The neurotic cannot endure life in its real form. It is too raw for him, too coarse, too common. To render it bearable he does not, like the healthy man, have the heart to "carry on in spite of everything." That would not be in keeping with his weakness. Instead, he takes refuge in a delusion. A delusion is, according to Freud, "itself something desired, a kind of consolation"; it is characterized by its "resistance to attack by logic and reality." It by no means suffices, therefore, to seek to talk the patient out of his delusion by conclusive demonstrations of its absurdity. In order to recuperate, the patient himself must overcome it. He must learn to understand why he does not want to face the truth and why he takes refuge in delusions. Ludwig von Mises

Analyzing financial markets has principally been about focus—particularly what we think or believe comprises and signifies as causal factors that lead to specific outcomes.

Focusing on Real Action

Since our focus has mostly been influenced by conventional theories, definitional context of issues involved and heuristics (or mental shortcuts), we are likely to be drawn to distractions from the allure of false relationships. Noise will be read as signals. Effects will be read as causes.

As Austrian economist and author Gary North wrote[1],

People can be misled by deliberately distracting them. This fact is basic to all forms of "magic," meaning prestidigitation. The performer seeks to persuade members of the audience to focus their attention on something peripheral, when the real action lies elsewhere. A skilled performer can do this "as if by magic."

In the marketplace, deliberate distraction has been part of the social convention. We docilely embrace mainstream ideas because this is mostly seen as a socially appropriate or the popular or the normative thing to do. We are hardly concerned about what works or not (but which we presume that they do work), or of the validity or soundness of theories, but rather have mostly been concerned with how we blend with crowds.

Thinking out of the box is seen as a form of heresy which risks ostracism and ex-communication and so must be sternly avoided. Thus, when the orthodoxy has become fixated with peripheral events or activities, we are predisposed to join them, even when the real action, as Professor North says, lies elsewhere.

Boom bust cycles are evidences of such dynamics. Lured by false signals from distortive policymaking, the public imputes many peripheral issues to explain and act on market activities.

The public’s understanding has mostly been influenced by mainstream’s popular obsession with peripheral based doctrines disseminated through media and or by institutional based literatures or through “expert” opinions.

Yet the effects of policies in shaping people’s incentives are hardly reckoned with, even if political actions influence almost everything we do—from savings, investment, consumption to everyone’s distinctive value scales. Conventional thinking reduces the import of political policies as “given” or as having neutral effects to people’s thought processes and the attendant incentives to action. Many for instance are engrossed with “aggregate demand”

The public, including the army of so-called establishment experts, who incidentally hardly saw the 2008 crisis coming[2], forgets that tampering with money essentially contorts half of every transaction that we engage in, whether in the real economy or the financial markets.

Also the boom phase of the bubble cycle influences greatly the market’s psychological framework.

Booms have the tendency to cover or forgive on many of our mistakes. Booms also have the proclivity to embed on the tenuous or flimsy methods we employ in the evaluation or appraisal of the markets. Lastly, because booming markets tend to confirm on most of our biases, there comes a point where the markets will be overwhelmed by an egotistical overreach, highlighted by systemic euphoria or to engage in colossal risk taking activities on the account of overconfidence.

By overlooking on the genuine relationships between perceived causal factors and the expected outcomes, we hardly realize that we may be imbuing on more risks than warranted.

The point is focusing on the peripherals without comprehending on the genuine actions driving the marketplace serves as recipe to a calamitous portfolio

And real action shows that this week’s marginal gains by the Philippine bellwether, the Phisix, have again been a global one and not a standalone or local event.

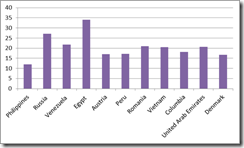

Outside the Philippine Phisix, the list of my top ten global market performers among 71 nations which I monitor seems like a horse race, where the dominant character has been sharp gyrations, although generally biased to the upside.

This week Greece, India and Brazil dropped out of the list and have been replaced by Denmark, United Arab Emirates and Columbia. Despite the latest bailout agreement[3], Greece benchmark fell by a nasty 9%, nearly halving the yearly gains in just a week. On the other hand, the declines of Brazil and India have mostly been due to recent marginal retracements amidst the fiery rally by other bourses.

Note that the gains have ranged from 17-34% while the median gains are at 20%.

With 90% of global bourses up on my radar screen, where almost half have posted gains of over 10%, it safe to generalize that bulls, running on central bank steroids, have been on a rampage since the start of the year.

The ASEAN-4 bellwethers have seen divergent performance. Thailand (red orange) and the Philippines (orange) are head-to-head in front of Malaysia (red) which seems to have stagnated and Indonesia (green) which appears to have stumbled. My guess is that eventually the laggards will pick up the pace.

