fuelled Boom Unfolds

What this implies is that the BSP’s move will fuel more upside to the Phisix where the prospective gains will be bankrolled mainly by the substantial expansion of domestic bank credit. Although auxiliary markets equities and bonds will tapped, most likely price expression of the bubbles will become apparent or ventilated in these markets too.

Importantly this credit boom will also filter into the real economy most likely to the property and the mining sector.

Such dynamics represents the business cycle at work.

The credit boom will be highlighted by a reflexive feedback mechanism between prices of securities and collateral values.

When people are eager to borrow, as George Soros writes in the Alchemy of Finance[12], and the banks are willing to lend, the value of the collateral rises in a self-reinforcing manner. High prices of securities extrapolate to higher collateral values which encourages more borrowings that eventually feed into higher prices which reinforces the feedback loop.

However the growth in lending based on artificial price signals through the interest markets, whether in the asset markets or in the real economy, will lead to the accretion of misdirected allocations of resources since artificial interest rates will skew the economic coordination process

As Professor Steve Horwitz[13] writes,

Once that bad interest rate signal is in place, intertemporal discoordination will result. The nature of money and the time-ladenness of production mean that we don't see that discoordination at first, as it is masked by the boom. The increased activity at both the higher orders of goods and the consumption level looks like growth until the fact that there is insufficient real savings to support the increased (now "mal") investment at the highest orders makes itself known.

Nonetheless, the phases of the bubble will run in conjunction with credit cycles (based from post Keynesian economist Hyman Minsky’s hypothesis[14]) which transitions from the current state of hedge financing (income flows will meet interest and principal liabilities) to speculative financing (income flows will meet interest payments only) and ultimately to Ponzi financing (income flows will not cover both interest and principal liabilities but will depend on asset prices which today has been very evident in the sovereign debts of western nations and which subsequent actions by central banks has been engineered to keep propping these up by zero interest rates, asset purchasing programs and direct interventions in the marketplace). Israel’s central bank buying into US stocks can be seen as direct intervention although cloaked as “investments”[15].

Actions in the external environment actions will substantially affect returns in the local markets too. As developed economies intensify their credit easing policies, these could lead to heightened capital inflows, partly through yield arbitrages or carry trades and partly through portfolio flows, into emerging markets as the Philippines which should amplify the domestic credit boom. Of course a credit boom will also occur in the international that would finance these carry trades and portfolio flows.

Given these interconnectedness of world markets, the Philippines will remain highly sensitive to the international risk environment.

The Ponzi dynamics of government debt markets, as well as the heavily politicized financial markets assures of outsized volatilities in both directions for financial markets.

The seeming epiphany of global stock markets on the side of the bulls have been underpinned by actions of major central banks who recently has jumpstarted the next wave of asset purchases such as Bank of Japan and Bank of England and indirectly through the ECB’s LTRO facilities which as predicted had an overwhelming reception[16].

The continuity of the current boom conditions has been principally dependent on liquidity conditions which emanates from feedback loop of market’s reactions to policy responses and vice versa.

For the recent past years, stock markets tend to experience amplified downside volatility when policy programs approached their maturity (such as in the US).

Yet given the rabid fear of another episode of recession or deflationary scare, the mechanistic response by central bankers has been to reflate the system with more credit easing programs. Thus we should expect mini-bubble cycles amidst a larger bubble framework.

Also, we cannot discount any upsurge in consumer price inflation given the scale of monetary injections. This will have repercussions on the market too. This is why markets will be volatile.

After 5,000: What’s Next for the Phisix?

Interim profit taking following the recent breakout of the Phisix from the 5,000 threshold level should be expected, given the partially overbought conditions.

But any retracements are likely to be minor and will not exhibit large scale broad market deterioration in the strict condition that the current domestic and international markets remains on a RISK ON mode.

Instead we should expect rotations among sectoral performances or issues within specific sectors.

The recent interest rate cut by the BSP will provide more fuel to the bulls. Given the relatively less leverage financial system, the booming Phisix will be augmented by a surge in domestic bank credit and possibly credit driven portfolio flows and carry trades from overseas investors.

Yet returns in the Phisix will be subject to the highly fluid conditions abroad.

Lastly the mercantilist goal of “promotion of exports” through low interest rate policies won’t work. What this will do is to foster an unsustainable domestic boom that will become evident in the stock market and in the real economy through specific sectors, that leads to an eventual bust in the fullness of time.

Moreover domestic inflation will undo any ephemeral cost advantage from policies that have been designed to undermine a currency’s purchasing power.

What I believe is that the real goal by the BSP has not been to promote export growth (which is in itself is a very bad mercantilist-protectionist idea). The economy has always been used as a veneer to promote certain unstated or unpublicized political agenda.

I believe that the BSP has been working in conjunction or in collaboration with other global central banks to enforce the Keynesian doctrine of “the euthanasia of the rentier” or to keep interest rates permanently low, not just to promote permanent quasi-booms, but also to assist in the rehabilitation of an unsustainable welfare based political, which plagues many developed economies today, along with their banking cronies.

Yet we can expect a blowback from such actions overtime.

For now profit from folly.

[1] See Phisix: Expect A Breakout from the 5,000 level Soon, February 26, 2012

[2] Inquirer.net BSP cuts interest rates to 4% for overnight borrowing, 6% for lending, March 1, 2012

[3] Emerging Market Weekly Global monetary easing is helping sentiment, February 22, 2012 Danske Bank

[4] Perry Mark, Dec. 2011 Sets Record for the Highest-Ever Volume of Global Trade and Global Output in History mjperry.blogspot.com February 28, 2012

[5] Garrison Roger W. Natural and Neutral Rates of Interest in Theory and Policy Formulation April 21, 2007 Mises.org

[6] Shostak Frank, It's Not Really about the Debt, March 1, 2012 Mises.org

[7] See Global Equity Market’s Inflationary Boom: Divergent Returns On Convergent Actions February 13, 2011

[8] See Investing in the PSE: Will Negative Real Rates Generate Positive Real Returns?, November 20, 2011

[9] Economist.com, Fleecing the flock, January 28, 2012

[10] Mises, Ludwig von The Monetary or Circulation-Credit Theory of the Trade Cycle, June 11, 2010 Mises.org

[11] ADB.org Asia Economic Monitor December 2011

[12] Soros George The alchemy of finance, p 23 John Wiley & Sons

[13] Horwitz Steve Austrian Cycle Theory is Not a Morality Play, March 3, 2011 CoordinationProblem.org

[14] Wikipedia.org Understanding Minsky's financial instability hypothesis, Hyman Minsky

[15] See Applying Bernanke’s Doctrine: Central Banks ‘Invests’ in Stock Markets, March 2, 2012

[16] See Record Bank Borrowing from ECB’s Second Round LTRO, March 1, 2012

No comments:

Post a Comment