Sectoral Indices: Mixed Actions and Changes in Composition

This week’s actions at the PSE suggest of two events: one that the interim consolidation partly represents selective retracements, and second, that the slight gains posted by the Phisix over the week, understate what has been going on in the broader market.

Selective retracements are visible from the divergence in sectoral performance.

Profit taking mode enveloped most industries except the financial and holding sectors, where the latter’s gains have mainly emanated from the astounding run by Aboitiz Equity Ventures [PSE: AEV] up 21.78% over the week.

And much like the sharply volatile global markets, year to date, the financial sector has captured the top spot from the property sector while the Holding sector has equally surpassed the service sector for third spot.

The banking and finance sector has essentially been lifted by the stupendous advances of Union Bank of the Philippines [PSE:UBP], which has been up by about a whopping 104%, followed by the Rizal Commercial Bank [PSE:RCB] and Security Bank [PSE:SECB]. Other giants as Bank of the Philippine Islands [PSE: BPI] and Metrobank [PSE:MBT] has basically reflected on the advances of the Financial index while Banco De Oro [PSE: BDO] and China Bank has lagged [PSE: CHIB]

The massive jump in share prices of the financial system has been reflecting on the recent spike in the credit growth of the domestic financial system[4]

Last year’s most outstanding performer, the mining sector, has lagged the advances of the Phisix due to the consolidation phase by the mining heavyweights. The transition in the mining sector has been exhibiting a shift in the market’s attention from the heavyweights to the periphery (second and third tier firms) and now to the oil issues.

Philodrill [PSE: OV, black candle], Oriental Petroleum [PSE: OPM] and Petroenergy Resources [PSE: PERC] posted extraordinary gains over the past two weeks. [disclosure I am a shareholder of PERC and OV]

Once again these are manifestations of the rotational process at work. And the transitions in the upside price actions have been in the context of companies within specific sectors and the relative performances among the sectoral benchmarks

All these actions have been confirming signs of an inflationary boom.

Yet index watching can’t be entirely relied on as they are subject to changes by the authorities based on several self-designed standards.

The Philippine Stock Exchange [PSE: PSE] has recently announced there will be some alterations in the composition of subindices, while leaving the main index or the Phisix unchanged.

From a news report at the Businessworld[5],

"A total of 11 companies will be added to the current composition of various sector indices while 13 companies will be removed," the PSE said.

For financials, National Reinsurance Corp. of the Philippines and Vantage Equities, Inc. will be taken out while CitisecOnline.com, Inc. will be added, the bourse said in a memorandum circular.

Industrials will see the departure of Integrated Micro-Electronics, Inc., Republic Cement Corp., San Miguel Brewery, Inc., and Ginebra San Miguel, Inc., and the entry of Greenergy Holdings, Inc. and Megawide Construction Corp.

For holding firms, South China Resources, Inc. will be replaced by Solid Group, Inc., Pacifica, Inc., and Alcorn Gold Resources Corp.

Leaving the services sub-index are Pacific Online Systems Corp., Liberty Telecoms Holdings, Inc., and TransPacific Broadband Group International, Inc. The inclusions are Premiere Horizon Alliance Corp. and IP E-Game Ventures, Inc.

Dropped from the property list were Philippine Realty & Holdings Corp. and A. Brown Co., Inc.

Mining and oil, lastly, will have Omico Corp. replaced by Benguet Corp. "A" and "B," United Paragon Mining Corp. and Abra Mining & Industrial Corp.

Any impact from the tweaking or changes in the composition of the sub-indices will be short-term.

Market Internals Turns Notably Bullish

While the market internals of the PSE has partly been exhibiting partial signs of profit taking, some vital indicators has been neutralizing or offsetting these.

Net foreign trades (averaged weekly) appear as showing signs of recovery from an interim slump. Any reacceleration of foreign buying will likely focus on Phisix component issues. And foreign buying into Phisix issues means a potential test or even a successful breakout of the Phisix 5,000 level.

The chart also shows that this cycle has broadly been about local investors driving the Phsix to record highs.

The daily average Peso volume (averaged on a weekly basis) has likewise been on an uptrend. This means that further expansion of trading volume will likely translate not only to a higher Phisix but also on a broad market based buoyancy.

Finally this has been the most surprising of them all, total number of trades (averaged weekly basis) has exploded.

This possibly extrapolates to a jump in the number of ‘new’ participants (most likely retail investors) and or more active or aggressive churning activities by traders and punters.

In short, the local markets have been exhibiting generalized bullishness.

Improving net foreign trade, rapidly ballooning trade volumes and spiking total daily number of trades seem like a pressure packed seething volcano awaiting the right opportunity to explode.

More Steroids from Global Central Bankers and their Real Side Effects

Well central bankers are there to ensure the continuity of the cyclical boom.

Despite talks of ‘stigmatization’ or the reluctance to avail of European Central Bank facilities by several banks[6], I expect the reopening of the second three year Long-term Refinancing Operations (LTRO) facility will be utilized to the hilt.

In addition, the expected implementation of the recently announced credit expansion programs via asset purchases or QEs by the Bank of England[7] and Bank of Japan[8], and China’s recent easing of reserve requirements[9] have all been pointing to another gush of liquidity headed for the global financial marketplace. And much of these should be expected to get funnelled into the asset markets.

Moreover, as of this writing the G-20 have reportedly been trying to forge for a $2 trillion global rescue fund[10] to erect a firewall from the European sovereign and banking debt crisis.

As stated earlier, real actions means that swamping the world with digital and or freshly minted money will have real side-effects, not only the financial markets, but also in the economy.

Prices of natural gas, which should remain under pressure from the supply side growth from the shale gas revolution (see chart above[11]), seem on the verge of a price recovery (see chart below).

One would note that the recent recovery in oil prices have coincided with the jump in the US S&P 500 benchmark. Also the price surge in gasoline in the US has been accelerating.

I have not persuaded[12] that the spike in oil prices have been because of geopolitical turbulence particularly a prospective war on Iran or the ongoing civil war in Syria.

A continued uptick of the prices of vital commodities would eventually push up interest rates through the inflation premium. And higher inflation could possibly either force a policy tightening which translates to an eventual bust, or shortage of money which will be met by even more money printing that leads to an acceleration of inflation or the crack-up boom.

Thus it pays to observe how pervasive the side-effects will be and how politicians will react to side-effects. Again a stimulus response feedback loop mechanism based on market’s response to political actions and vice versa

Global Credit Easing Policies Points to A Firming of the Philippine Peso

Going back the immediate transmission effects of global policies to the local markets, perhaps recent signs of the recovery seen in the NET foreign flows in the PSE can be traced to cross-currency yield seeking arbitrages or carry trades.

To add, should portfolio flows into the Philippines intensify, through the PSE and local bond markets, then the lagging Philippine Peso will likely see more room for appreciation.

The Philippine Peso’s historic 40 decade long of decline (see the upper window of the above[13]) had been reversed as portfolio flows to the local debt and equity markets surged from 2004-2007 (see the lower window of the above[14]).

In addition, when the Phisix peaked at the 3,800 level in 2007, the Peso eventually firmed up until the 40.25 level. Today with the Phisix knocking at 5,000 levels the Peso still remains at the 42.84 levels. Much of this can be explained by the current locally driven bullmarket and the relatively lack of participation by foreigners.

I would suspect that part of the Peso’s lagging performance could also be due to interventions by the BSP. But I would need evidence to confirm this.

The ramping up of QEs may change the complexion of the game where local bulls will likely be complimented by foreign yield spread arbitrageurs.

And the bottom line is: Expect a break of the Phisix 5,000 level soon.

[1] North Gary Inside Job: How Nixon Was Taken Down, June 8, 2005 Lewrockwell.com

[2] Telegraph.co.uk The Queen asks why no one saw the credit crunch coming November 5, 2008

[3] Bloomberg.com Euro Finance Ministers Said to Reach Agreement on Greek Bailout February 21, 2012

[4] See Global Equity Market’s Inflationary Boom: Divergent Returns On Convergent Actions February 13, 2012

[5] Businessworldonline.com PSE limits tweaks to sub-indices, February 22, 2012

[6] Weekly Focus, Two steps forward – one step back Danske Research February 24, 2012

[7] See Bank of England Adds 50 billion Pounds to Asset Buying Program (QE), February 9, 2012

[8] See Bank of Japan Yields to Political Pressure, Adds $128 billion to QE, February 14, 2012

[9] Bloomberg.com China Cuts Reserve-Ratio for Growth as Inflation Deters Interest-Rate Move, February 20, 2012

[10] Reuters.com G20 inches toward $2 trillion in rescue funds February 26, 2012

[11] Gruenspecht Howard Annual Energy Outlook 2012 Early Release Reference Case, US Energy Information and Administration, January 23, 2012

[12] See Are Surging Oil Prices Symptoms of a Crack-up Boom? February 24, 2012

[13] Wikinvest.com Philippine Peso (PHP)

[14] Tradingeconomics.com Portfolio investment; excluding LCFAR (BoP; US dollar) in Philippines

Portfolio investment excluding liabilities constituting foreign authorities' reserves covers transactions in equity securities and debt securities. Data are in current U.S. dollars.This page includes a historical data chart, news and forecats for Portfolio investment; excluding LCFAR (BoP; US dollar) in Philippines.

No comments:

Post a Comment